Jerome Powell falters US inflation disaster

Fed still talks of this as transitory, and in any case we can control it so it doesn't become entrenched?

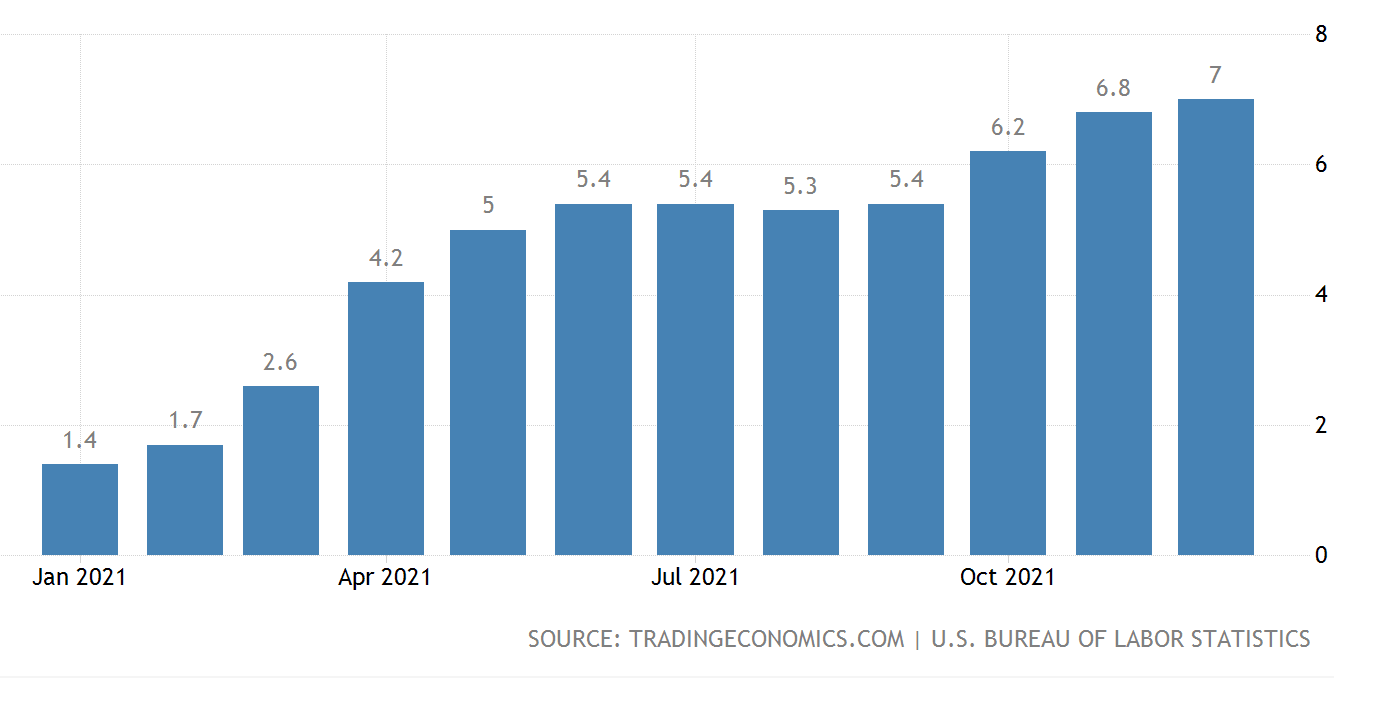

What is not entrenched about the chart below?

We discussed a few days ago how the data is clearly showing the US is already in a wages/inflation self-generating spiral.

The absolute numbers, seriously, 7.0%, could not be more catastrophic.

CONCLUSION:

Jerome Powell is not up to the job.

Here is an idea; let's all just look the other way?

No. Not happening.

The market cannot ignore this.

The market will crash.

