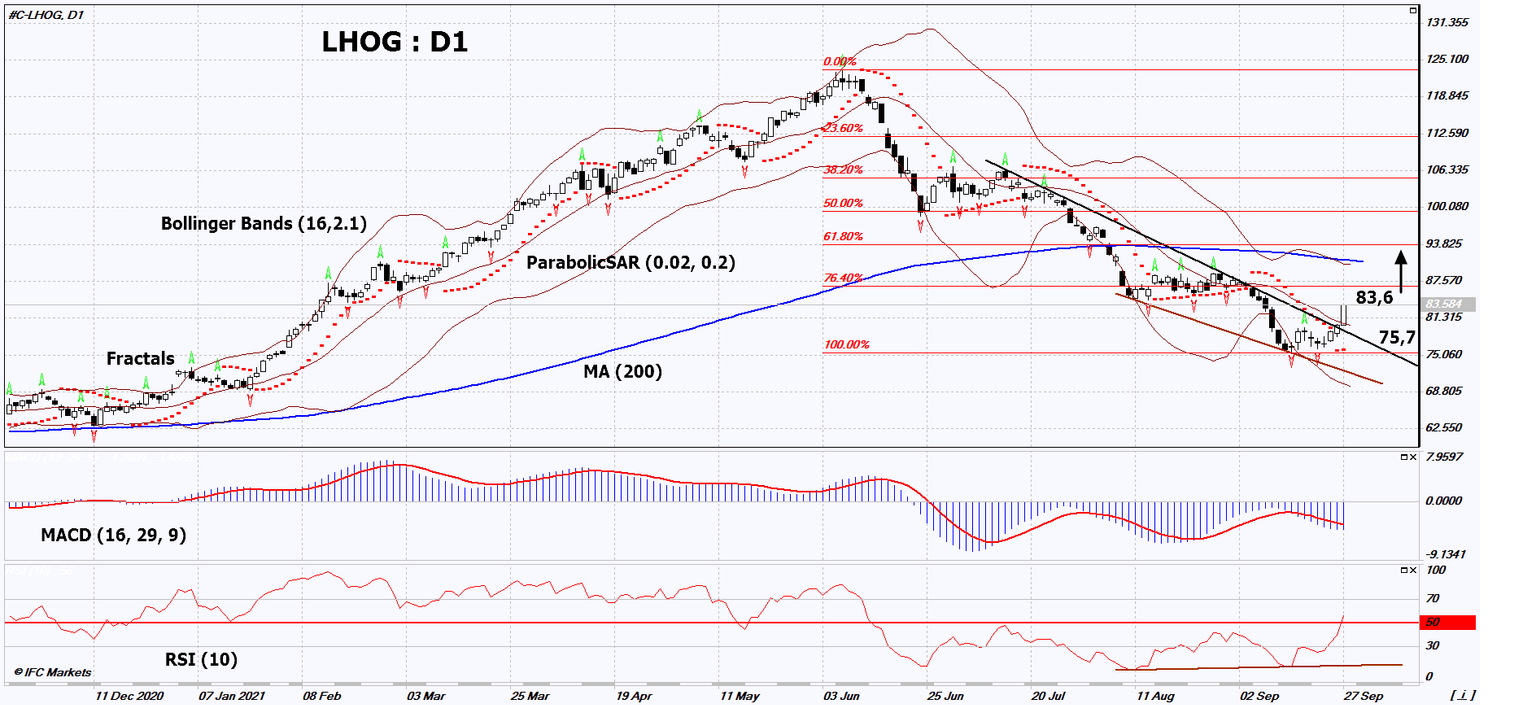

Technical analysis: Will the LHOG quotes grow?

Lean hog technical analysis summary

Buy Stop: Above 83.6.

Stop Loss: Below 75.7.

| Indicator | Signal |

| RSI | Buy |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic | SARBuy |

| Bollinger | Neutral |

Lean hog chart analysis

Lean hog technical analysis

On the daily timeframe, LHOG: D1 has exceeded the downtrend resistance line. A number of technical analysis indicators have generated signals for further growth. We do not rule out a bullish movement if LHOG rises above its latest high: 83.6. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal and the last two lower fractals: 75.7. After opening a pending order, move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit / loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (75.7) without activating the order (83.6), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental analysis of commodities - Lean hog

In the United States, the number of pigs has decreased. Will the LHOG quotes grow?

According to the U.S. Department of Agriculture (USDA) as of September 1, 2021, the head herd of pigs in the United States was 75.35 million. This is 3.08 million or 4% less than in 2020. At the same time, the slaughter of pigs lags behind last year's level by only 1.8%. In theory, this could further reduce the American pig population. The USDA also noted that from June to August 2021, the pig crop was 33.9 million. This is 6% less than in the same period in 2020. The number of breeding sows (sows farrowing) decreased in June-August this year by 7% compared to last year. Another outbreak of African swine fever (ASF) may become an additional factor for the increase in pork quotes. Earlier, the National Pork Producers Council noted the emergence of this disease in the Western Hemisphere (Dominican Republic and Puerto Rico), for the first time in 40 years. So far, ASF has not spread further in the region thanks to quarantine measures.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

Author

Dmitry Lukashov

IFC Markets

Dimtry Lukashov is the senior analyst of IFC Markets. He started his professional career in the financial market as a trader interested in stocks and obligations.