Japanese yen falls as BOJ leaves rates unchanged

The Japanese yen declined slightly after the Bank of Japan delivered its interest rate decision. As was widely expected, the bank left interest rates unchanged at -0.10%. The bank also left its yield curve control program intact and continued with its aggressive quantitative easing program. On the QE, the bank is acquiring government bonds, corporate bonds, and real estate investment trusts. The goal of corporate purchases is to prevent bankruptcies and boost asset prices at a time when the economy is going through its worst recession in years. Later this week, we will receive interest rates decision from the Swiss National Bank, Norges Bank, and Bank of England.

The Australian dollar rose after the RBA released the minutes of the meeting held earlier this month. In the minutes, the bank’s officials said that it would leave the current monetary policy in place until progress is made on employment and inflation. The two are in a dire state, with the unemployment rate rising and inflation falling. The bank also warned that even with the reopening, the outlook remained highly uncertain and that the pandemic would have long-lasting effects on the economy. In addition, the bank will be ready to make additional purchases as needed.

The economic calendar will be heavy today with important economic data from around the world. In Switzerland, the State Secretariat for Economic Affairs (SECO) will release its economic forecasts. These forecasts come two days before the SNB’s rates decision. In the UK, the ONS will release the April employment numbers while in Germany, the statistics office will release the inflation data. In the United States, the bureau of statistics will release the May retail sales numbers while the Fed chair will have a speech. Finally, the American Petroleum Institute will deliver its weekly inventory update.

EUR/USD

The EUR/USD pair bounced back in overnight trading as risk aversion ended. The pair is trading at 1.1345. On the four-hour chart, this price is inches above the 25-day and 50-day EMAs. The pair has also formed a three white soldiers pattern, which is usually a bullish sign. The likely scenario is that the pair continues to rally today as bulls attempt to test the previous high at 1.1420.

USD/JPY

The USD/JPY pair rose to an intraday high of 107.62 after the BOJ decision. On the four-hour chart, the price is slightly below the 61.8% Fibonacci retracement level. It is also slightly below the 50-day and 100-day exponential moving averages. Most importantly, the price has moved slightly above the previous resistance at 107.56. Therefore, there is a likelihood that the pair will continue rising as bulls attempt to test 108.

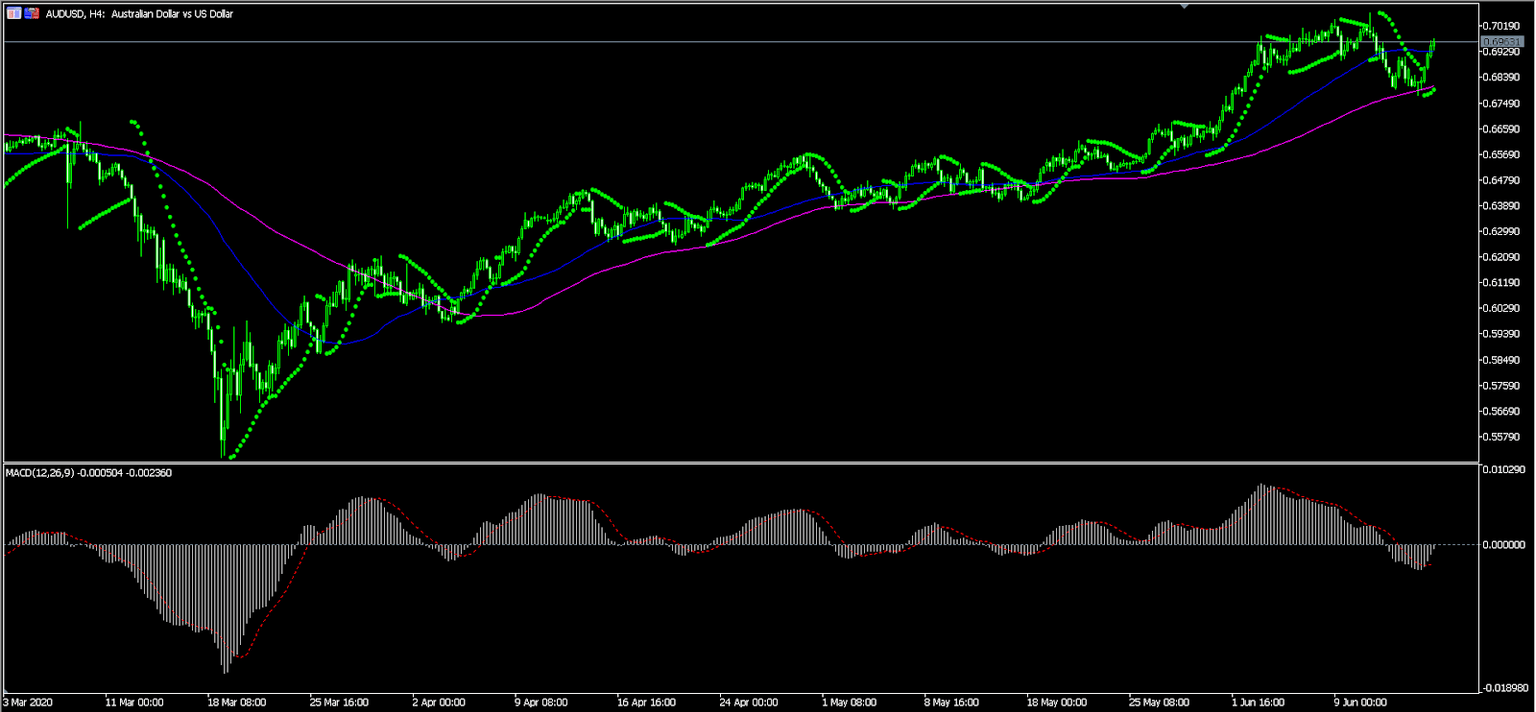

AUD/USD

The AUD/USD pair rose to an intraday high of 0.6980, which is the highest it has been since June 11. On the four-hour chart, the price is above the 50-day and 100-day exponential moving averages. The signal and histogram of the MACD has almost turned positive while the dots of the Parabolic SAR are below the price. This means that the price may continue rising as bulls attempt to move above 0.7000.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.