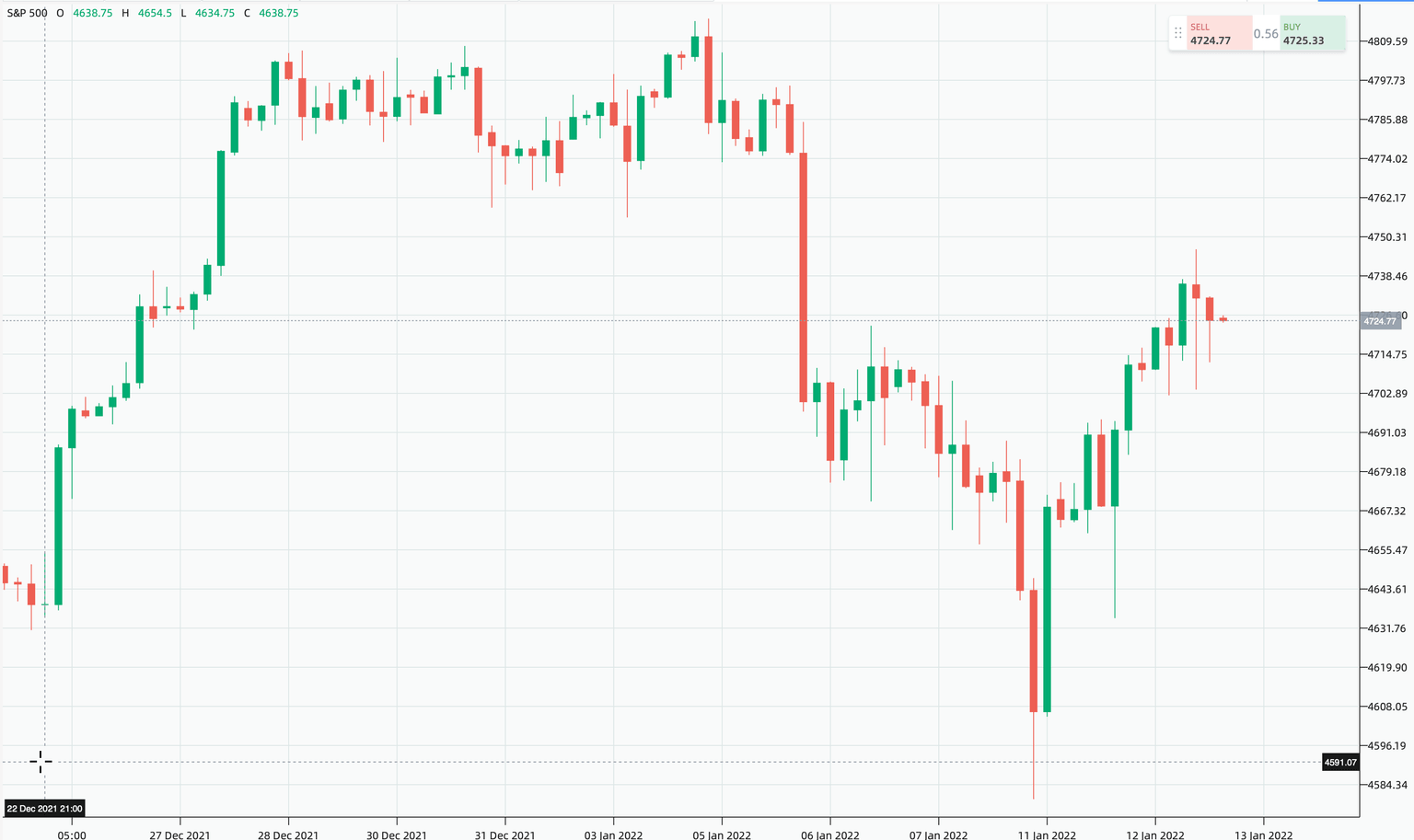

SP500 Index 4 hourly chart

The price action is showing stall, rather than a further relief rally that could have been expected. This price action is sending a silent warning message.

