Intraday market analysis – Testing daily support

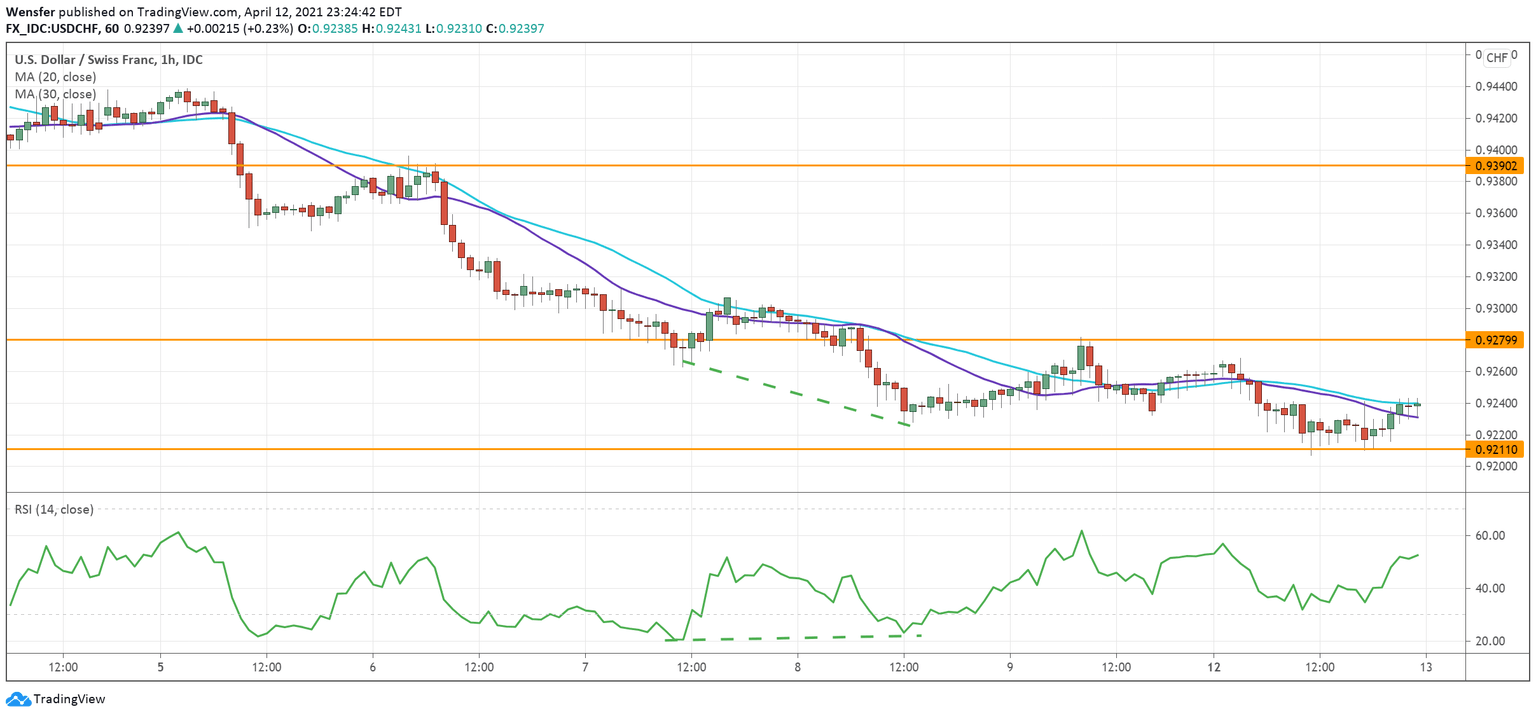

USD/CHF retreats to major support

The US dollar is treading water as traders await inflation data which would dictate the next movement.

The greenback has fallen back to test the medium-term support (0.9210) from the daily chart after a three-month-long rally.

An RSI divergence right above the key level is a sign that the correction has lost its momentum. Though a bullish breakout above 0.9280 will be needed to confirm a reversal.

To the downside, a drop below the said support would trigger a new round of sell-off towards 0.9140.

XAU/USD looks for support

Gold is striving to consolidate its latest gains after a fall in US yields last week. After having established a solid support base at 1677, the price has rallied back to March’s high at 1757.

A bullish breakout could lead to a sharp recovery as a result of triggering stop-losses and momentum buying.

But for now, an overbought RSI has prompted profit-taking within the supply area. 1730 is the first line of defense as the metal pulls back to rebuild support.

A deeper correction may lead to test 1710.

US 30 rises along the trendline

The Dow Jones flies high after Chairman Jerome Powell expressed his optimism in an interview that the US economy was set for a strong rebound.

Following a breakout above its latest consolidation range (33250), the index has been grinding up along a rising trendline.

The psychological level of 33400 would be the next target for the bulls. Though an overshot RSI may lead to a temporary pullback.

The 30-hour moving average is the immediate support. Further down, 33510 along the trendline may see more buying interests.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.