June ISM: Activity still soft, but prices cooling

Summary

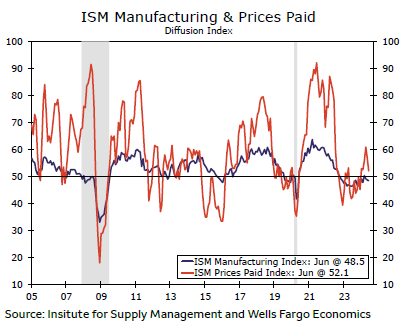

Manufacturing activity remained in contraction territory in June, but in a sign of moderating inflation pressure, the prices paid component fell 4.9 points. New orders rose more than any other component but remains in contraction.

Prices cool

The ISM manufacturing index slipped to 48.5 in May as tight credit conditions and elevated borrowing costs continue to constrain activity in the factory sector. The headline reading marks a 0.2 point decrease from last month while the prices paid measures at 52.1 represents a 4.9 point monthly decline, the single biggest drop of any component (chart). Price pressures have not gone away, but they have abated.

A bounce in the orders component to 49.3 after slipping to 45.4 in May suggests that the decline in both orders and shipments of core capital goods in May could be short-lived. The 3.9 point jump here was the biggest gain of any component.

One interesting thing to watch is the emerging difficulties in shipping and supply chains. The ongoing attacks in the Suez Canal and the associated re-routing is both expensive and time-consuming. We have heard from a number of clients on this topic in recent weeks, but it was conspicuously absent from the respondent comments. For now at least, the supply chain disruptions are more of an annoyance than they are a massive disruption. The supplier deliveries measure came in at 49.8, up a bit from May's reading.

Author

Wells Fargo Research Team

Wells Fargo