Is the USD/CAD ready for a pullback?

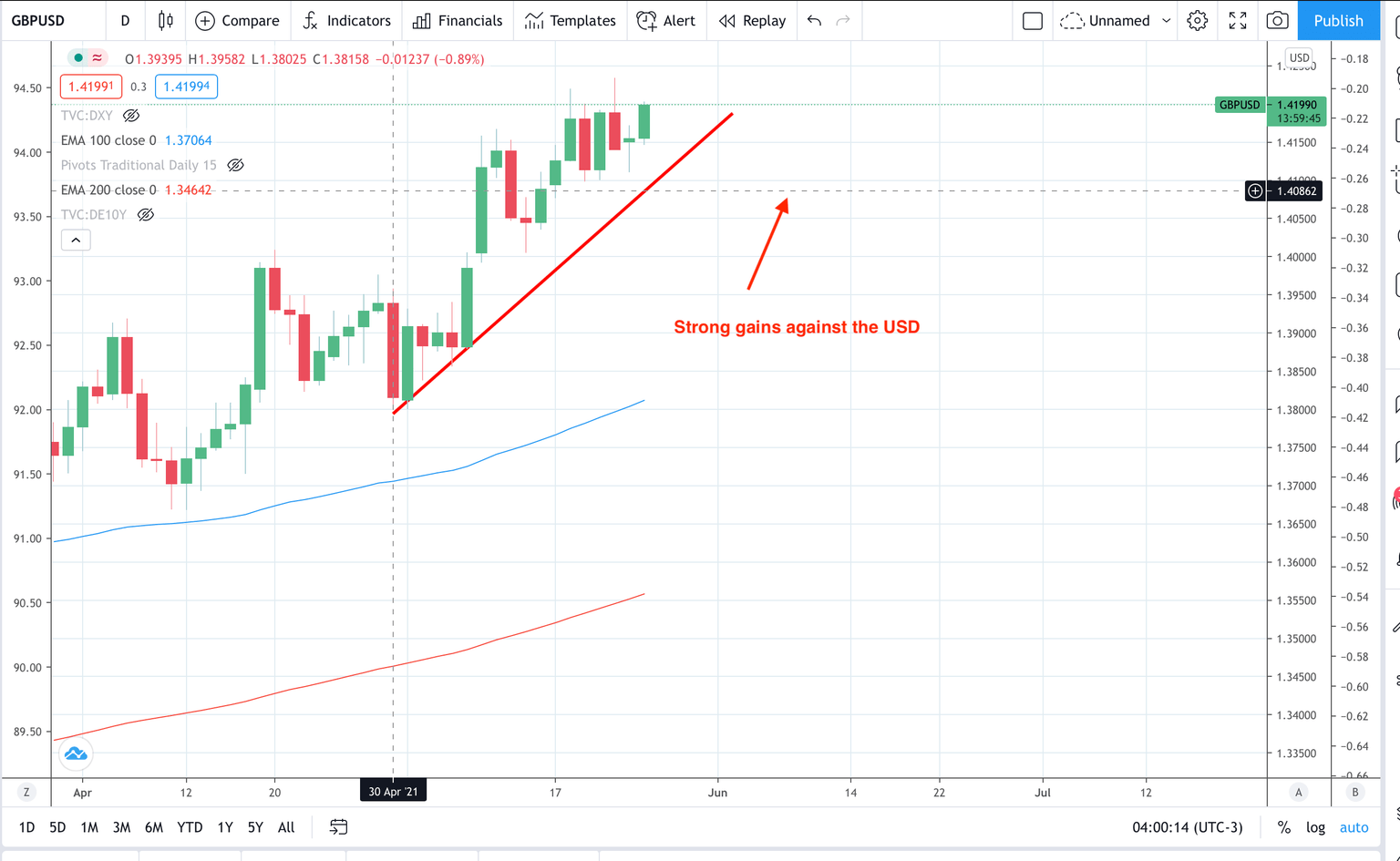

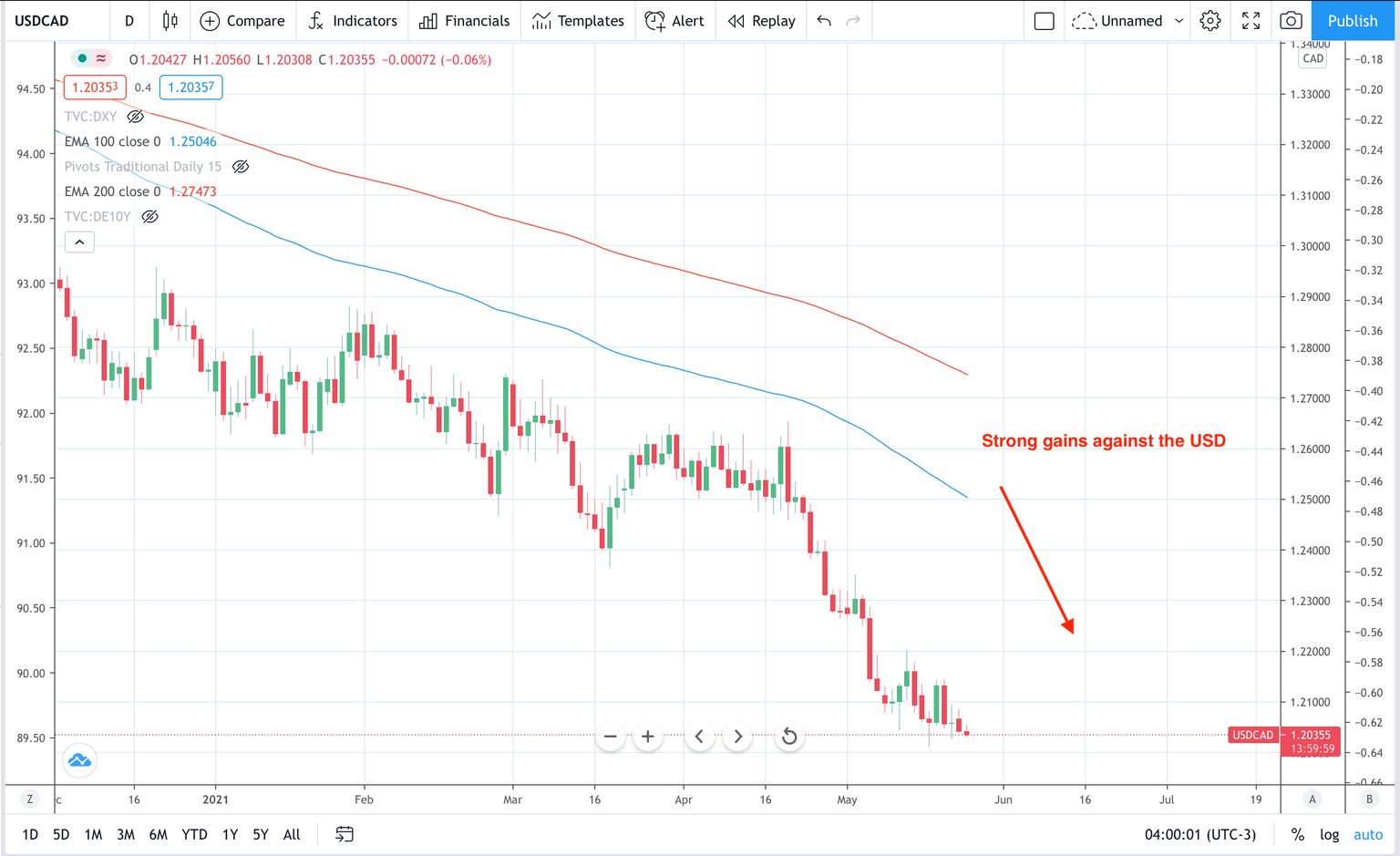

The recent run higher in the GBP and the CAD has been for good reasons. The BoC signaled an exit from their easy monetary policy and the UK is expected to beat its 6% GDP expectations for a number of reasons. Not least because of a very fast vaccine rollout and easing of COVID-19 restrictions. That means the GBP and the CAD should remain supported on the dips. The GBP and the CAD have both been big winners against the USD.

Watch out for a retracement on possible USD strength. US 10 year yields rose sharply higher in Q1 on US growth hope. In the FX space, the heavily oversubscribed USD short position from 2020 Q4 saw some unwinding. The Bloomberg Dollar Index moved higher by over +2.5% in Q1.

Recently the USD has resumed its medium-term bearish trend, but the chances of another spike higher in the USD are rising. This all revolves around the recovery in the US. If it is deemed to be significantly strong that will cause the Federal Reserve to start tapering. Tapering = US10 year yield strength and USD strength.

The takeaway

The extension this year of both the GBP and the CAD may make them ideal candidates for a deeper pullback against the USD. The CAD may be the preferred option given that the BoC are concerned about the recent strength of the CAD. The BoE has not expressed any concerns about the GBP levels due to its deeper depression due to Brexit. The trigger for a USDCAD long would be on any taper talk coming from the Federal Reserve.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.