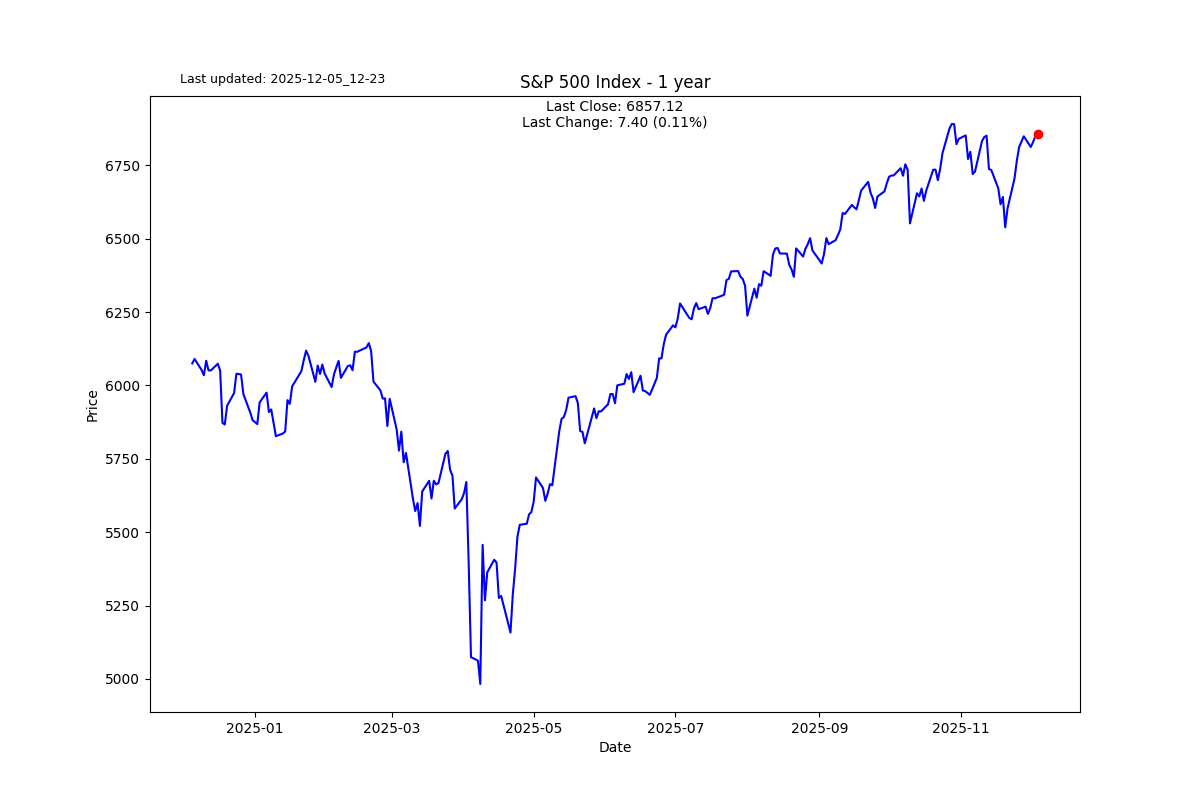

The economics of these massive AI datacenters don’t look nearly as magical

S2N spotlight

I cannot help but smirk at how so many market strategists are walking around like headless chickens trying to come up with the next call that is going to happen on time and make them stand out from the crowd.

If there is one thing I have learned about macro, it is that it often takes time, decades often, for a thesis to unfold. If you put yourself on the treadmill to call it with Newtonian precision, then you are likely to be like the headless chicken in the picture above, chasing whatever stimuli makes you feel like you are a master of the universe.

If you are making macro calls, the best you can do is mitigate risk for the lengthy periods you may be early. Early doesn’t mean wrong, as the future is unknowable. Blowing up because you are early means you were wrong. With that intro I want to touch on a subject that is one of the most misunderstood in trading and investing.

