MACD and more Caution Signals

Stocks rose led by telecoms, real estate and utilities...sectors that have been beaten up as investors considered the opportunities created by the very beating that took them all lower......and as some strategists warn investors about piling into sectors that have outperformed since the election.....suggesting that the 'herd mentality' is a dangerous mentality.... Volumes as expected were low and will continue to fall as the week moves into the weekend - and with little to no eco data today - I suspect the mkt will churn - higher - for no other reason than the momentum.....

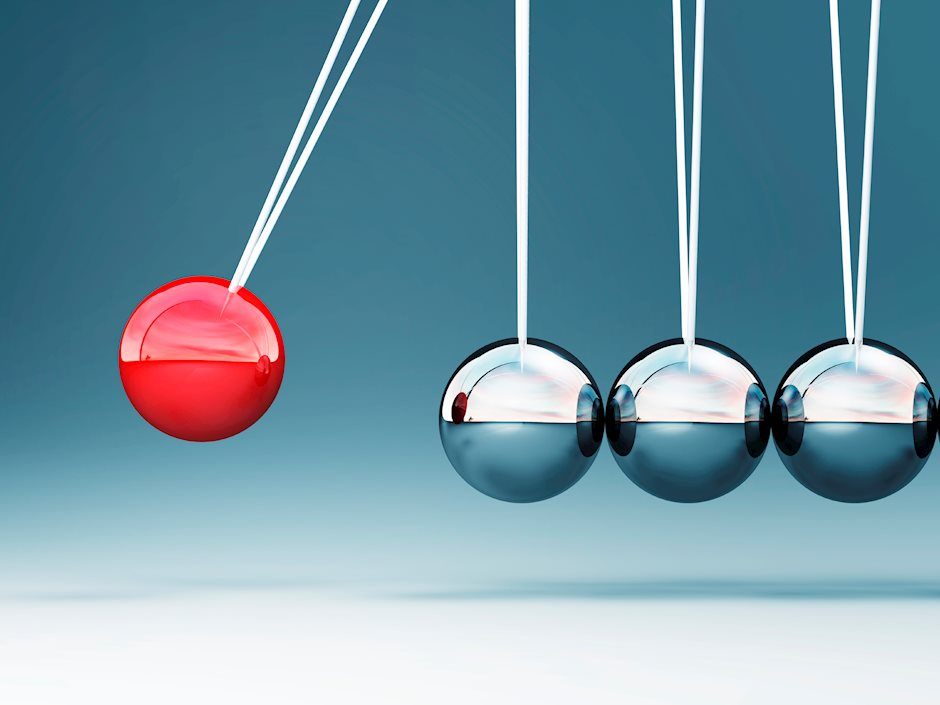

[Herd mentality describes how people - in this case investors - may be influenced to adopt certain behaviors in a herd like move....so as the mkt moves higher - investors copy the behavior of other perceived successful investors hoping for the same results - re-enforcing a certain trend - in this case the move higher.]

Which brings up the caution flag we discussed yesterday - the RSI (Relative Strength Index) along with other technical indicators that are also flashing 'caution ahead'. Consider another indicator - the MACD (known as the MAC 'D') - for those of you unfamiliar - the MACD (Moving Average Convergence Divergence) momentum indicator is a 'trend following indicator' that details the relationship between two moving averages. In this case - you subtract the 26 day ema (exponential moving average) from the 12 day ema. You then plot this figure on a graph to produce a trend - and when the MACD crosses over the signal line and rises dramatically - or when the 12 day ema pulls away from the 26 day ema - it usually signals an overbought condition resulting in a return to 'normal levels' - and this is happening now......(think correction...- but correction does not necessarily mean a 20% decline - in this case it is suggestive of a return to the core trend).

Now while all of this is more technical than you all prefer - it is just a comment on how technicians use the data to determine future price action.....and that signal suggests caution.....that's all.

