Lost in translation

S2N spotlight

I came across an interesting article in the WSJ today where it suggests that the spread of the yields of all major US assets are at 40-year lows.

I spent a bit of time trying to recreate the results and was basically able to. The current spread I have is 0.8%, placing it in the bottom 10th percentile and equal to the lowest I have in history back to 1989.

The grey vertical shading represents recessions. What you can see is that lows usually precede a recession and lead to major spreads. I have spent a fair bit of time lately highlighting the risks in the market. Today is another such day where I am flashing warning signs. These are not normal markets. While fortune favours the brave, most brave don’t have a fortune. You get my vibe?

I have spoken about trading a spread widening of junk debt (shorting JNK) versus buying quality debt ETFs like GOVT as a way to express this trade idea.

S2N observations

On 6 June 2025, reports came out that the PBOC (People’s Bank of China) conducted 1 trillion yuan of reverse repo operations. They apparently felt the need to increase the liquidity in the system to avoid a potential “blockage.”

If you were paying close attention last week, you would know that if the Fed was conducting a reverse repo operation, that would be to mop up excess liquidity. That is why I named today’s letter Lost in Translation.

Central Bank Action Effect.

PBOC Reverse repo Injects liquidity.

Fed (ON RRP) Reverse repo Drains liquidity.

I am not talking about my round shoulders and stooped neck. I have been in the markets a long time, and I have a sense that something is about to go bang in the night. The world’s financial system is built on the back of a huge debt machine. If the debt machine starts to stall, then we all crash.

You can see that now half of the investment into fixed income in the market is going to government debt. That is robbing commercial debt from seeing the light of day and greasing the economic engine.

If you ask me, does that mean we are at the end of the road? I cannot answer that, but this chart gives me some reason to still be cautious about getting too bearish. The green line is the total bank credit from all commercial banks. Of course it is upsloping, as the value of money has eroded with the profligate spending of government and all the groupies who have participated in the orgy of low interest rates. I may need therapy with all my mixed metaphors, but we knew that. All eyes should rather be on the year-on-year growth, which has been growing at 1.6% per annum. If this turns down, which I think is highly probable, then you can say, Good night, nurse.

S2N screener alert

Microsoft makes an all-time high (ATH). What an incredible company that has stood the test of time. To think Bill Gates created this masterpiece and walked away, and it has remained a gold mine, is quite marvellous. It was the world’s most valuable company until Nvidia pipped it last week.

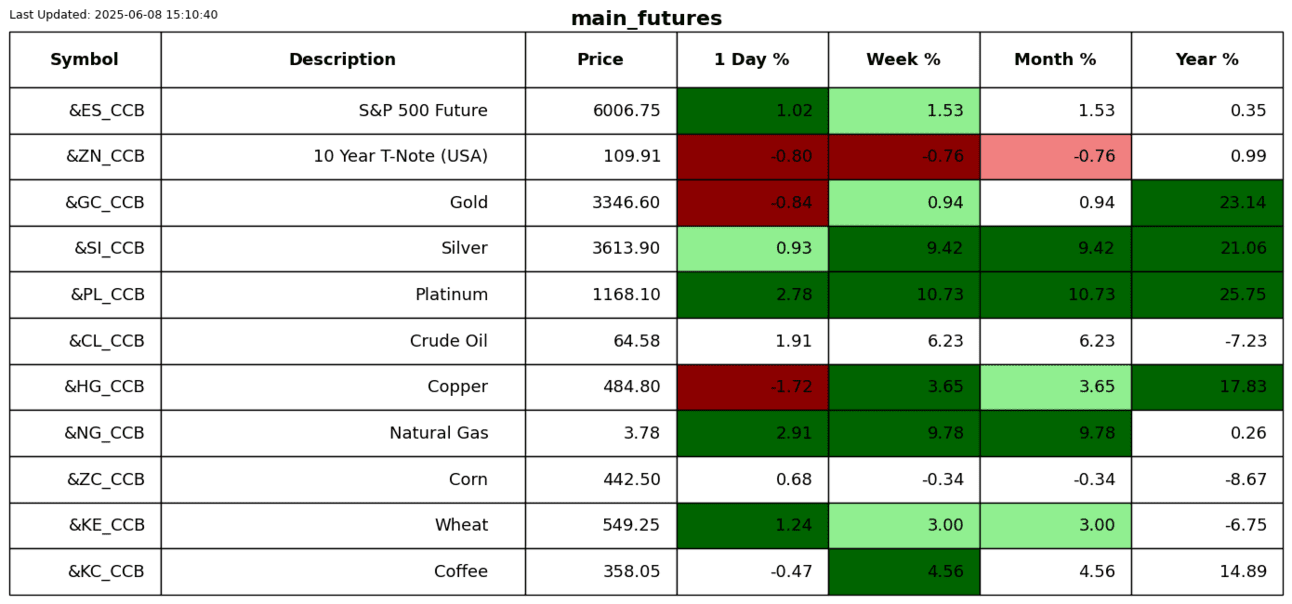

Platinum continues to be a big mover in the market based on its historical returns.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.