Is gold weakness set to stay?

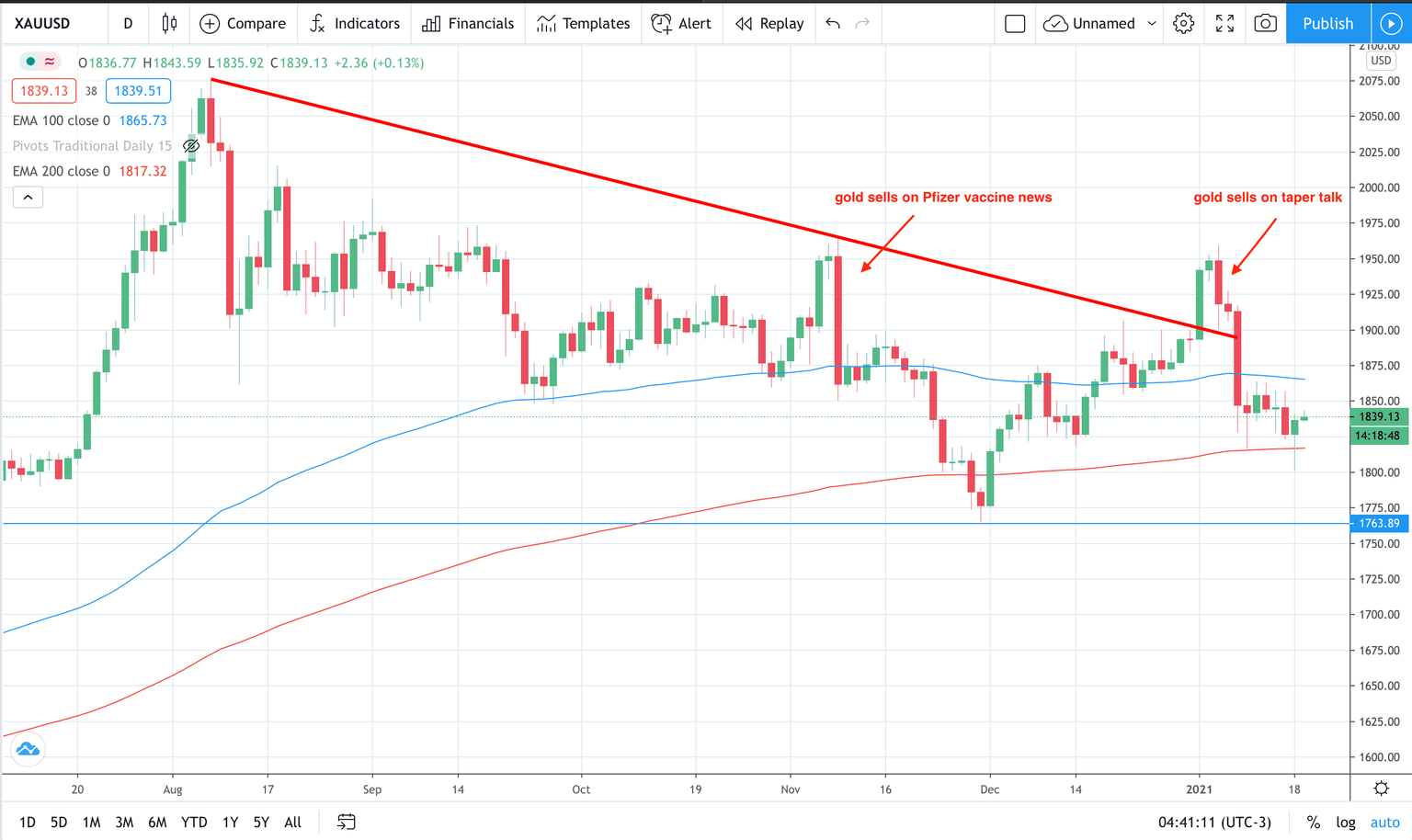

Gold normally has a great start to the year on Chinese gold buying for the Lunar New year celebrations. In fact, over the last 10 years gold has risen in eight years out of ten during the month of January. 2012 saw a large rise of 9.14%. 2011 recorded a -6.74% loss. Despite the normal strong seasonals (see chart below) this year gold has been struggling during the month. So, is this the end of the strong fundamentals for gold buying?

Will gold break its 7 year winning seasonal streak this January?

The last fall in gold occurred in 2013 when gold saw -1.71%. During the rest of 2013 prices fell around 28% at one point according to Bloomberg. Two days in April 2013 saw around half of that drop lower alone. So, what was the reason? It was rising real rates on the Fed’s tapering. This triggered a sell off in Exchange Traded Funds (ETFs). So any talk of more tapering will sent jitters down gold bulls remembering 2013.

The case for gold bears

-

Economies bound back, so gold plunges on falling ETF flows.

-

The Fed starts tapering this year and the US economy bounces back from COVID-190.

The case for gold bulls

-

Substantial falls brings in gold value buyers.

-

Post COVID-19 economies are still weak and more QE is undertaken which will provide a strong buying environment for gold.

The takeaway

The globe will soon be preparing to exit COVID-19 stimulus packages as long as the vaccine works as intended. This should result in a more optimistic perspective for central banks, including the Fed. My take is that the recovery could be very swift when it comes and the Fed will most likely find themselves talking about tapering sooner that Dec 2021. One interesting tell for me is that the two largest periods of losses in gold have come on the Pfizer vaccine news and the tapering talk. This indicates to me that the directional bias is to the downside the stronger the global recovery is. The key will be the speed to which tapering is spoken about with gold likely to fall on talk of Fed tapering.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.