The mkt is ahead of itself as it anticipates President Elect Trump’s fiscal policies to become law. This is a classic “buy the rumors” scenario because these policies are not in effect just yet and the jury is out on whether he gets what he wants. Investors have factored it in as if every market favorable policy change has already occurred and won’t be challenged and this is the issue at hand........because what happens if he hits resistance? What happens if guys like Rand Paul and Teddy Cruz (both Republicans) try to build consensus in Congress against him to thwart his vision? Just how fast do you think investors would punish the mkt? (think FAST. We have all seen what happens when you unleash the power of automation on the mkts.....outsized moves can happen before you realize it and in this case - those moves would be lower and when that happens - all the regulators will say "How did that happen?" - I mean you can't make this up.....) But that is another story......

With no eco data today - the mkts may focus on the latest geo-political issues - think the attacks yesterday in Berlin, the assassination of the Russian Ambassador to Turkey and the ongoing devastation of innocents in Syria - Now while none of these issues will drive specific mkt moves - they do give investors reason to pause when there is a void in economic data.

European mkts are all churning higher this morning and US futures are doing the same. Currently futures are up 3 pts and Dow futures are up 18 pts....the excitement experienced over the past month does appear to be slowing - but if the Dow breaks up and thru 19k again - then look for the momo (momentum, trend playing, herd mentality) guys to jump on board......as they try once again to push the Dow to 20K before year end - just because.

Yesterday Janet Yellen gave a commencement speech at the University of Baltimore and told this graduating class that they are entering the strongest job market in 'nearly a decade'. She cited the (artificially) low unemployment rate of 4.6% and the recent strong wage growth for younger workers (which remains a mystery really....) She told them that because they finished school - they are more likely to find jobs and earn more (one has nothing to do with the other - just ask all of those out of work graduated students saddled with student loan debt). She also noted that technology has made 'some jobs redundant' - as if they needed her to tell them that......Either way her speech did little to inspire the mkts -

There is a lot of eco data later in the week - highlights include - Existing Home Sales of 5.5 mil or a 1.8% decrease m/m, Chicago Fed Survey of -0.1, 2nd revision of 3rd Qtr GDP - exp of 3.3% is expected....Personal Consumption, Durable Goods, Personal Income and Personal Spending will round out the week. But again - Unless these data points completely miss the mark - don't expect them to drive sentiment....there are only 8 days of trading left in 2016.....no one is making any last minute bets on eco data reported in the final hours of 2016. (They have already made those bets and are set up for what they believe 2017 will bring).

This morning the DXY is currently up 30 cts.........Oil is up 25 cts barrel and Gold is again under pressure - down $8 an oz at $1138. I would look for the S&P to test the most recent highs of 2275 ish...before hitting resistance again.....with no new news - investors will find no reason to become aggressive in either direction - so expect more churn.

As we move into the holiday - I am going to take a couple of days off - so the next Morning Thoughts Blog will be on Tuesday, December 27th. Merry Christmas and Happy Hannukah - and may we all find peace and happiness with those we love.

Take Good Care

KP

Ricotta Coffee Cream

One more great and simple desert for the holidays -

Ricotta Coffee Cream - If it take you longer than 1 min - you did something wrong!

This is a combination of Ricotta cheese, rum and espresso coffee......(who remembers Medaglia d'Oro Espresso?)

You need: 1 12/ lbs of Ricotta Cheese, 2/3 cup of sugar, 5 tblspn of dark rum, 2/3 cup of espresso.

Get out the food processor (or blender) - add the ingredients. Blend until you have a nice creamy consistency.

Pour the mixture into individual glasses or small desert cups/bowls. You can use white wine glasses for a more dramatic effect. Place in the fridge and allow to cool overnight. After your dinner party - remove from the fridge - adorn with fresh coffee beans and serve.

Buon Appetito.

Author

Kenny Polcari

KennyPolcari.com