ISM drops to lowest level since May 2020, new orders plunge into contraction

The September ISM report is much weaker than expected, with employment, new orders, and new export orders all in contraction.

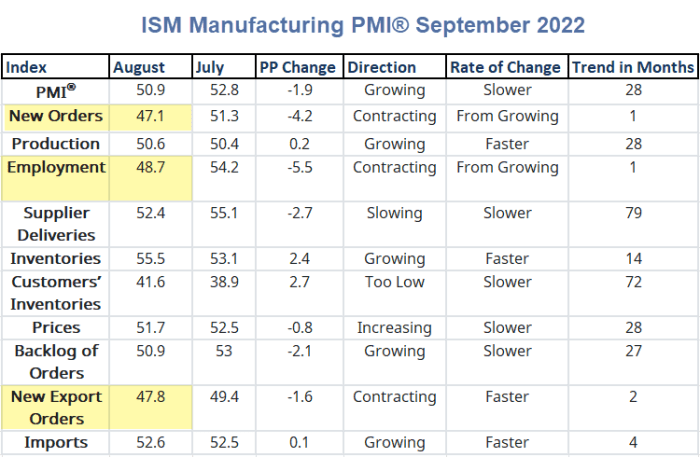

ISM table and synopsis by permission

Please consider the Manufacturing ISM® Report On Business® for September 2022.

Manufacturing PMI® details

- “The September Manufacturing PMI® registered 50.9 percent, 1.9 percentage points lower than the 52.8 percent recorded in August.

- The Manufacturing PMI® figure is the lowest since May 2020, when it registered 43.5 percent.

- The New Orders Index returned to contraction territory at 47.1 percent, 4.2 percentage points lower than the 51.3 percent recorded in August.

- The Production Index reading of 50.6 percent is a 0.2-percentage point increase compared to August’s figure of 50.4 percent.

- The Prices Index registered 51.7 percent, down 0.8 percentage point compared to the August figure of 52.5 percent. This is the index’s lowest reading since June 2020 (51.3 percent).

- The Backlog of Orders Index registered 50.9 percent, 2.1 percentage points lower than the August reading of 53 percent.

- After a single month of expansion, the Employment Index contracted at 48.7 percent, 5.5 percentage points lower than the 54.2 percent recorded in August.

- The Supplier Deliveries Index reading of 52.4 percent is 2.7 percentage points lower than the August figure of 55.1 percent. This is the index’s lowest reading since before the coronavirus pandemic (52.2 percent in December 2019).

- The Inventories Index registered 55.5 percent, 2.4 percentage points higher than the August reading of 53.1 percent.

- The New Export Orders Index contracted at 47.8 percent, down 1.6 percentage points compared to August’s figure of 49.4 percent. This is the index’s lowest reading since June 2020, when it registered 47.6 percent.

- The Imports Index remained in expansion territory at 52.6 percent, 0.1 percentage point above the August reading of 52.5 percent.”

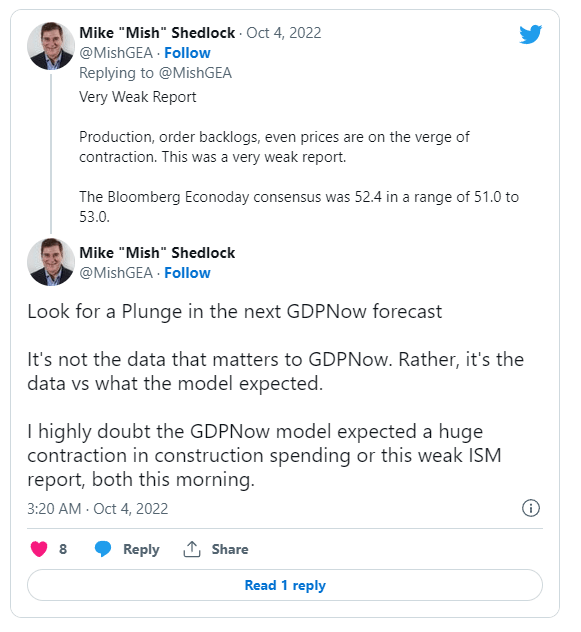

Very weak report

Production, order backlogs, even prices are on the verge of contraction. This was a very weak report.

The Bloomberg Econoday consensus was 52.4 in a range of 51.0 to 53.0.

GDPNow impact

On September 30, I noted GDPNow for the 3rd Quarter Surges Following Strong Trade, Inventory, and Income Reports

It's not the data that matters to GDPNow. Rather, it's the data vs what the model expected.

I highly doubt the GDPNow model expected a huge contraction in construction spending or this weak ISM report, both this morning.

For additional details, please see Construction Spending Unexpectedly Dives 0.7 Percent in August With Negative Revisions.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc