Looking at a dollar retracement

An effective method to actually deal with a Dollar pullback

The latest market chatter is how much is the latest dollar strength a retracement vs a shift in the trend? It’s a good question and at the very least we need to be prepared for a dollar pullback. The US10 Y yields spiking higher on the US stimulus package from a blue sweep has been the recent catalyst for dollar strength. Sometimes, when there is uncertainty looking at the technical picture can help us to see areas of opportunity that present themselves.

Technical look at the DXY -Three steps to take

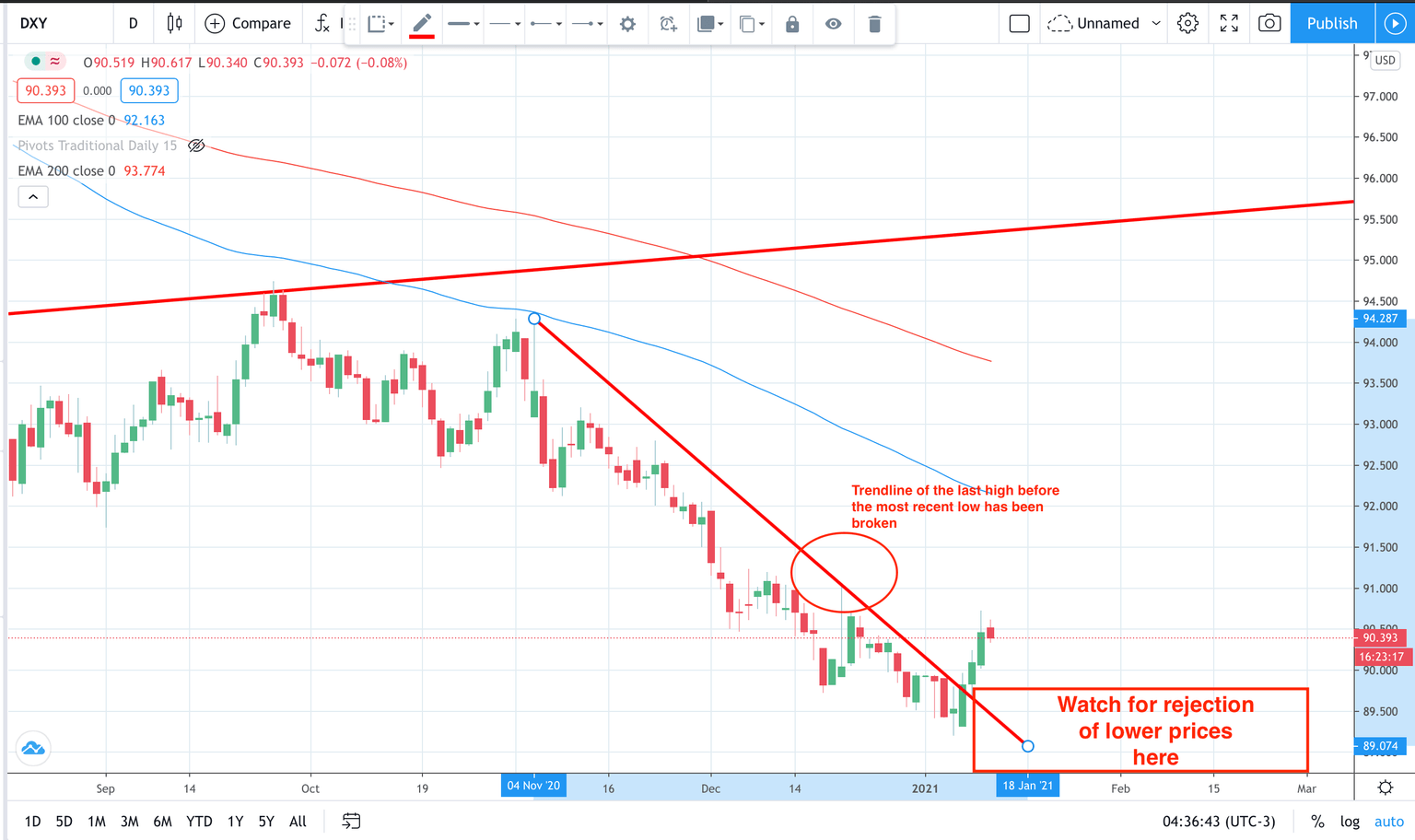

Step number 1: Look for a break of the descending trend line. This is the key trend line on the daily chart as it is the high before the most recent low. This break, which has taken place, is significant and it has already happened. In itself it indicates a probable trend change.

Step number 2: a retest of recent lows. This is still to happen. However, if we get a pullback to the recent lows and a rejection of those prices this tells us a trend change/retracement is probable. Look at the chart below for the area to look for this.

Step number 3: If we see a break higher of the recent highs in the DXY that will confirm a pull back. However, due to the narrow reward here (a possible return to 93.00) a favourable entry would be most likely found on a rejection of a recent low re-test. That kind of entry should provide a low risk high reward entry. The technical risk would be the most recent lows. Any return through this level would invalidate this outlook.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.