ISM Services PMI Preview: Strength may spook markets, boosting US Dollar

- Economists expect the ISM Services PMI to remain above 50, a sign of persisting expansion.

- Growth in America's largest sector implies "sticky" inflation is strong and more rate hikes are needed.

- Stocks may sink and the US Dollar could rise unless the data shows softening price pressures.

Shop until you drop – the restless US consumer should never be underestimated, and fresh strength from services activity, America's largest sector, also warrants caution. The Federal Reserve (Fed) fears an acceleration of "sticky" inflation, and any positive surprise in the sector’s performance may spook the bank and markets. For the US Dollar, it may mean another boost.

Here is a preview for the ISM Services PMI, due on Wednesday at 14:00 GMT.

Why is ISM Services PMI important?

The services sector is roughly 70% of the US economy – the world's largest. The Institute for Supply Management (ISM) publishes a highly regarded Purchasing Managers' Index (PMI) for the sector every month, providing a forward-looking view on the economy. The data is based on a survey of supply executives in the US services sector, who are asked to assess the conditions of their business in the reporting month.

When the data is released before the Nonfarm Payrolls (NFP) report, it tends to serve as a leading indicator toward it. This time, jobs figures will have been out for five days, giving the ISM Services PMI its own space.

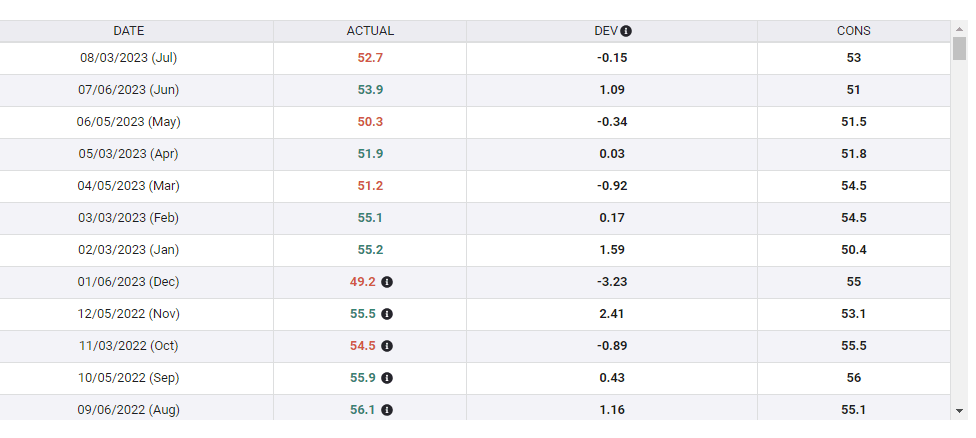

The sector has been expanding in 37 of the past 38 months, scoring over 50 points in the ISM Services PMI. The single dip came in December 2022, and since then it has been hovering above that threshold, scoring 52.7 points in the last read for July. August’s figure is expected to be almost identical – 52.6 points.

ISM Services PMI in the past year. Source: FXStreet.

The indicator is not only important due to the sector's size, but also because of the current focus of the Federal Reserve. The world's most important central bank is busy fighting inflation, and more specifically, "non-shelter core services" price rises. In plain words, everything except manufacturing and housing.

These are usually labor-intensive areas, where higher wages tend to hold up after jumping, and refuse to fall down. That is what makes inflation stemming from services "sticky". Only a greater moderation – or even a mild recession – could bring prices back in line. The key ISM Services Prices Paid subindex, which came at a strong 56.8 in July, will be key to see how persistent price pressures are.

Economic activity in the sector remains stubbornly high, meaning sticky inflation is hardly retreating. If economists' projections are right and the ISM Services PMI holds up above 52 points, rate cuts will likely have to wait for longer. Markets will not like it.

While companies want a strong economy to thrive, their stocks need lower interest rates to become more attractive. For the US Dollar, there is room for further gains, as it would show that the American economy continues outperforming.

ISM Services PMI scenarios to consider

My baseline scenario is for expectations to materialize and for markets to shiver. Still, there are other scenarios to consider.

The happy path for investors would be a drop toward 50 points, the "Goldilocks" zone, which would signal that services activity is cooling but not freezing. This scenario would lift stocks and weigh on the US Dollar.

A big plunge below 50 and especially under 48 – highly unlikely – would scare investors as it would show a rapid deterioration in business activity. In this case, funds would likely flock to the US Dollar as a safe haven.

The other extreme scenario is a jump to 55 or even above that level, an outcome with a low probability. In such a case, the moves described in the baseline scenario would be amplified – an even quicker stock plunge and a more rapid rally for the US Dollar.

Final thoughts

The ISM Services PMI has a tendency to catch traders off guard, triggering significant volatility, which is already elevated. Any surprise may cause massive moves.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.