Intraday market analysis: US Dollar Index seeks support

USD/JPY tests daily support

The yen consolidates gains after a drop in Japan’s unemployment rate.

The pair has met stiff selling pressure at March 2017’s high (115.50). The drop below 114.80 then 114.00 has forced short-term positions to bail out, exacerbating the sell-off.

The US dollar is hovering above the key daily support at 112.70. An oversold RSI has brought in some buying interest. 114.20 is a fresh resistance. On the downside, a breakout could dent the optimism in the medium-term and pave the way for a bearish reversal.

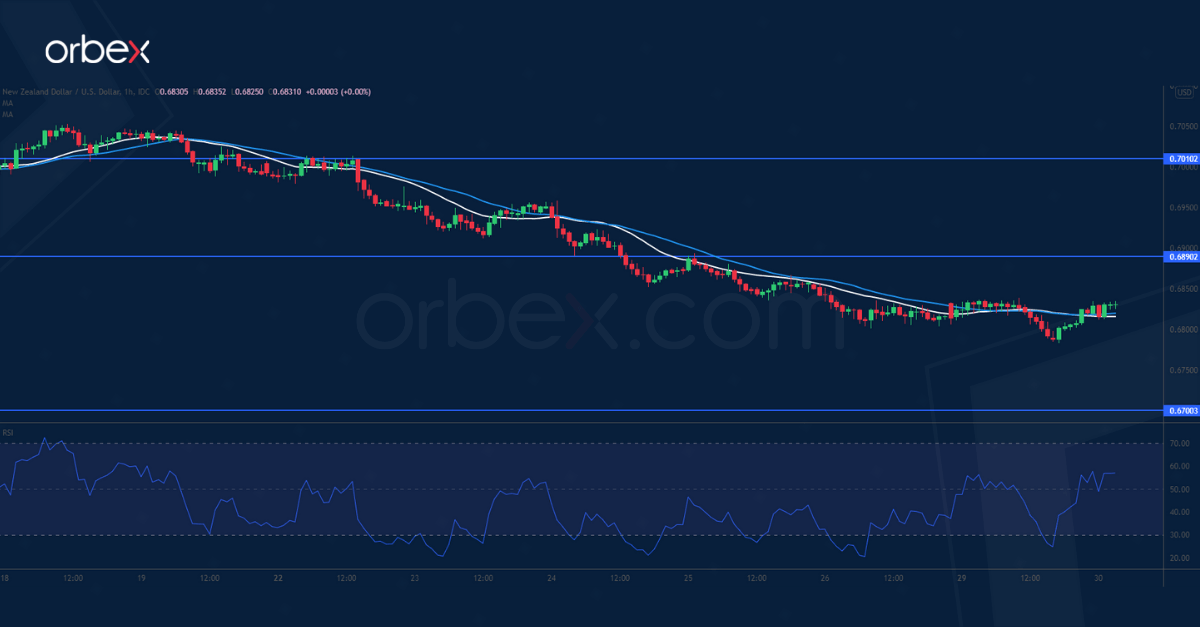

NZD/USD breaks major support

The New Zealand dollar remains under pressure as risk assets suffer from the omicron variant scare. A break below the daily support at 0.6860 has put the buy-side on the defense.

Sentiment has become increasingly downbeat after the pair fell past last August’s low at 0.6805, which is a second line of defense on the daily chart. 0.6700 would be the next support.

The RSI’s repeatedly oversold situation has caused a temporary rebound. But buyers will need to clear 0.6890 before they could turn the tables.

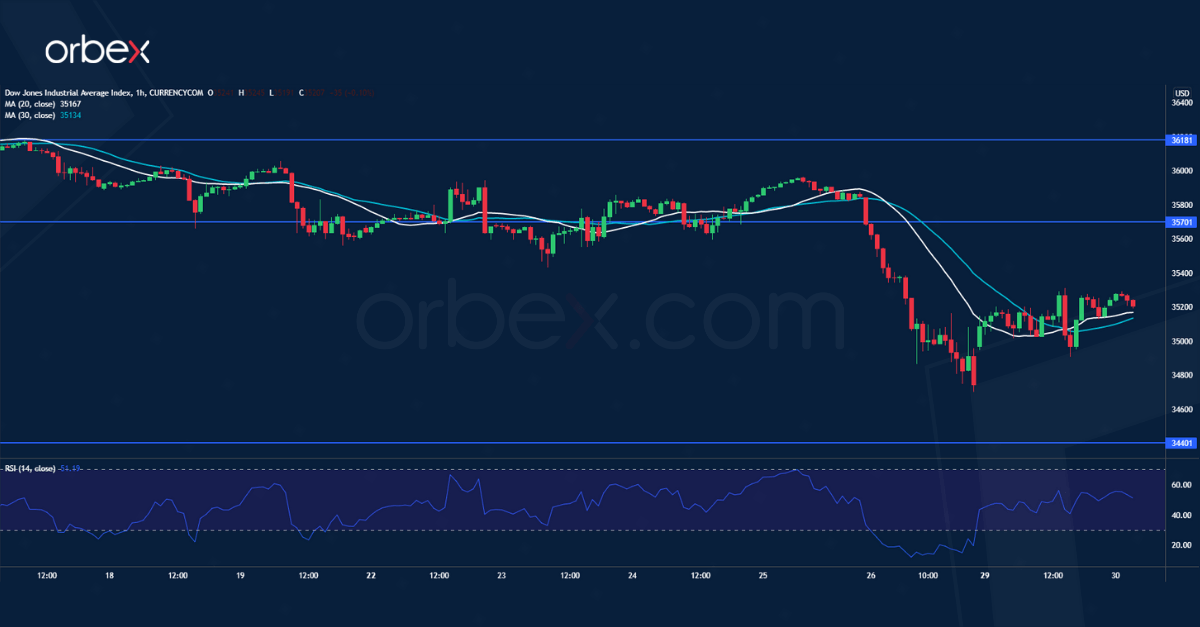

US 30 sees limited rebound

The Dow Jones 30 struggled to bounce as investors grew cautious. A break below the demand zone near 35500 has prompted the bulls to exit and reassess the short-term sentiment.

An oversold RSI may cause a limited rebound as traders take profit. 35700 is now a resistance and the bears may see a rally as an opportunity to sell into strength.

The demand zone between 34150 and 34400 from mid-October is a major floor to keep the uptrend intact. A deeper correction may send the index towards 33000.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.