It's a FOMC day

- Silver takes for infinity and beyond!

- The markets look to see what the FOMC has to say...

Good Day... And a Wonderful Wednesday to you! A wonderful night of getting together with some of my former colleagues Monday night... I always get a kick out of seeing that Wily Old Veteran, and of course Frank Trotter! Who's the Wiley Old Veteran I hear you asking? My old softball teammate, Jack Milner! I came home Monday night, and realized I hadn't eaten anything... I scoured the pantry, and came up with zilch, so I just went ahead and went to bed... note for next year... eat before you go! Marcus Anderson greets me this morning with his version of the song: A Few Of My Favorite Things...

So... The dollar, which when I signed off on Monday was getting sold, turned its red figure around on Monday and ended up gaining 1 index point to 1,214... Tuesday brought about drifting along in the dollar... The dollar continued to trade all day, at 1,214 in the BBDXY... The euro remains in the 1.16 handle, as it awaits further movement in the dollar. The real Big Kahuna mover yesterday was Silver... Silver gained $2.42 and closed the day above $60! It wasn't that long ago that some naysayers were calling for a Top in Silver... They are nowhere to be seen or heard now...

Gold also gained but Silver outperformed Gold once again... Gold gained $18 to close at $4,209.. It was at this level on Monday morning, before the SPTS took their pound of flesh from Gold... So, one step back and one step forward for Gold, so in my mind this has to end at sometime, and then Gold can move upward once again without having to repeat previous day's levels... I'm just saying...

The price of Oil seems to be range trading these days, between $58 and $60... Every time it bumps higher to $60 it gets slammed back down... So, $60 is the line in the sand for Oil right now, I still believe that Oil should be priced higher, but then that's just me...

The 10-year Treasury bond is really adding to its yield these days, as it ended yesterday trading with a 4.19% yield... I've gone over what I think the bond boys are doing here, so I won't repeat myself... At least this time! HA!

In the overnight markets last night... the 10-year's yield bumped up another basis point to 4.20% yield... The Dollar saw a bit of selling overnight, and the BBDXY lost 1 index point to 1,213... I don't think we'll see much movement in the dollar until the Fed/ Cabal/ Cartel speaks today... The price of Gold is seeing some SPT action to prep for the rate cut... I aways say that the SPTS sell Gold ahead of the rate cut announcement so that it has to start from a lower basis... But Silver is back on the buyers' shopping list this morning and is up 51-cents!

Silver really took the ball and ran with it yesterday, right around the end and down the sideline to the HOUSE! It didn't take Silver that long to go from $50 to $60, and from here on out, I don't think the timeline will be stretched in any imagination regarding how long takes Silver to go to $70, and infinity and beyond!

Yahoo Finance is reporting that there could be 5 dissident rate cut voters at the FOMC meeting today... My Golly, that seems to be a lot! And makes me question why, if that is the case, would the FOMC go ahead and cut rates? 5 naysayers to all that favor a rate cut say "AYE"... That seems like too many for me, but then I think with logic and not utopian thoughts like the Fed Heads...

If they do go ahead and cut rates this afternoon, I suspect the Fed Heads will temper the enthusiasm of a rate cut by talking about the need for further rate cuts will be data driven... That should keep the dollar from falling a lot... And that is important to the Fed Heads... But it will be yet another debasing of the dollar, and with the money supply continuing to grow, a rise in inflation it right around the corner folks... Are you ready?

The Chinese renminbi has really been allowed to move higher VS the dollar in recent times... I don't know what the Chinese's end game with the renminbi is here, but allowing it to move stronger VS the dollar is a shift in their position... I'm just saying...

The SPTs are still taking measure of Copper... After reaching $5.47 on Monday, Copper dropped to $5.33 Monday and Tuesday... The fundamentals are still the same, the shortage of Copper is very real and playing into the price, but the SPTs have found a new whipping boy... UGH!

One of the things that caught my attention on Monday was an article on Kitco.com that talked about how Gold & Silver were getting sold because of the thought that the FOMC would be hawkish with their statement, even after cutting rates... Oh, so the Fed/ Cabal/ Cartel are going to say, "This is the last rate cut for this cycle"? I doubt that very much... I guess we'll have to wait-n-see tomorrow afternoon, when all the board games are put away, and the FOMC announces their decision along with any further comment they may want to opine about...

