Jobs, jobs, jobs: It’s becoming a mini-theme

Jobs rolling

I wrote Monday about why I think we are about to see a string of weak US jobs data this week, with the exception of JOLTS. So far, the data is coming in logically with JOLTS strong and ADP weak. JOLTS is completely meaningless, fwiw.

There is no read through at all from yesterday's "strong" JOLTS to today's ADP because:

a) JOLTS is a mean reverting series. It missed in March and thus the beat in April is to be expected given the way the series evolves.

b) JOLTS was for April, before tariff angst hit ... ADP and NFP are for May and thus represent a post-regime shift look at the labor market, while JOLTS is pre-regime shift

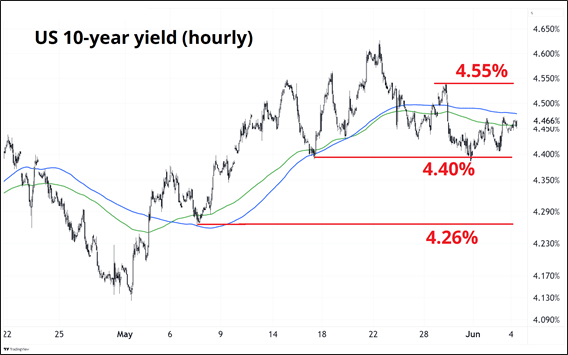

I continue to like long bonds into Friday and I want to take a shot at short USDJPY. 4.40% / 4.55% are the key short term levels in 10s. Below 4.40% and 4.23% is quickly in play.

On the other hand, when ADP misses by 30-50k, you see a higher probability of a weak NFP. Looking at 2010 to now excluding COVID period,

-

If ADP misses by 50k or more, NFP missed 5 out of 6 average miss 39k.

-

If ADP misses by 30k or more , NFP missed 9 out of 16 average miss 24k.

It missed by 77k today. Coupled with my 02JUN piece (using claims and conference board data) … Everything points to NFP miss, even more than it did before. I don’t really think this weakening data is bad equities because the seasonals are strong, the data is not close to recessionary, AI is in vogue again, and lower yields on low bond market volatility are a relief from the bond vigilante stuff.

I am adding Friday 1.1450 EURUSD calls to the sidebar for a USD bleed lower into Friday and a weak number. See Monday’s am/FX: Could jobs be a new narrative? for main discussion on NFP.

While it’s fun to try to time the rollover in the US labor market and/or oncoming recession, it’s always worth remembering that this is a perennial sport and we really have not had a true recession since 2008. Yet every year there is good reason to be skeptical of the permanently-growing US economy. For example, here are the concerns looking back. All of them seemed reasonable, as does the current fear of trade wars and max uncertainty.

2010

Premature withdrawal of stimulus measures.

2011

European debt crisis.

2012

US Fiscal cliff, Eurozone Crisis, EU recession.

2013

Fed tapering of QE. Taper tantrum.

2014

Geopolitical tensions, China slowdown, slowing global growth.

2015

China deval, Strong dollar, weak global demand.

2016

Oil collapse and global economic uncertainty.

2017

Ageing economic expansion and potential asset bubbles.

2018

Trump Trade War 1.0, rising interest rates, restrictive Fed.

2019

Inverted yield curve and global manufacturing slowdown.

2020

COVID-19 pandemic. We did have a hyperquick recession, depending on how you measure things.

2021

Supply chain disruptions and inflation. As economies reopened, supply chain bottlenecks and rising prices led to concerns about sustained inflation potentially triggering a recession.

2022

Aggressive monetary tightening to combat inflation. Global central banks raised interest rates to address high inflation, sparking fears of a policy-induced recession.

2023

High interest rates, Silvergate banking “crisis”, and inverted yield curve.

2024

Sahm Rule triggered in July, persistent inflation, and geopolitical uncertainties.

2025

Trade war, DeepSeek = Peak Capex, geopolitics, high rates, and record policy uncertainty.

The base case has to be continued soft landing but with massive sensitivity and an open mind to adjust the view quickly based on incoming post-Liberation Day data. The slow bleed in the Conference Board Jobs data and Initial Claims is reason for concern, but not panic.

Final thoughts

In case you missed yesterday's am/FX, might be worth making a Post-It Note on your desk that reads: PIE repeal headlines are mega bearish USD.

Author

Brent Donnelly

Spectra Markets

Brent Donnelly is the President of Spectra Markets. He has been trading currencies since 1995 and writing about macro since 2004. Brent is the author of “Alpha Trader” (2021) and “The Art of Currency Trading” (Wiley, 2019).