Macro Releases: EUR/USD, GBP/USD

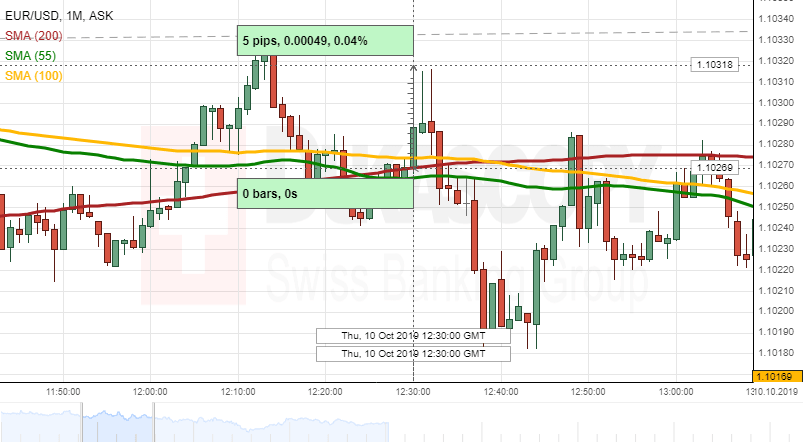

EUR/USD: US CPI

The European Common Currency traded sideways against the US Dollar, following the US CPI data release on Thursday at 12:30 GMT. The EUR/USD exchange currency rate lost 5 pips or 0.04% right after the release. The Euro continued trading at the 1.1025 level against the Greenback.

The Bureau of Labor Statistics released the US Core CPI data, which came out worse-than-expected of 0.1% compared with the forecast of 0.2%.

According to the official release: "The index for all items less food and energy rose 0.1 percent in September after increasing 0.3 percent in each of the last 3 months. Along with the shelter index, the indexes for medical care, household furnishings and operations, and motor vehicle insurance all rose in September. The indexes for used cars and trucks, apparel, new vehicles, and communication all declined."

GBP/USD: UK GDP and Manufacturing Production

The British Pound traded sideways against the US Dollar, following the UK GDP and Manufacturing Production data releases on Thursday at 08:30 GMT. The GBP/USD exchange currency rate lost 8 pips or 0.06% right after the release. The British Pound continued trading at the 1.2240 level against the Greenback.

The Office for National Statistics released the UK Manufacturing Production data, which came out worse-than-expected of negative 0.7% compared with the forecast of 0.1%.

According to the official release: "The 0.7% monthly decrease in manufacturing output was widespread with falls in 10 of the 13 subsectors; the largest downward contribution came from a 4.7% fall in basic pharmaceutical products. For the three months to August 2019, production output decreased by 1.3%, compared with the same three months to August 2018; led by a fall in manufacturing of 1.5%."

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.