January inflation scorches US markets: Fed cornered on rate increases

- Consumer Price Index jumps to 7.5%, core rises to 6%.

- Treasury rates soar, equities tumble on four decade inflation record.

- 2-year yield rockets 24 points, 10-year adds 11 points.

- Dollar gains, falls sharply, then reverses on Fed comments and futures.

The reasons behind skyrocketing US inflation are many.

Labor shortages and lockdown policies, a tangled global supply chain, just-in-time manufacturing, deferred consumer demand, a central bank that kept the monetary pedal floored far too long and profligate Washington spending, all these, and many others, played a part. Behind everything is the pandemic that has scrambled nearly every part of global life for the past two years.

The culprits are many also.

Congress, the Federal Reserve, state governors and legislators, the Center for Disease Control, the Trump and Biden administrations, the list can be long or short as one likes and twisted to any political preference.

Yet among all the guilty, only one will be expected to do anything to correct the situation–the Federal Reserve.

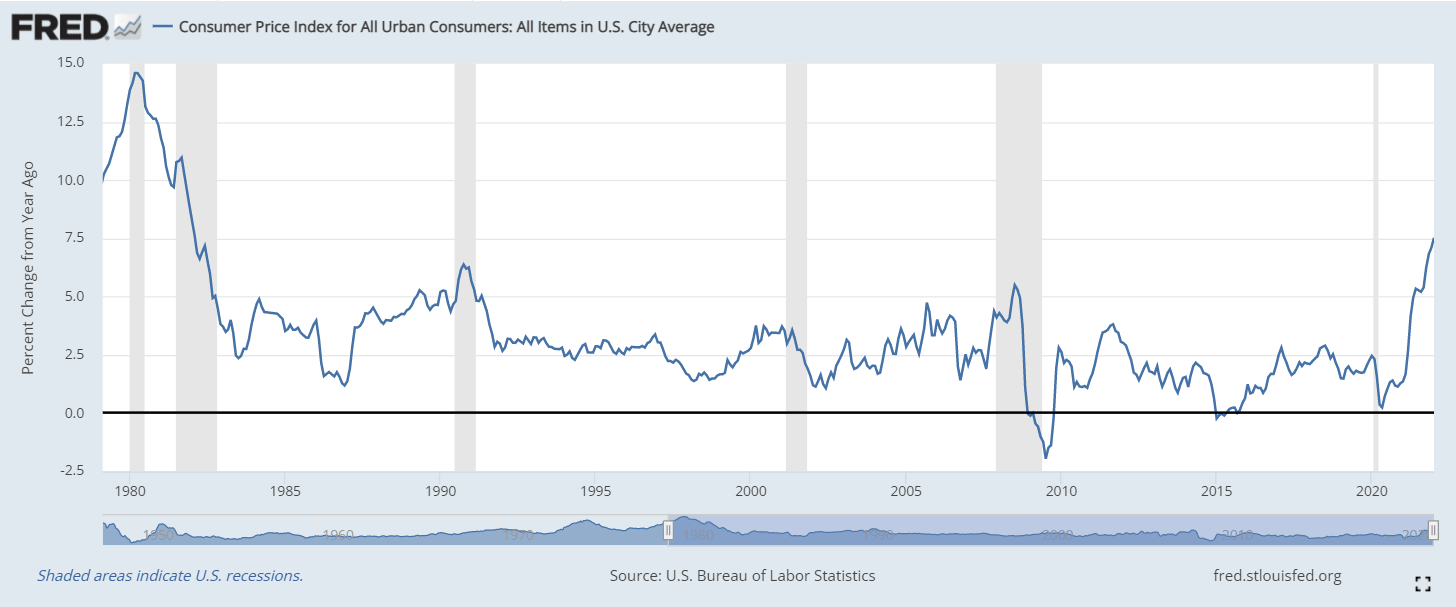

CPI

Consumer prices climbed 7.5% on the year in January, up from December’s 7%, as US inflation conditions continue to worsen. It was the fifth monthly rise in a row, and the highest annual rate since February 1982 The consensus estimate for the Reuters survey was 7.3%.

The Core Consumer Price Index (CPI), which excludes food and gasoline, rose to 6% from 5.7% in December and just ahead of the 5.9% forecast. Monthly increases were 0.5% for the general index and 0.6% for core.

Markets

Markets reacted immediately to the CPI data as traders priced in a more aggressive rate policy from the Federal Reserve this year.

Equities fell hard with the Dow down 526.47 points, 1.47% to 35,241.59. The S&P 500 shed 1.81%, 83.10 points to 4,504.08. The Nasdaq was the big loser falling 2.10%, 304.73 points to 14,185.64.

Treasury returns climbed steeply across the entire yield curve. The return on the 2-year Treasury soared 24 basis points to 1.59% bringing it back to the level of December 2019. The commercial benchmark 10-year note rose 11 points to 2.035%, its first close above 2% since July 2019. The 5-year added 15 basis points to yield 1.95% and the 30-year return rose 7 points to 2.30%. Yields on all durations except the 30-year long bond are now higher than where they were at the start of the Covid pandemic in March 2020.

CNBC

Currency traders initially responded in line with rising Treasury yields, sending the dollar higher in every major pair. The euro dropped from 1.1436 to 1.1375 in the first hour after the 8:30 am New York release. The USD/JPY rose from 115.80 to 116.34 and the sterling fell from 1.3579 to 1.3523. The USD/CAD rose from 1.2677 to 1.2719.

