Is Gold Set to Skyrocket Again?

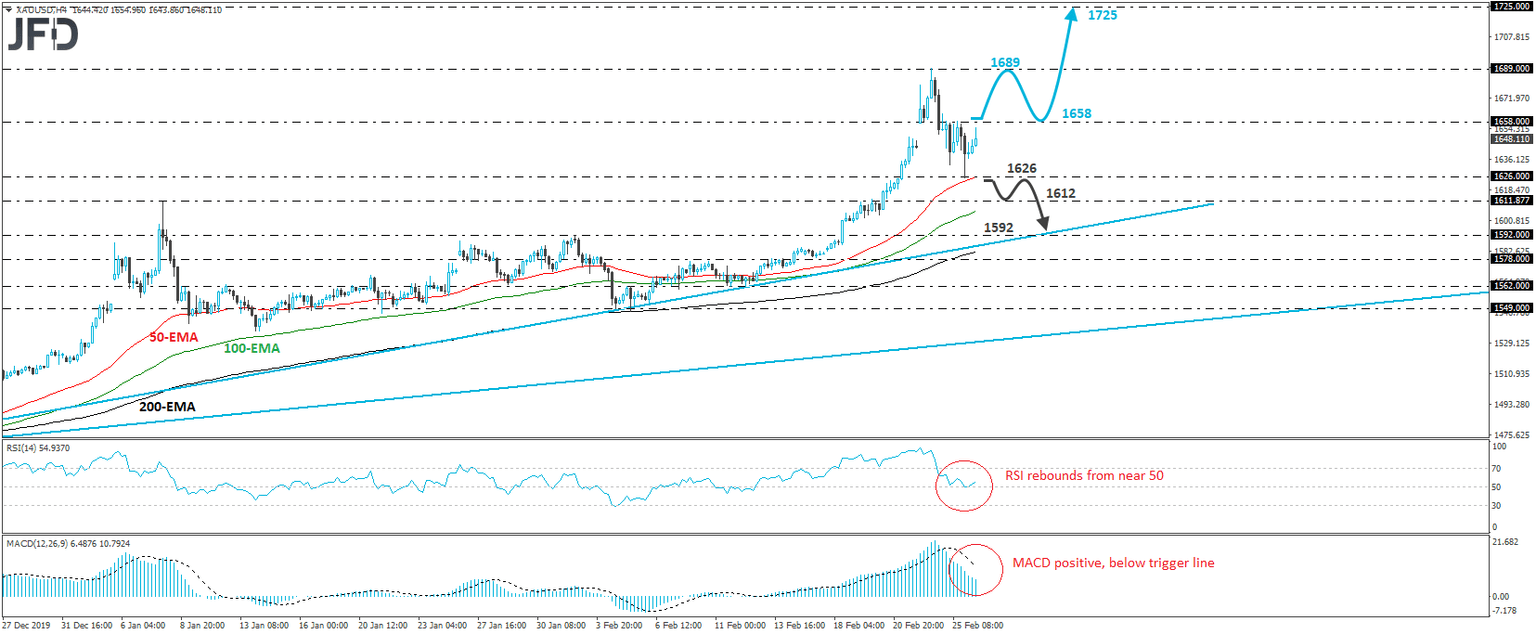

XAU/USD skyrocketed last week, with the rally extending into the Asian morning Monday. However, the precious metal hit resistance at 1689 and then it started correcting lower and eventually hit support yesterday, at around 1626. Today it rebounded somewhat again. Overall, gold is trading above an upside support line drawn from the low of the 21st of May, while since December 12th, it has been showing respect to another shorter and steeper upside line. All this, combined with the fact that the price is also trading above all of our moving averages on the 4-hour chart, keeps the near-term outlook positive.

Further recovery and a break above the 1658 zone may signal that the recent corrective setback is over and may set the stage for advances towards the 1689 zone again. The bulls may decide to take another break near that zone, thereby allowing another corrective retreat. However, if the bulls take charge from above 1658, they may also decide to drive the metal above 1689, into territories last seen in January 2013. They could then aim for the 1725 zone, defined as a resistance by the high of the second week of December 2012.

Shifting attention to our short-term oscillators, we see that the RSI hit support twice near its 50 barrier and turned up, while the MACD, although below its trigger line, shows signs it could start bottoming within its positive territory. Both indicators suggest that the yellow metal may have started gathering upside momentum again and support the notion for another round of advances.

Now in case the price falls below 1626, we will start examining the case of a deeper correction. We could initially experience declines towards the 1612 area, marked by the inside swing highs of January 8th and February 19th, the break of which may pave the way towards the inside swing high of February 3rd, at around 1592, or the aforementioned short-term upside line drawn from the low of December 12th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD