Keeping it real

S2N spotlight

I don’t know why, but yesterday I was stuck on this simple idea. I had no idea it would produce the fruits it has. If I had invested 50% in the S&P 500 market cap index (traditional one) and 50% in the S&P 500 equal-weighted index and rebalanced the portfolio once a year. I think the results speak for themselves.

In case you think that this was just a lucky 25 years, I ran the same analysis over 50 years, and guess what. There is more outperformance in this strategy than 99% of the active managers over long periods of time, and the best part is it's free—no fund manager fees.

S2N observations

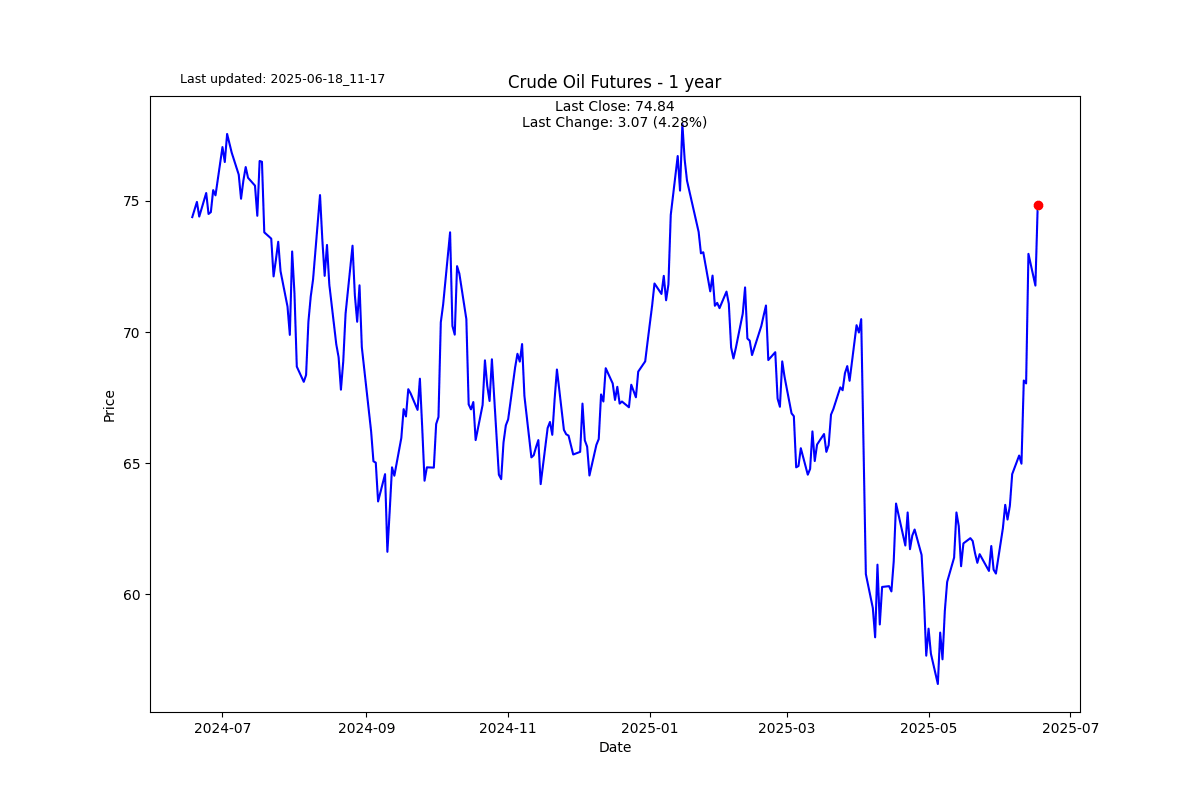

Naturally the last few days have been dominated by the war in the Middle East. The only asset class that seems to be experiencing any real volatility is oil.

