ISM Manufacturing PMI Preview: High inflation component steal the show, boost dollar

- US ISM Manufacturing PMI is set to show slower growth in June.

- The inflation component is critical and low expectations may lead to an upside surprise.

- Risk-aversion ahead of the weekend could compound dollar strength.

First Nonfarm Payrolls hint – that is how I used to describe the US ISM Manufacturing Purchasing Managers' Index (PMI). Not this time. While the indicator also provides an insight into the jobs report, the focus this time will undoubtedly be on inflation – the other mandate of the Federal Reserve, and currently the overriding priority.

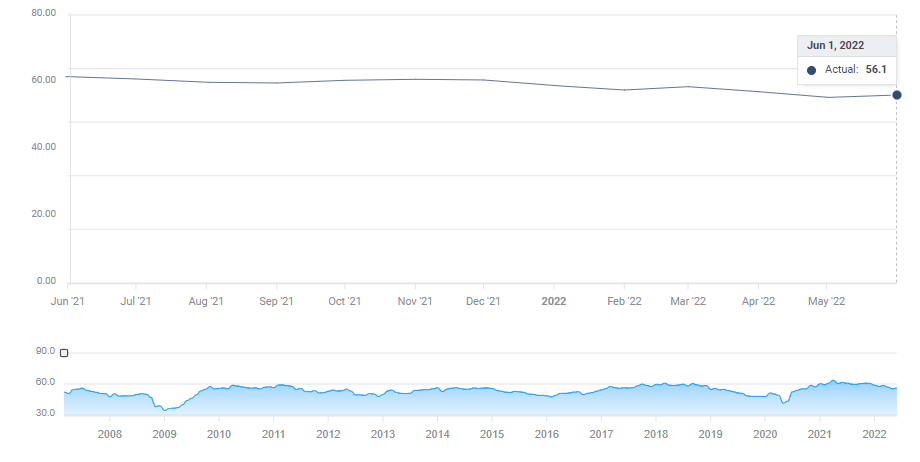

The headline Manufacturing PMI is set to decline from 56.1 point in May to 55 in June, reflecting slower growth and lower expectations from businesses in the industrial sector. Nevertheless, any score above 50 still represents expansion. The dollar would react negatively to the headline only if it tumbles below that 50-point threshold:

Stable but eroding growth in the headline ISM Manufacturing PMI:

Source: FXStreet

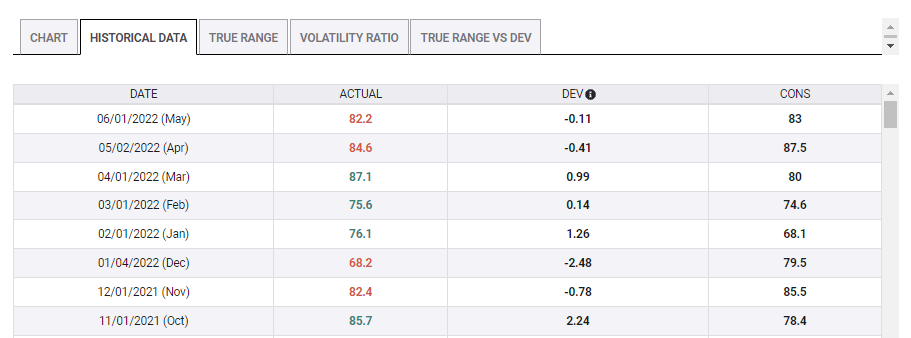

The more important data point is Prices Paid, which is a snapshot of purchasing managers' inflation expectations. The economic calendar is pointing to a slide from 82.2 to 80.5 points. However, with rising prices being on everybody's minds – television sets and gas stations serving as billboards – there is room for an upside swing rather than a downside one.

Moreover, the most recent Consumer Confidence survey by the Conference Board showed an uptick in one-year inflation expectations, from 7.5% to 8%.

Perhaps the most convincing argument I have for the upside is found by examining recent publications. It seems that economists adapt themselves to recent surprises – either expecting a high Prices Paid figure when the data is elevated in the previous month, or projecting a weak number after a miss.

Source: FXStreet

High inflation expectations in the manufacturing sector may lead markets to expect a similar outcome in the services sector PMI released next week. Moreover, the central bank is watching as well. Fed Chair Jerome Powell has mentioned forward-looking inflation expectations figures as critical to his decision-making process.

A higher Prices Paid figure means a stronger dollar in anticipation of a faster increase in interest rates.

Another reason to expect the greenback to gain ground is the general trend in its favor, boosted by Powell, who said it would be a bigger mistake to allow prices to rise quickly and his hint that he would accept a recession.

Final thoughts

Inflation, not employment, is what matters in the ISM Manufacturing PMI. Any small beat would extend the uptrend in the dollar, especially as the weekend draws near and end-of-month flows have been cleared.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.