Is rising volatility tarnishing Gold's appeal?

We’ve seen some sharp price swings in the gold market over the last couple of months. Should this diminish gold’s investment appeal?

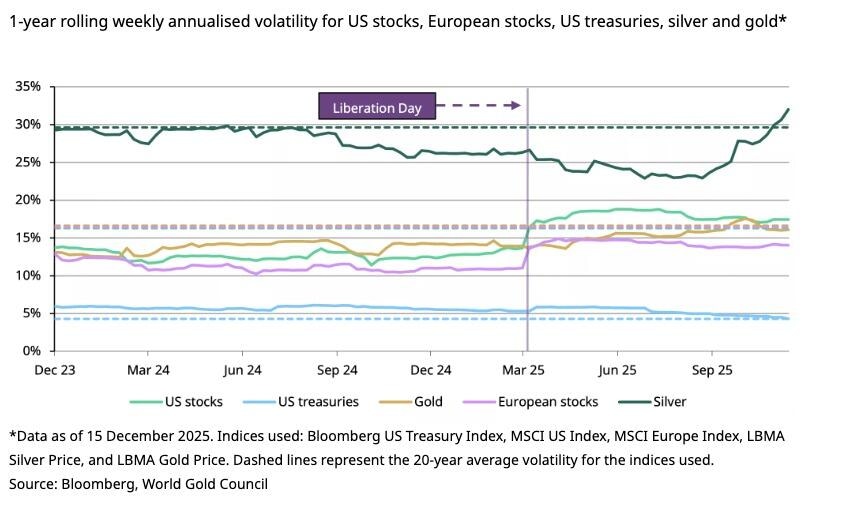

Volatility has increased without a doubt, but it’s important to put it into context. Based on analysis by the World Gold Council, we find that gold’s volatility is up from a low base and is broadly in line with other assets and long-term averages.

Volatility measures the speed and depth of price movements over time. Economists calculate volatility by computing the standard deviation of returns (daily or monthly) over a specified time period. When volatility is high, you will observe larger and more frequent price swings (as we’ve seen with gold recently). In a low volatility environment, price movements tend to be smaller, steadier, and easier to predict.

Uncertainty and high levels of risk tend to drive volatility higher. There was no shortage of those factors impacting the markets in 2025, from tariffs to geopolitical tensions to inflationary pressure.

Gold isn’t the only asset impacted by volatility. Equities also charted significant price swings over the last year. Meanwhile, U.S. Treasury volatility has dropped.

According to the World Gold Council, “On the whole, all asset class volatilities remain broadly in line with their long-term averages.”

While gold’s volatility rose along with its 64 percent gain in 2025, it remained well below levels seen during previous periods of similar strong price performance. According to the World Gold Council, “This suggests that, despite recent price strength, gold has moved in an orderly manner.”

Furthermore, when gold hit periods of high volatility last year, the brief spikes quickly normalized. This underscores gold’s resilience as a strategic asset.

Gold in your investment portfolio

Even with the modest increase in volatility last year, gold still reduces overall risk in a diversified portfolio. This is especially true given that there is a growing correlation between bonds and equities. In the past, these assets tended to counterbalance each other, with equities climbing in a more risk-on environment with strong economic tailwinds, and bonds seeing gains when the economy gets wobbly, and investors become more risk-averse. However, bonds have been behaving more like risk assets in recent months.

As stocks and bonds correlate more closely, it is increasingly important to include an asset in your portfolio that tends to move in the opposite direction. Gold fits that bill. This is why Morgan Stanley CIO Michael Wilson recently came out with an investment strategy that includes a 20 percent allocation to gold. Most American investors have little to no exposure to precious metals.

As the World Gold Council pointed out, “We know that gold has been an efficient source of portfolio diversification with its low correlation to equities and fixed income assets.”

“In this current environment, adding gold to our hypothetical portfolio1 reduces the overall portfolio risk. In fact, adding 5 percent of gold reduces the portfolio risk by nearly 5 percent while its contribution to overall portfolio risk is negligible at 1.9 percent.”

In summary, there was increased volatility on the gold market last year, driven by heightened geopolitical and macroeconomic risks. However, as the World Gold Council noted, gold’s long-term behavior remained broadly consistent, comparable to that of other growth assets.

“Against a backdrop where traditional diversification benefits are waning, gold continues to play a valuable role in reducing overall portfolio risk, reinforcing its importance for investors seeking stability amid uncertainty.”

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.