Inside day SPY recovery

S&P 500 was readying a break of 4,415, and then the hapless Treasury auction results came, sending stocks and bonds sharply lower. 4,365 was breached, but the NFPs breakout level of 4,330 didn‘t come into jeopardy. The biggest China bank, ICBC, ransomware incident – and the resulting counterparty risk (looking over your shoulder) striking at roughly the same time, didn‘t help either. It‘s all the more positive for stock market buyers that the break into 4,350s stopped there – and that DAX continued doing well while yields instead of continuing the plunge, started retreating.

Therefore the biggest (medium-term) risk remains BoJ untimely exit from yield curve control because of the weakening yen.

Let‘s move right into the charts – today‘s full scale article contains 5 of them.

Stocks and sectors

NFLX keeps delivering a pleasant, earnings fuelled surprise – the company would turn out to be one of the Q4 rally winners, just compare its pricing power to TSLA (and consider the unionizing support as another factor in its yesterday‘s decline).

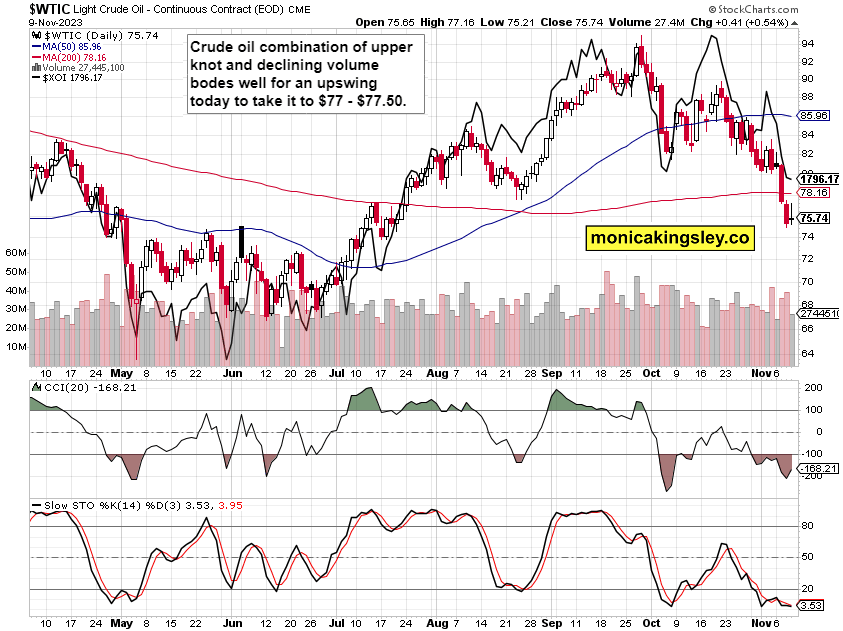

Crude Oil

Crude oil $76 has better prospects holding than $1,946 gold – getting over $80 next week though would be a very much uphill battle.

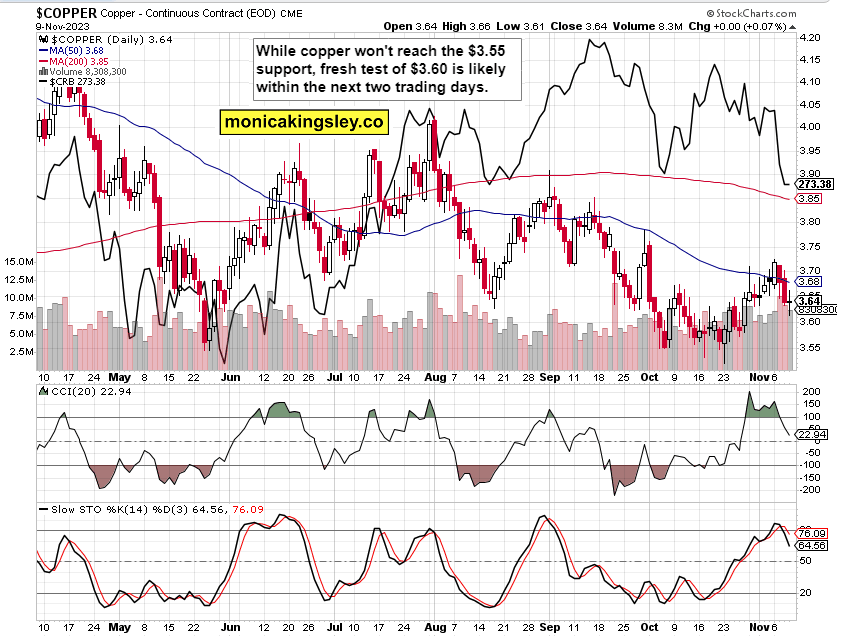

Copper

Copper would have to repel the sellers today and Monday – similarly to precious metals, the very short-term picture is unsettled, and not yet bullish.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.