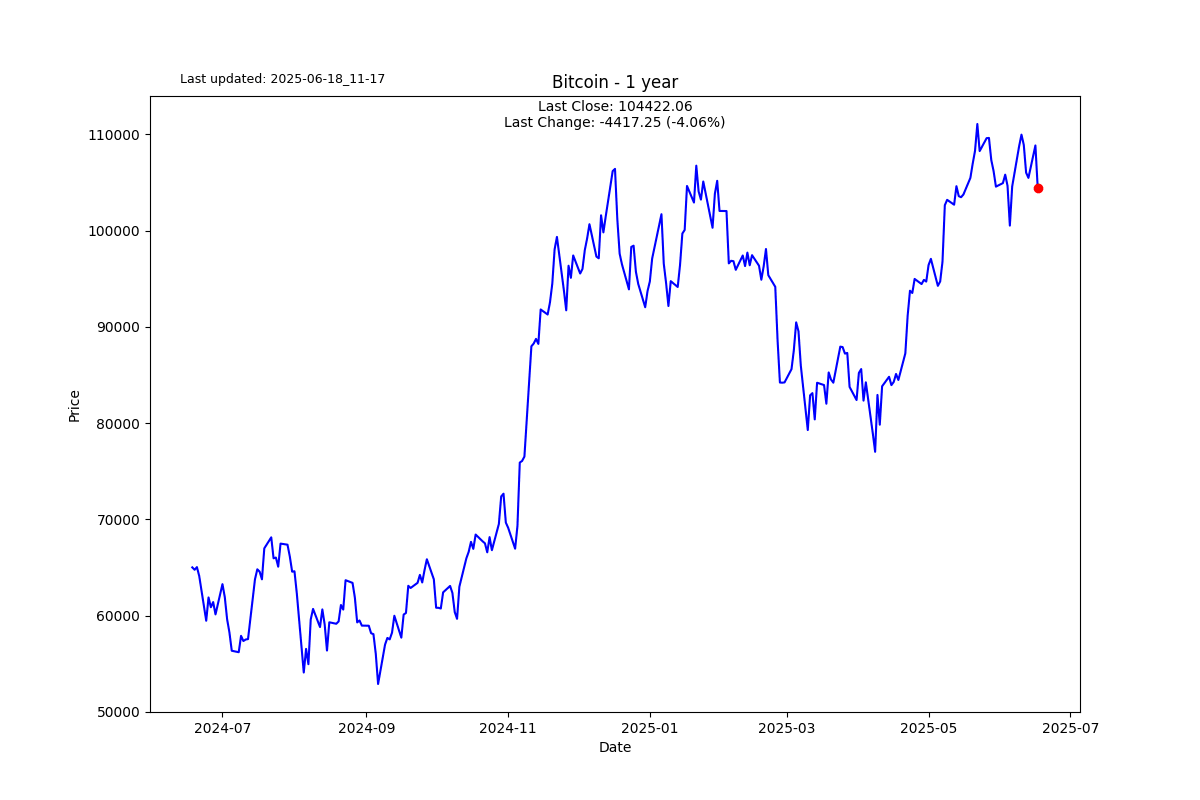

USDC is definitely becoming a serious competitor to Tether. I saw some legislation was passed in the US overnight relating to stablecoins. It sure seems these guys will continue to be the grease of the crypto world's engine. I think this is a fertile ground for stat arb traders, an area I want to spend more time on.

S2N screener alert

After registering a very weak day in the shekel. The Israeli shekel registered its biggest 1-day Z-score (7.64) with a 3.62% daily return. [this alert is a day old, but I wanted to share it as it is a biggie.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.

-638858133189090638.png&w=1536&q=95)

-638858133428626627.png&w=1536&q=95)

-638858133693551013.jpg&w=1536&q=95)

-638858133758158136.jpg&w=1536&q=95)

-638858135425064731.png&w=1536&q=95)

-638858136197158009.png&w=1536&q=95)