The dollar gains were short lived. In the next two hours, the dollar lost all in every pair except the USD/JPY. The EUR/USD climbed more than a figure from 1.1385 to 1.1495. The sterling ascended from 1.3527 to1.3644 and the USD/CAD sank from 1.2714 to 1.2636.

After the London close, a dollar revival may have been helped by comments from St Louis Fed President James Bullard, a well-known inflation hawk, that the bank should raise the fed funds rate 100 basis points by July 1, which would entail at least one 0.5% increase over three FOMC meetings.

A rapid migration of opinion in the Treasury futures market assisted the greenback's return.

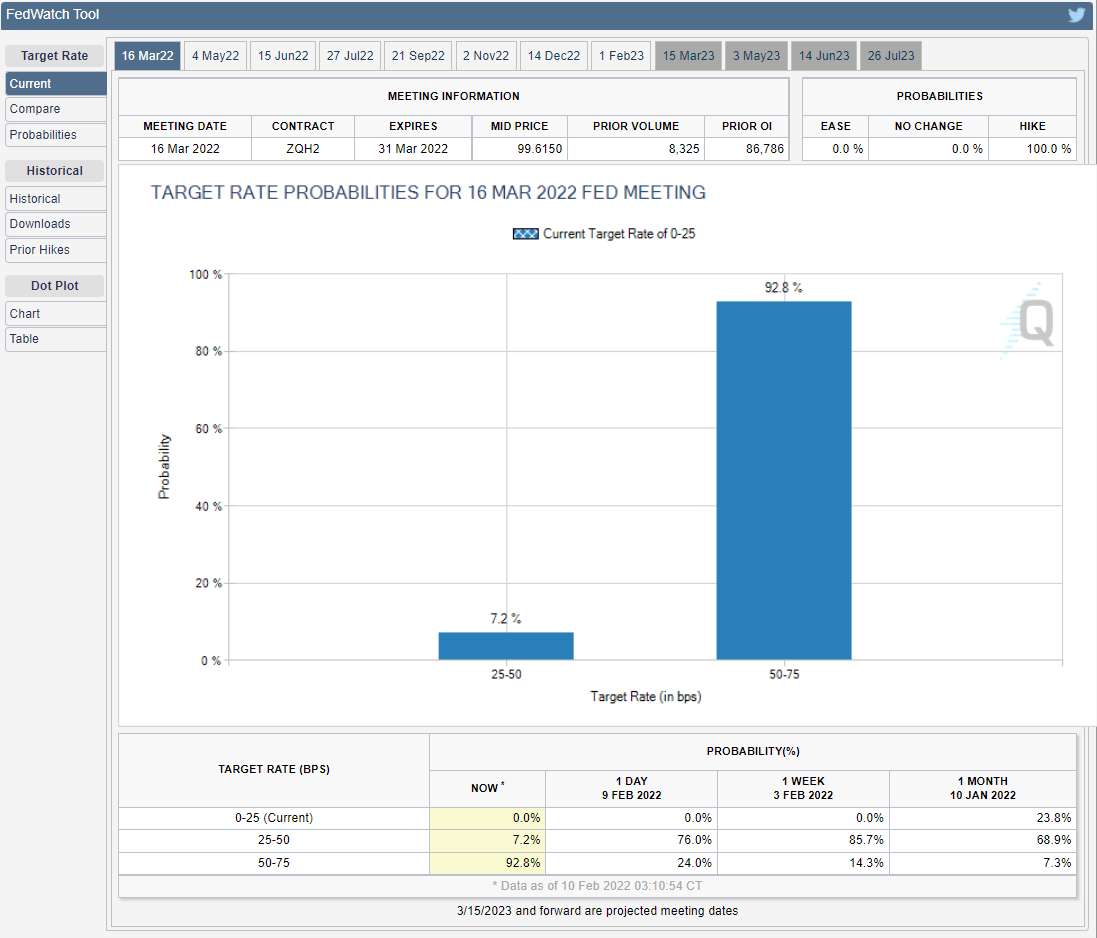

Yesterday, the fed funds futures had rated the odds of a 0.5% increase in the US base rate at the March 16 Federal Open Market Committee (FOMC) meeting at 24%.

On Thursday afternoon, the same Chicago Mercantile Exchange (CME) FedWatch Tool, listed the odds at 92.8%.

CME

By Thursday's close the dollar was higher against all majors except the sterling.

Conclusion

The pressure on the Fed to raise the fed funds rate 0.5% at the March 16 FOMC may have become irresistible. The remaining inflation reports before that meeting, January’s Producer Price Index (PPI) and Personal Consumption Expenditure Price Index on February 15 and 25 and the February CPI numbers on March 10 and PPI on 15 are not going to alter the situation in the least

Over the past six months PPI has led the overall inflation rate. December PPI was 9.7% and is forecast to rise to 9.8% in January. The PCE Price Index has followed the direction of CPI, reaching new records just as the older index has.

Even at the risk and onus of inducing a stock market correction and a slowdown in the economy, the Fed governors have little choice but to try to remedy an economic problem that has many authors.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637801335837489639.png&w=1536&q=95)

-637801277701905374.png&w=1536&q=95)

-637801383777054045.png&w=1536&q=95)