Is Builders FirstSource (BLDR) looking for next multi year rally?

Builders FirstSource, Inc., (BLDR) manufactures & supplies building materials, components & construction services to professional homebuilders, sub-contractors, remodelers & consumers in the United States. It comes under Industrials sector & trades as “BLDR” ticker at NYSE.

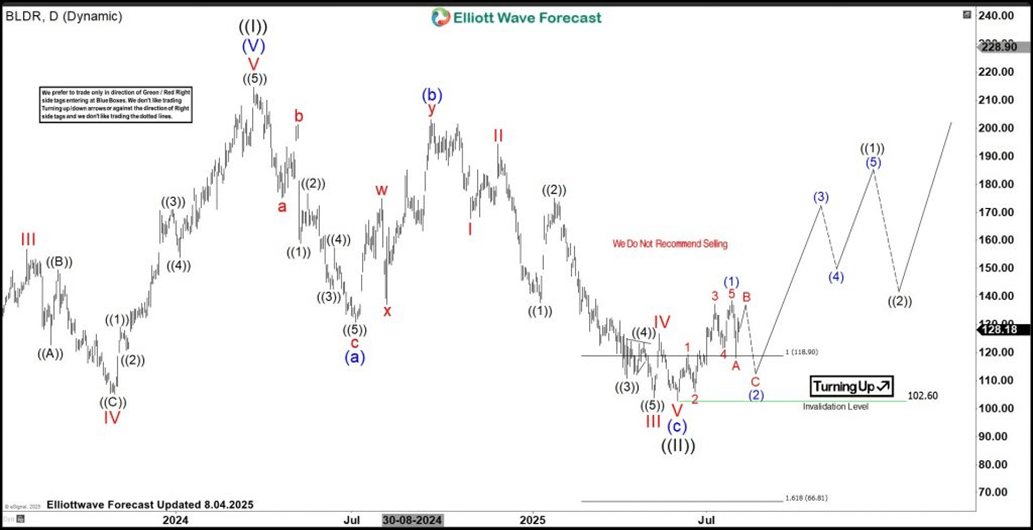

BLDR was corrected more than 50 % since all time high of $214.70 in June-2025 low. It ended correction of ((II)) at $102.60 in 6.02.2025 low in daily extreme area. Above there, it favors upside in next cycle or at least larger 3 swings bounce. We like to remain long from the daily extreme area against 6.02.2025 low.

BLDR – Elliott Wave latest daily view

It ended multi year impulse sequence at $214.70 high in March-2024 from inception. It ended (I) of ((I)) at $28.43 high in February-2020, (II) at $9.00 low in March-2020, (III) at $86.48 high in January-2022, (IV) at $48.91 low in June-2022 & (V) at $214.70 high. Within (V), it ended I at $74.48 high, II at $52.70 low, III at $156.85 high, IV at $105.24 low & V at $214.70 high. It ended ((II)) in flat correction. Within ((II)), it ended (a) at $130.75 low, (b) at $203.14 high & (c) at $102.60 low. The (a) unfold in zigzag, (b) in double three & (c) in impulse sequence in ((II)) pullback. It ended ((II)) correction in daily extreme area between $118.90 – $66.81 & now turned higher.

Above ((II)) low, it proposed ended (1) at $138.44 high & favors pullback in (2) against 6.02.2025 low. Within (1), it ended 1 at $119.35 high, 2 at $106.03 low, 3 at $137.21 high, 4 at $121.55 low & 5 at $138.44 high. Currently, it favors bounce in B of (2), while placed A at $118.17 low. It expects B to fail below $138.44 high to extend lower in C to extreme area to finish (2). We like to buy the extreme area against 6.02.2025 low for the next leg higher. Alternatively, it can break above $138.44 high to be 3 of (1), while placed 1 at $138.44 high. In that case, it can see two more highs to finish (1) before next pullback may unfold.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com