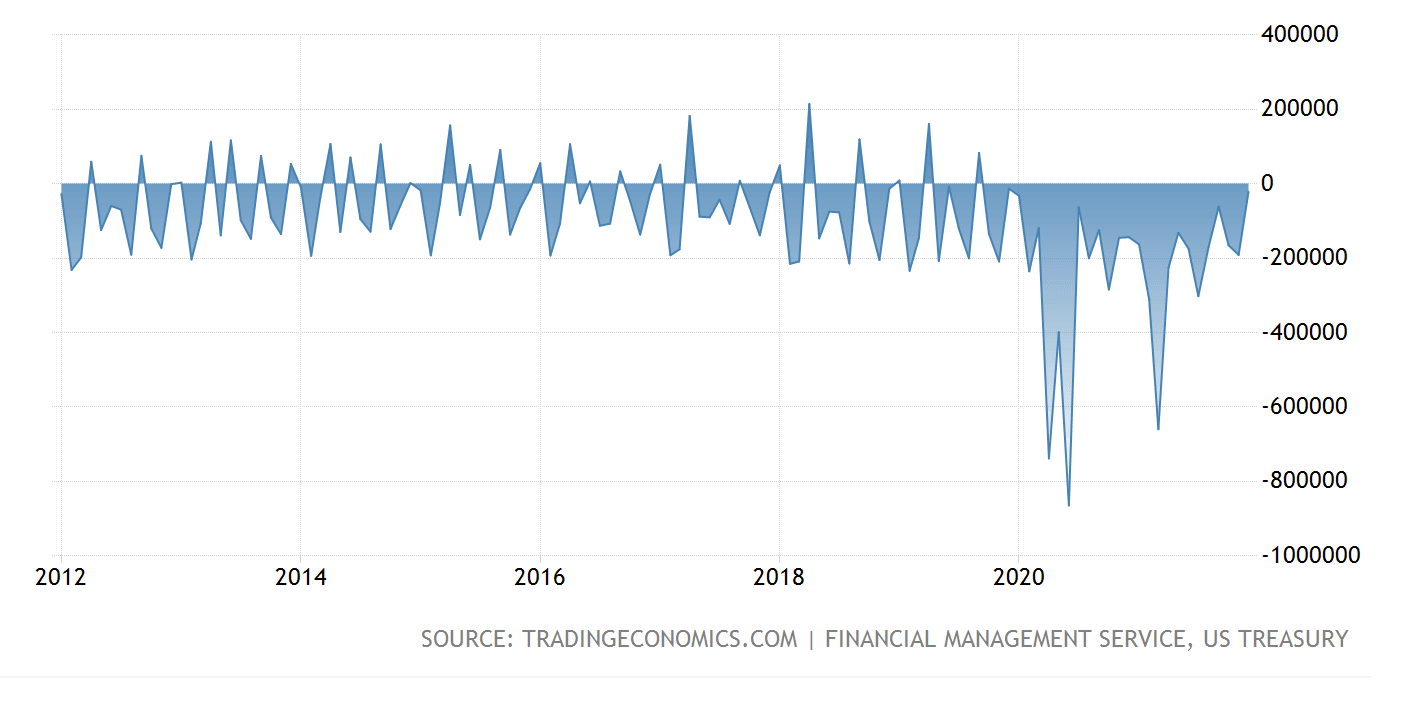

US Budget Deficit

Moving gradually back toward more normal territory and volatility.

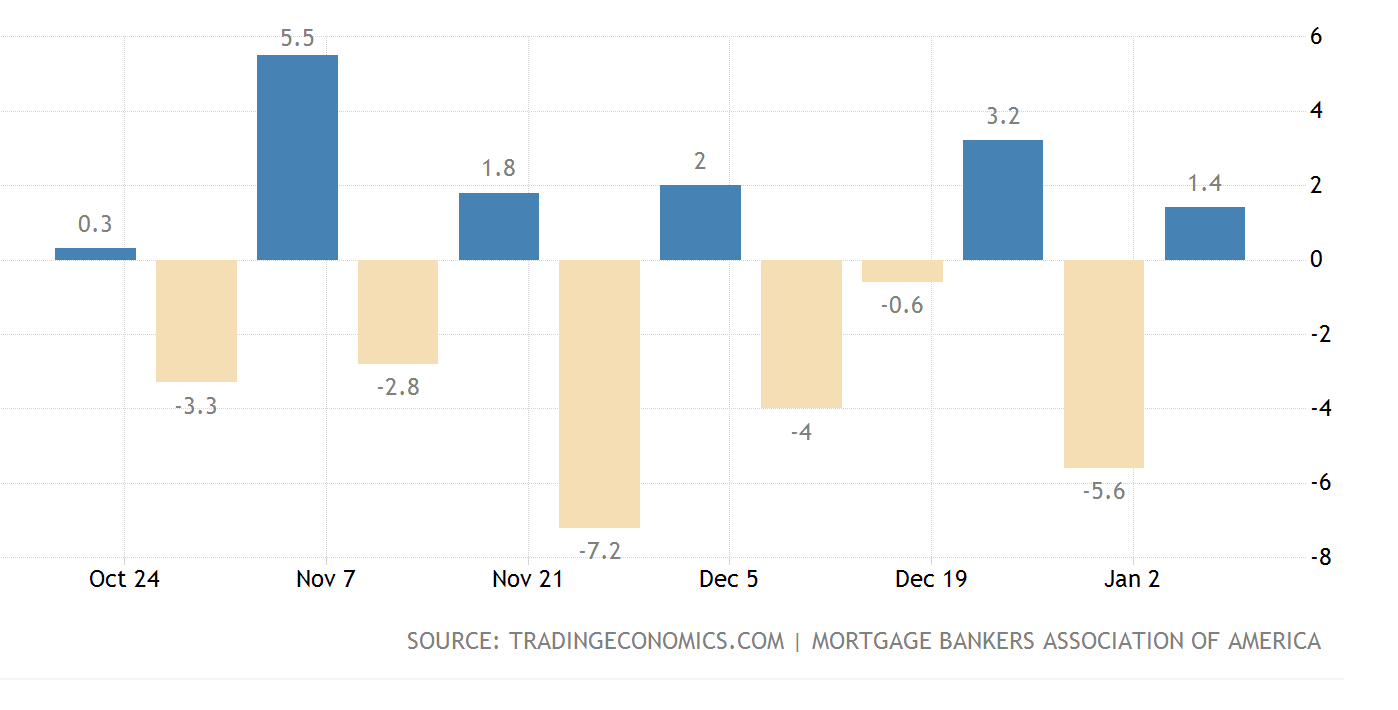

US Mortgage Applications.

