Intraday market analysis: USD attempts rebound

USD/CHF seeks support

The US dollar initially tumbled after a minor drop in August’s core CPI. However, the pair can capitalize on strong buying interest from the trough near 0.9150.

A tentative break of August’s high at 0.9240 suggests that buyers are in control of price action. Though an overbought RSI has tempered the bullish drive, the latest pullback to 0.9180 can be an accumulation phase.

A rebound may lift bids to July’s high at 0.9275. A breach of that ceiling would attract momentum buying and resume the greenback’s rally.

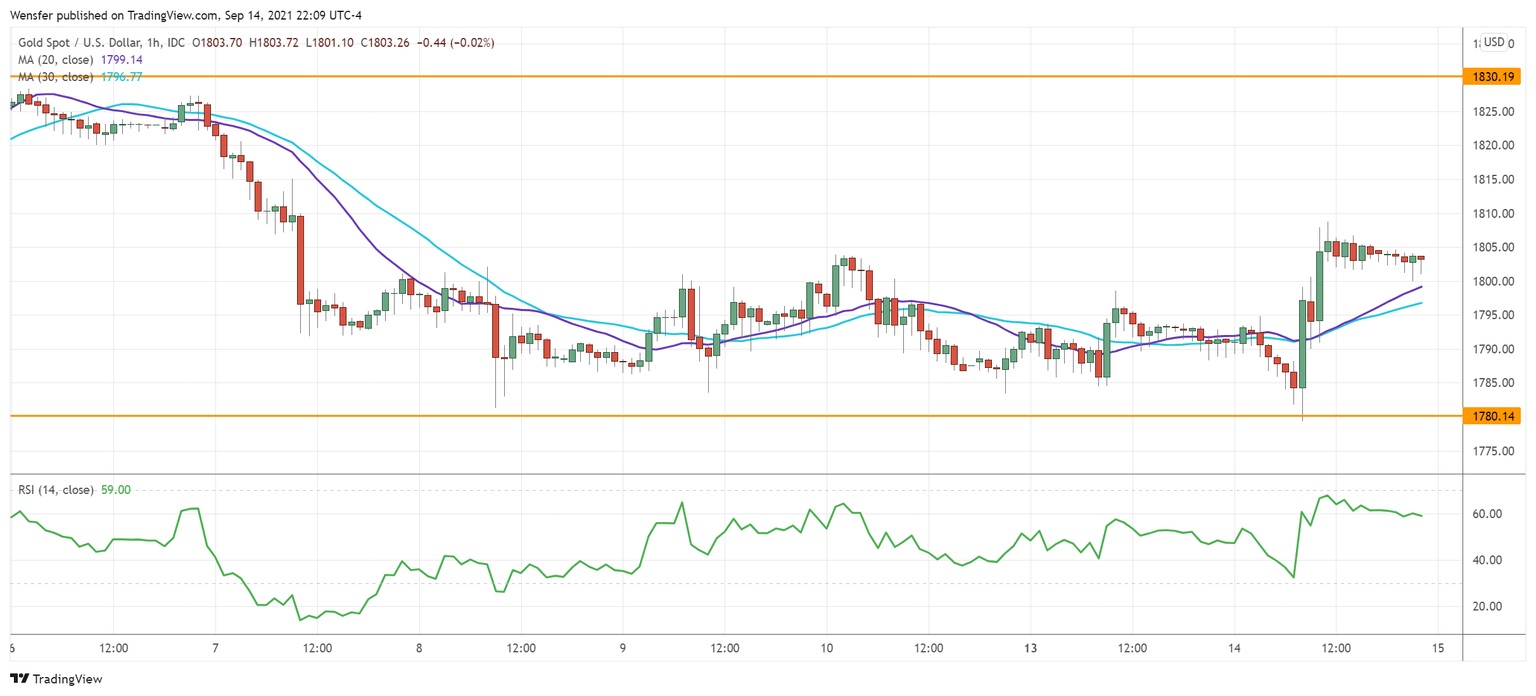

XAU/USD bounces off demand zone

Gold surged thanks to a decline in Treasury yields. The precious metal had met stiff selling pressure at the triple top (1830) from the daily chart.

Short-term sentiment has turned positive after a week-long consolidation above the demand area of 1780. The break above 1803 would prompt the bears to cover their bets. An overbought RSI may trigger a temporary pullback.

A rebound would challenge the critical level of 1830 once again, where a bullish breakout may resume the five-week-long rally.

US 30 breaks support

The Dow Jones 30 retreated as last month’s US inflation remained above the Fed’s target. The index was bought out of the dip over the daily support at 34580.

The rebound turned out to be short-lived after a breakout invalidated this key floor. A bearish MA cross indicates that sentiment has become increasingly downbeat.

The psychological level (34000) from last July would be the next target. On the upside, 34950 is a fresh resistance where sellers would be eager to erase any rebound.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.