Long-Short Equity Strategies 'Hedging' Your Bets

With US equities near record highs, investors may be seeking ways to position their portfolios for what lies ahead. It could be an opportune time to consider the inherently riskmitigating characteristics of long-short equity strategies.

As the name suggests, long-short equity strategies invest both long and short in publicly traded equities and equity-related instruments. Compared to their long-only counterparts, long-short strategies are designed to have lower sensitivity to equity market movements, as measured by beta, volatility and drawdowns. When included as part of a broadly diversified portfolio, such strategies have the potential to: (1) generate profits from their long and short positions and (2) provide an element of protection, or hedge, when markets decline because gains on short positions will dampen losses on long positions.

What is shorting? Short selling involves borrowing shares and selling them at a certain price on the assumption that the price will decline, allowing the seller to buy shares back at a lower price and return them to the owner. Short selling is only profitable when share prices decline and may be exposed to steep losses if share prices rise.

A Broad Category With A Strategy For Every Risk Appetite

A range of strategies fall under the general category of long-short equity (Display 1). In our view, the most compelling strategy in today's market environment would be a low-net or zero-net strategy, otherwise known as "market neutral." Compared to other long-short equity strategies, market neutral strategies tend to exhibit low or zero beta, lower market risk, lower market volatility and seek to generate returns through stock selection. These strategies are not designed to shoot the lights out, but they have the potential to provide steady gains even in down markets.

Long-Short Strategies Are Also Actively Managed

In addition to the potentially riskmitigating benefits of including short positions, long-short strategies typically have flexibility to adjust their risk profiles in response to changing market conditions. They are not required to maintain static exposures, nor are they tethered to a benchmark. Managers of market-neutral strategies can take a variety of steps to reduce risk and protect capital, specifically:

-

Reduce overall portfolio gross exposure by selling longs and covering shorts at the same time, so that the portfolio has less capital at risk.

-

Reduce position sizes to reduce volatility.

-

Incorporate portfolio protection in the form of index hedges, futures or options.

Long-Short Strategies Have Held Their Own In Prior Market Downturns

During the bear markets of 2000-2002 and 2007-2008, and the down markets of mid-2011 and late-2018, long-short equity strategies broadly, as measured by the HFRI Equity Hedge (Total) Index, and market-neutral strategies more specifically, as measured by the HFRI Equity Market Neutral Index, achieved their goal of mitigating downside risk relative to the broad markets across a variety of metrics (Display 2).

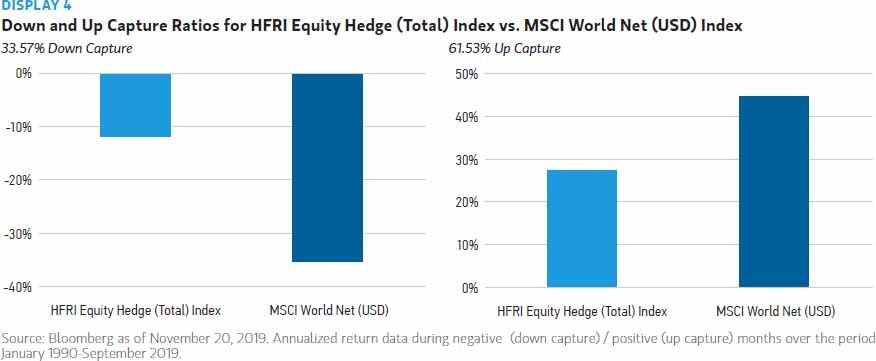

Among long-short equity strategies, marketneutral strategies have proven particularly adept at managing downside risk over time, while allowing investors to participate in up markets as well (Displays 3 and 4).

Of course, past performance is no guarantee of future results. Four main risks will always face long-short equity investors:

1. MARKET RISK: the risk of loss due to the impact of general market movements.

2. IDIOSYNCRATIC RISK: the risk of loss due to company-specific factors that are generally not correlated with the broad market movement.

3. SHORT-SALE RISK: the risk than an investment sold short generates significant losses because the stock price appreciates.

4. LEVERAGE RISK: the risk of loss due to unexpected interaction between longs and shorts or an improperly hedged portfolio.

Conclusion

Against a backdrop of the longest-running bull market in history, investors may well be concerned about the potential for weaker markets. In our view, including an allocation to market-neutral strategies in a well-balanced portfolio could provide valuable downside risk-mitigating benefits.

Author

Clint Sorenson, CFA, CMT

WealthShield