And once again, I want to point out that Kitco.com won't talk about price manipulation in the metals, so they have to come ups with some reason why the metals are down...

And then Monday night when I arrived home and turned on my laptop, I saw this Headline: Di Martino Booth says the Fed is Trapped.... Ok, so longtime readers know that I used to quote Danielle Di Martino Booth in the Pfennig. She's a former assistant to the Fed Gov in Dallas and had the inner workings of the Fed at her fingertips... So... I just had to check out what she was saying... Here's a snippet: "the Federal Reserve is in a "trap" or "impossible dilemma", primarily because its policies have created systemic vulnerabilities that limit its ability to respond effectively to new crises without causing a market crash.

In essence, she views the Fed as being caught between its mandate to control inflation and the need to maintain financial stability, a position she believes has left the institution "trapped" with no good options. You can find more of her analysis through her company's website, Quill Intelligence, or her Substack newsletter. "

Chuck again... What's the way out of this trap? There is no way out... Unfortunately... this is the dilemma that we as investors are going to have to face... Of course, there's a different viewpoint and it comes from Enrique Abeta from Paradigm Press, says that on Dec 10th at 2 pm, the stock market will start new "melt up"... So, figure out which one you want to follow...

That day and time tunes into the day and time the FOMC will make their rate announcement... So, the rate announcement is a BIG Cookie here...

I'm not going to go further, because I'm no stock jockey, and I don't want to get in trouble talking about stocks... But to me, cutting rates while inflation is still higher than your target rate of 2%, is like playing chicken... Somebody is going to lose... and to me, it's the consumers, investors, and mom and pops... And that, I would be willing to bet a shiny quarter on...

The U.S. Data Cupboard is basically empty this week, with the FOMC meeting the Big Cookie to view... There will be a report on the 3rd QTR Employment Cost Index today, ahead of the FOMC announcement... So, there's that... But it's all about the FOMC meeting announcement this afternoon, so get set, get ready, and go!

To recap... The dollar traders are really sitting on their collective hands these days, not giving the dollar any true direction, and so the BBDXY remains around 1,214... The euro remains above the 1.16 level, and all the other currencies are falling in line behind the Big Dog euro. Silver really kicked some tail and took names later yesterday, gaining over $2 on the day and ending the day above $60.

For What It's Worth... I went to the well again for his article from my friend, Dave Gonigam and his 5 Bullets that a reader gets sent when they subscribe to one of the Paradigm Press newsletters...

Here's your snippet: "Wall Street has slipped into neutral — as it often does ahead of a Federal Reserve decision.

The Fed’s Open Market Committee convened this morning for one of its every-six-weeks meetings to set policy.

There’s no drama about the decision: Tomorrow afternoon the Fed will lower the benchmark fed funds rate another quarter percentage point to 3.75%. That’s down from a peak of 5.5% less than 18 months ago.

But there will be big drama going into that decision: “This meeting promises to be one of the most divisive at the board level since the 1980s,” says Paradigm macro maven Jim Rickards.

“There are only two ways to vote on an interest rate decision — yes or no. But there are three distinct views among the board members.

“A group of doves led by Stephan Miran, recently appointed by President Trump, not only want to cut rates but are pushing for a larger rate cut of 0.50%. Board members Michelle Bowman and Christopher Waller lean in that direction.

