US Initial Jobless Claims: Markets take rising claims in stride for now

- Unemployment claims rise for the first time in nine weeks.

- Business restrictions on restaurants, bars and public venues may be responsible.

- Many states have limited hours on dining and in-person services.

- Increase was in the survey week for the November Nonfarm Payrolls.

- Markets saw nothing new in the claims figures.

Initial claims for unemployment insurance rose for the first time in nine weeks to 742,000, according to the Labor Department, as many states have imposed limits on restaurants, bars and other establishments that require in-person contact.The consensus forecast was 707,000.

Continuing Claims dropped to 6.372 million in the November 6 week from 6.801 million, improving on their 6.47 million prediction.

Both claims figures are the lowest of the pandemic era.

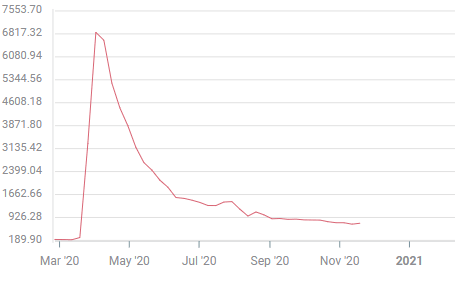

Initial claims have declined almost ten-fold since the late March weekly peak at 6.867 million, but the current level of 742,000 is still higher than any single week in US history prior to March 20 and more three times the 212,000 average in January and February.

Initial Jobless Claims

Unemployment insurance

Unemployment insurance normally lasts for six months, a payment extension that was part of the stimulus bill expired in July. About 4.4 million people were receiving 13 extra weeks of benefits from Washington's Pandemic Unemployment Assistance in early November, up from 4.1 million.

All told 20.32 million people were receiving some form of government unemployment benefits, lower by 841,245 than the previous week. In October 2019 the total recipients were 1.48 million.

Initial claims rose the most in Washington, California, Massachusetts, Alabama and Louisiana. Application dropped fastest in Georgia, Illinois, Kentucky, Texas and New Jersey.

Unemployment payments

Waal Street Journal

Pandemic accounting

The US listed 162,00 new COVID-19 diagnoses on Tuesday the 11th straight day above 130,000, according to Johns Hopkins University data. Fatalities have been above 1,000 for eight of the past nine days.

Hospitalization and deaths remain far below their percentages in the springtime even though positive tests are more than four times as high.

Record COVID-19 diagnoses in much of the country and concerns that hospitals could reach capacity, they are currently (11/4) about 5% above normal nationwide, though much higher in some states, are driving the new restrictions.

US economy

The US economy more than reversed the second quarter's 31.4% decline in annualized gross domestic product by soaring 33.1% in the third. The Atlanta Fed estimated that growth was running at 5.6% in the current quarter on November 18th up from 3.5% on November 13th.

Payrolls have rehired 54.4% of the 22.16 million job losses in March and April. Employment Index reading in the manufacturing and service sectors from the Institute for Supply Management expanded in October and the number of job openings are nearing the levels from before the pandemic.

American firms added 638,000 workers in October the sixth straight month of job gains.

This week's claims numbers come from the survey week for the November Nonfarm payrolls and may diminish forecasts for the month. Payrolls for November will be released on December 4th.

Consumer demand has remained healthy despite the turmoil in the labor market. October Retail Sales rose 0.3%, slightly less than anticipated, but the average gain over the eight months of the pandemic beginning in March is a very respectable 0.89%.

In September the Federal Reserve's Projection Materials estimated that the US economy would contract 3.7% in this year. Market forecasts now anticipate a 2.7% reduction in 2020. The Fed will release updated predictions at its December 16th meeting.

Conclusion

For employers the difficulty is in balancing the present of increasing business restrictions and possibly reduced consumer traffic against future improvements. Except for restaurants, bars and other business directly affected by new closures and curfews, other business are likely to sit tight on employees in anticipation of a better spring.

Markets have already voted for the vaccinated future with equities having recently set all-time records and Treasury yields near four month highs.

The dollar has remained within its recent ranges against the majors. Currency markets have not treated the global surge in cases as a reason to invest in the dollar safety-trade. That is a sign that more normal markets lie ahead.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.