Again, the bounces are very modest indeed against the sharp drops in this see-saw series. The heat continues to rapidly come out of the housing market.

The US inflation relief rally was definitely seen on the currency front. How this is driven is that all the US dollar longs waiting for an easy profit on the inflation result, or perhaps an even bigger number found themselves all needing to exit at the same time.

This Euro rally could stall out here in much the same way as I am looking for in US stocks.

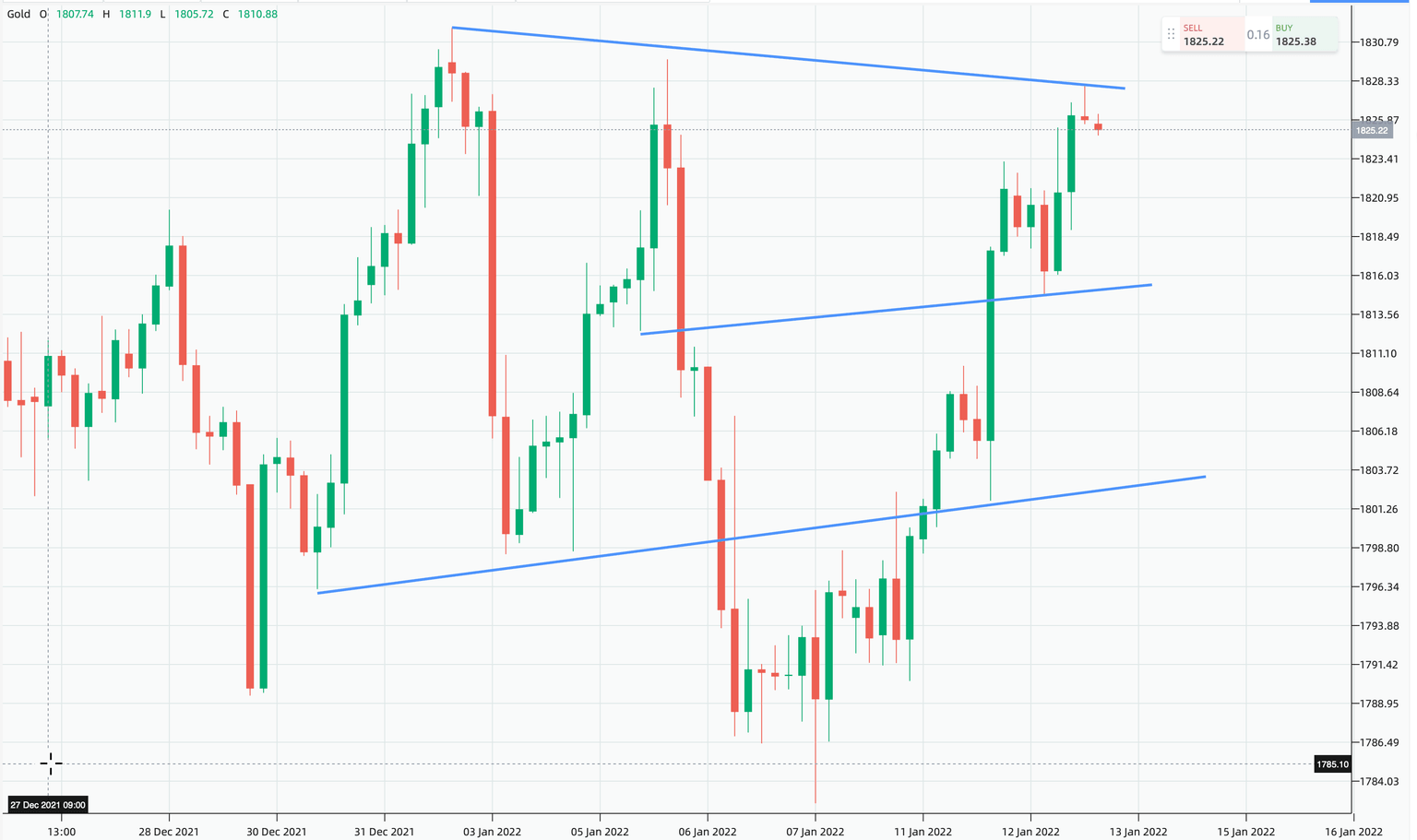

Gold 4 hourly chart.

Our favourite investment continues to build very nicely indeed.

Have the best of days,

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a