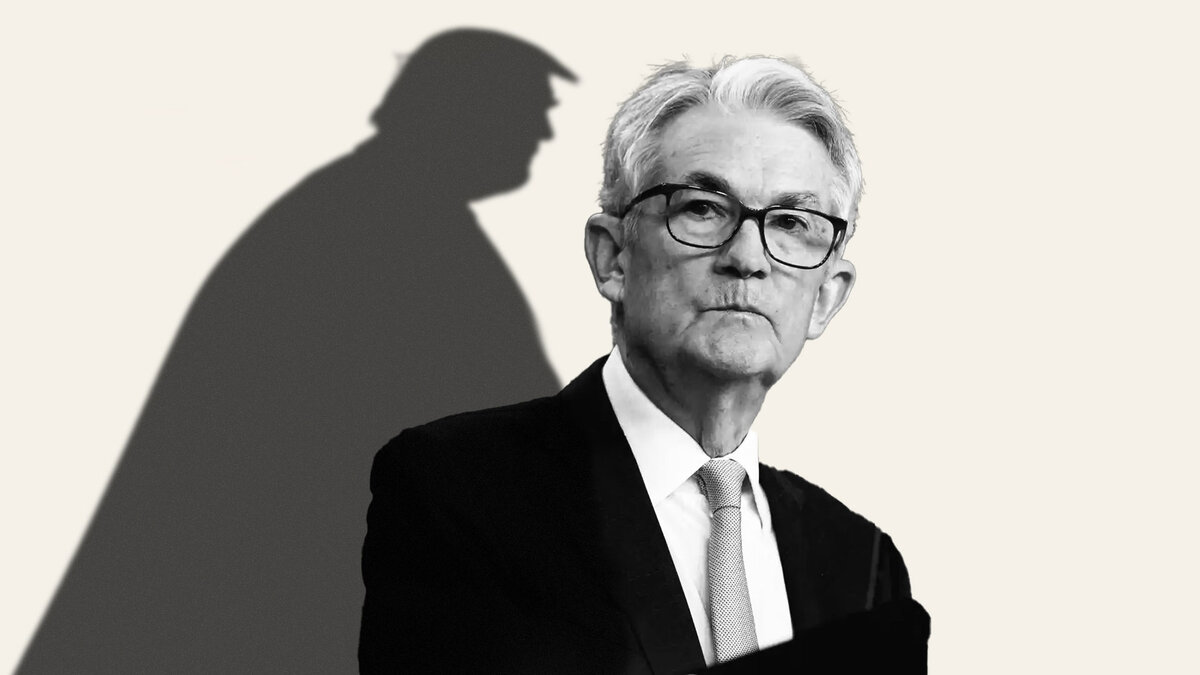

“A group of hawks led by Kansas City Federal Reserve Bank President Jeff Schmid and a large group (described as ‘many’ in recent FOMC minutes) favor no rate cut. A centrist group led by Chair Jay Powell and other governors including Phil Jefferson, Michael Barr and Lisa Cook support the 0.25% rate cut, although some may lean in a hawkish direction.

“The result may be an 8-4 vote in favor of the 0.25% rate cut where the four dissenters are of two different minds — some supporting a larger cut and some supporting no cut at all.

“The takeaway will not be about interest rate policy but about Powell’s loss of control of his own board. That will clearly weaken Powell’s role in early 2026 and accelerate the timing of Powell’s replacement. In effect, Powell will be a lame duck chair.”

Reminder: Powell’s term is up next May. Usually, markets hang on every word uttered by a Fed chair during the post-meeting press conference. But maybe not this time?

Stay tuned…:

Chuck again... Dave does an outstanding job with his letter and gives me lots of ideas and thoughts...

Market Prices 12/10/2025: American Style: A$.6649, kiwi .5787, C$.7223, euro 1.1640, sterling 1.3316, Swiss $1.2431, European Style: rand 16.9992, krone 10.1374, SEK 9.3225, forint 329.68, zloty 3.6295, koruna 20.8366, RUB 77.77, yen 156.71, sing 1.2959, HKD 7.7815, INR 89.96, China 7.0633, peso 18.18, BRL 5.4327, BBDXY 1,1213, Dollar Index 99.13, Oil $58.59, 10-year 4.20%, Silver $61.11, Platinum $1,673.00, Palladium $1,509.00, Copper $5.39, and Gold... $4,199

That's it for today... I met a young lady from Chicago Monday night, at the Mark Twain Gathering, she is the FX person at 5th 3rd bank in Chicago... She wanted to know what I wrote about, and I told her: Currencies, metals, economies and dolts.... of which the Fed Heads qualify for... That made her laugh... My beloved Mizzou Tigers football team will play in the Gator Bowl on 12/27 VS Virginia... The Gator Bowl is in EverBank Field, and it would be a hoot to get to go, but airfare is outrageous! Kenny G takes us to the finish line today with his version of the song: Silver Bells... I hope you have a Wonderful Wednesday today, and Please Be Good To Yourself!

Author

Chuck Butler

The Aden Forecast

Chuck has a long history of being associated the investment markets. He started in a regional brokerage firm in 1973, and it was just like the act of Nixon taking the U.S.