Nassim Taleb one of the greatest risk philosophers of the last century plus has just published a paper: Trading With a Stop that has every quant talking like an authority on the subject, me included Professor Tom Gastaldi, a good friend, introduced me to the idea Taleb is sharing more than 12 years ago.

I share the screenshot below for those who are partial to a differential. I myself am more likely to ponder the equation of the latest coffee brew. Nerd joke – please excuse me.

Don’t panic; I’ve got you covered. Stop it, Michael; these puns are calling for a hedge.

Taleb’s point is beautifully uncomfortable: most stop-losses don’t protect you—they sabotage you. Traders imagine a stop cuts off the nasty left tail while keeping the upside pristine. But prices wander like drunk tourists. A stock can finish the year up 40% and still dip through your stop on a random Tuesday, instantly converting what should have been a winner into a guaranteed loss. Tight stops don’t save you from disaster; they manufacture a slow drip of small, pointless losses that have nothing to do with your thesis being wrong. Put simply: the very thing designed to protect you often becomes the assassin—early, repeatable, and with irritating precision.

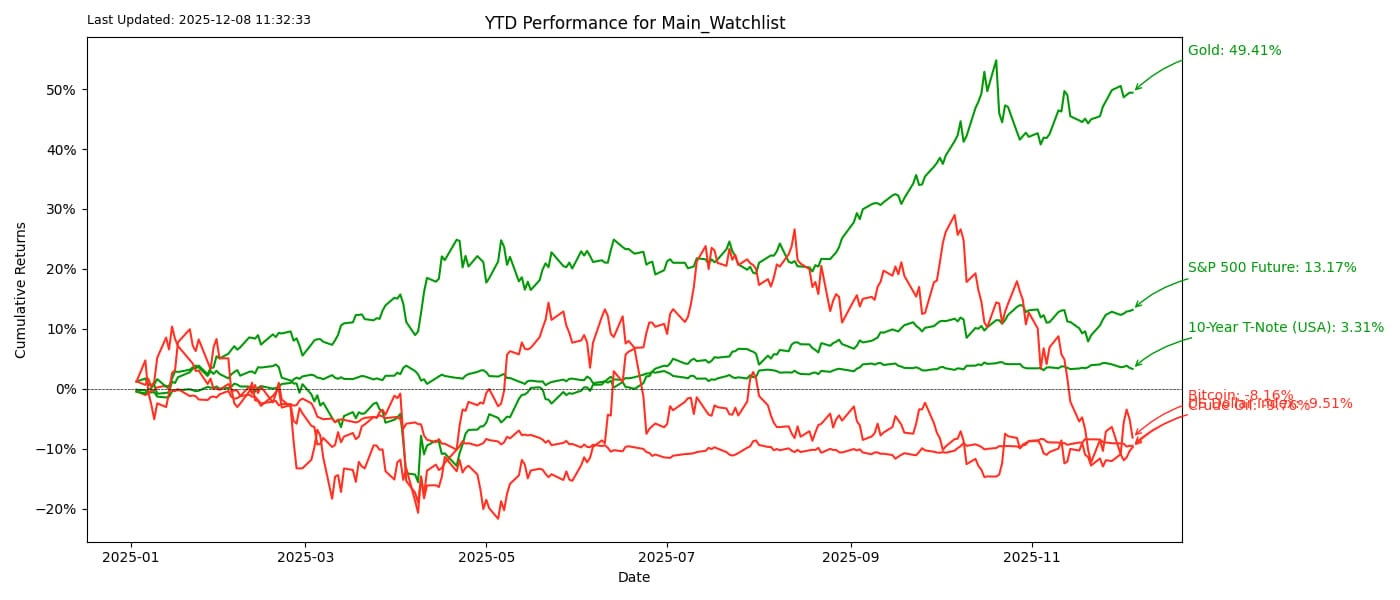

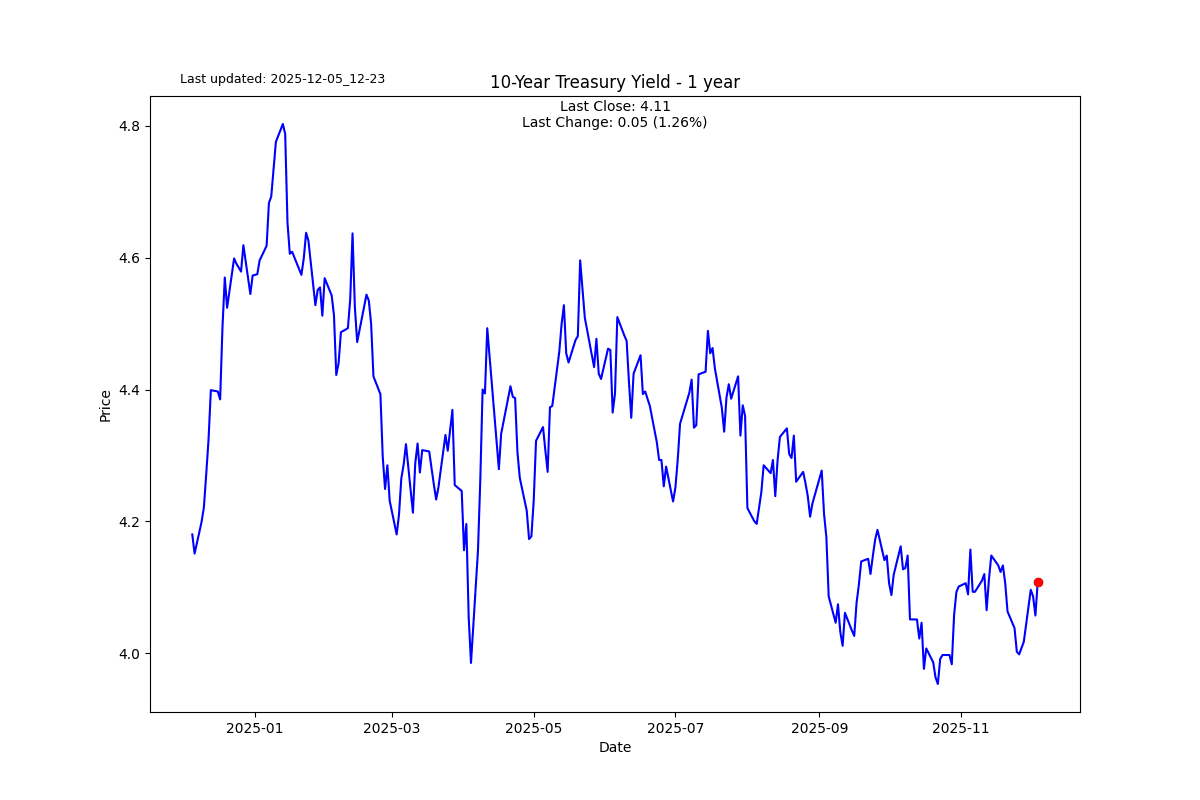

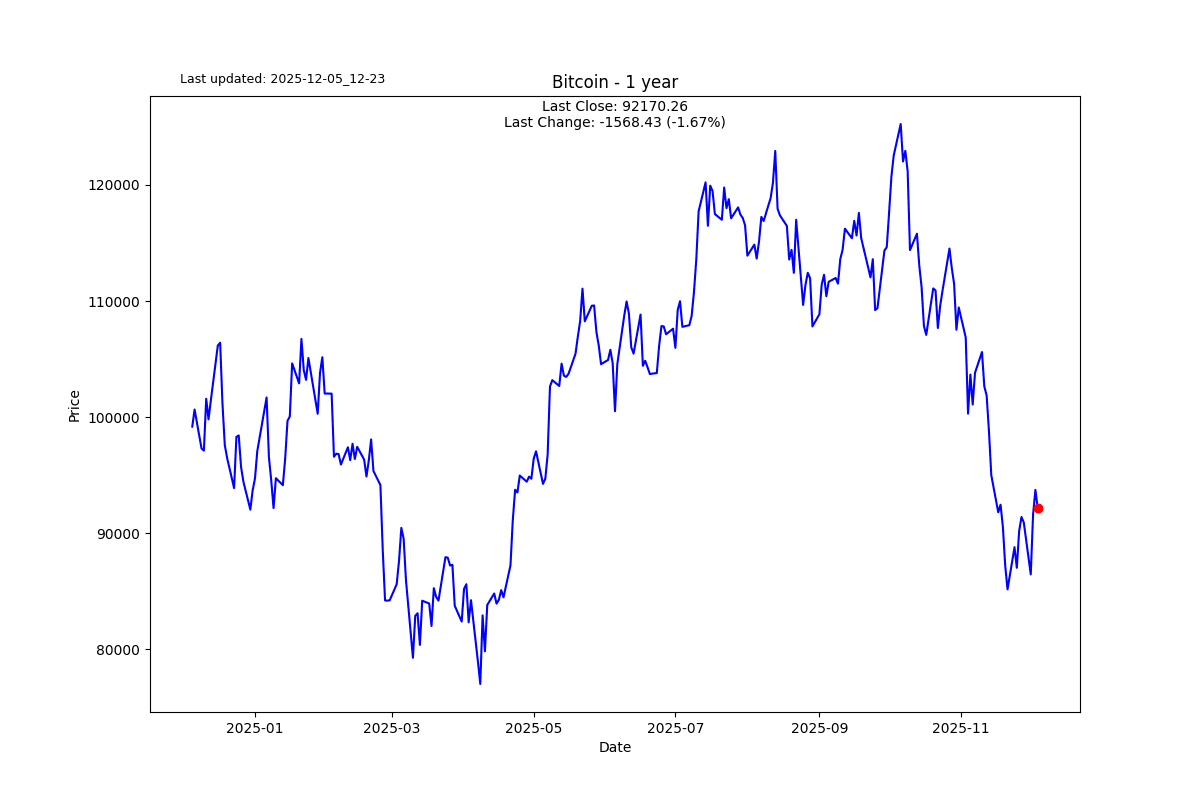

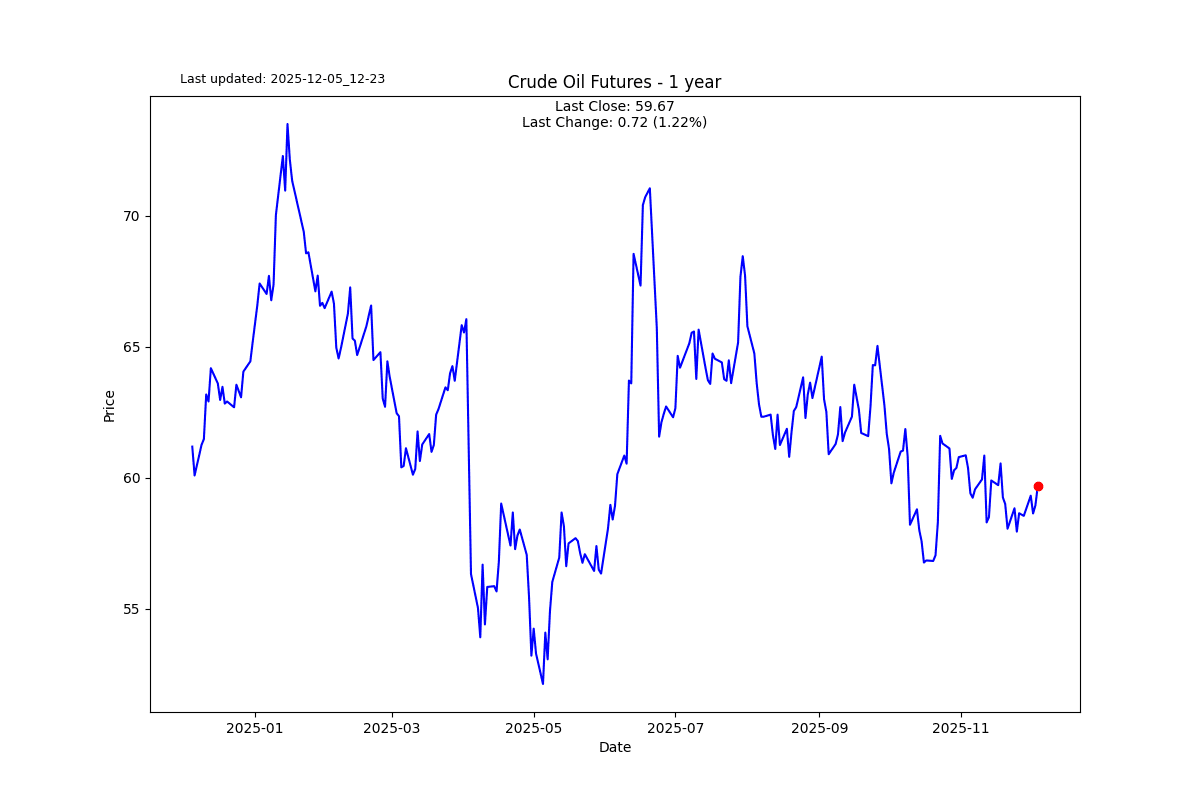

One of my favourite chart views is what I call the Price Journey. Look at Bitcoin: underwater for the year today, but heavily positive as recently as October. If you were short BTC with a tight stop, you’d have been shaken out long before the sell-off actually paid you. That’s Taleb’s message in math and mine in macro: you must survive being early. Hard stops—whether in price or time—don’t just reduce risk; they often choke your idea before it has a chance to breathe. In markets, a tight stop will kill you faster than a spitting cobra with a dental crisis.

If I am sounding more manic than usual, that is because I am.

S2N observations

I’ll keep this brief; I’ve probably said more than is socially advisable already.

I nearly choked on my coffee this morning reading how the Wall Street Journal laid out an entire invasion blueprint—in infographic form, no less—as if planning World War 3 were just another content vertical. The world has become so desensitised to existential risk that we now absorb it with the same emotional bandwidth we reserve for celebrity gossip. Call me an alarmist, call me a nutjob—fair—but at least have the courtesy to also call me a realist.

Now, to another guilty pleasure: Paul Krugman. I read him even though I disagree with roughly half of what comes out of his keyboard—including the parts he’s most proud of. Still, the man can think, and more importantly, he’s not afraid to actually say what he thinks. (A trait he oddly shares with Trump)

In a recent column, Krugman interviewed Paul Kedrosky of MIT, who understands AI infrastructure at a frighteningly granular level. And here we go again—yes, Michael, everything looks like a nail. Down, boy.

Kedrosky’s point is brutal in its simplicity: GPU chips die. Run them at full throttle 24/7 for two years and you will, quite literally, burn through them. It’s like comparing a car driven nonstop for 50 hours straight versus one driven for an hour a week for 50 weeks. One is a machine. The other is a mechanical hostage begging for retirement.

Which brings us to the punchline: the economics of these massive AI datacenters don’t look nearly as magical once you factor in depreciation. If your core asset melts under sustained use, your cost structure isn’t exponential—it’s existential.

I haven’t personally built a discounted cash flow model on these AI farms (I don’t ever intend to either), but if Kedrosky and Krugman are even halfway right, then this AI boom is starting to look less like the next industrial revolution and more like the dot-com bubble’s big brother.

S2N screener alert

I am skipping screeners today, like I skipped leg day yesterday.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.