Inflation beast roars: Gold only modestly up

The inflation beast is growing stronger. Unfortunately for gold bulls, we cannot say the same about the yellow metal. Is sacrifice going on tomorrow?

“Woe to you, oh earth and sea, for the Devil sends the beast with wrath, because he knows the time is short (...). Let him that hath understanding count the number of the beast,” says the Bible. The current number of the beast is not 6.66%, but 6.8% - this is how high the CPI annual inflation rate was in November.

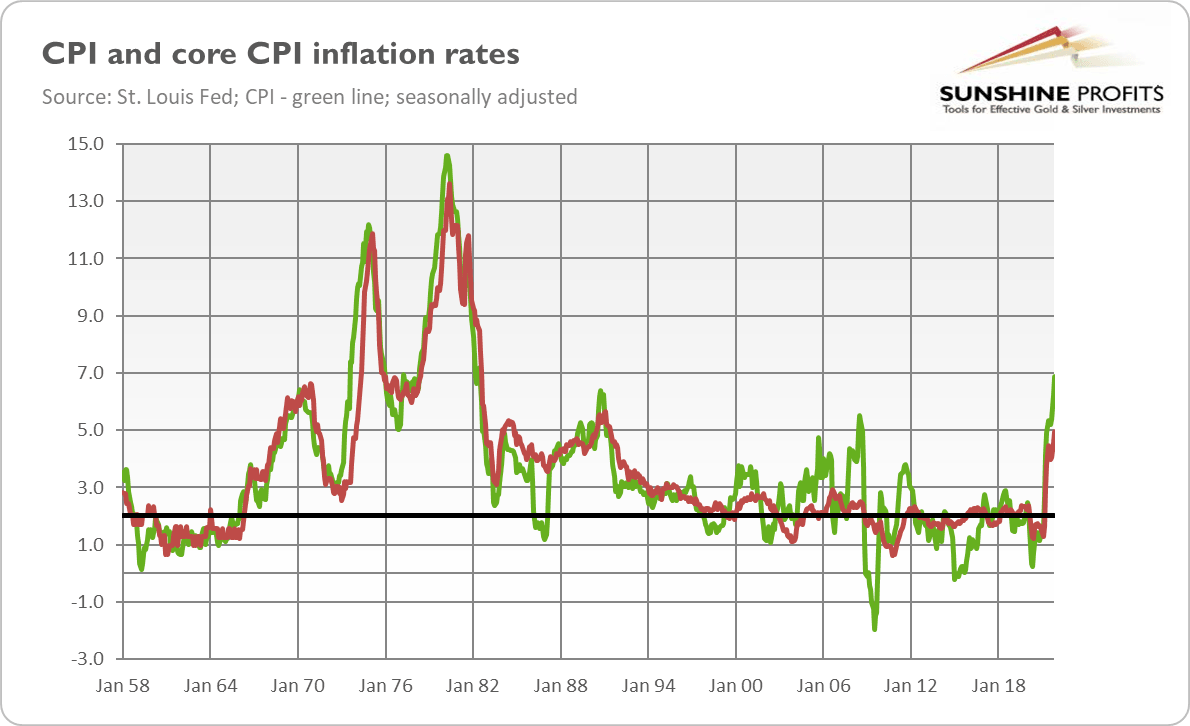

The number came above expectations and implies further acceleration in inflation from 6.2% in October. It was also the largest 12-month increase since the period ending June 1982, as the chart below indicates.

The latest BLS report on inflation also shows that consumer inflation rose 0.8% on a monthly basis after rising 0.9% in October. The core CPI rate increased 0.5% in November, following a 0.6-percent increase in the previous month. On an annual basis, it jumped 5% after a 4.6% increase in October (see the chart above). So, as Iron Maiden sings, “hell and fire was spawned to be released”.

Indeed, November readings clearly falsify central banks’ narrative about transitory inflation (which was already partially abandoned) and confirm my claim that inflation will stay with us for longer. As a reminder, my bet is that we will see the peak of inflation no earlier than somewhere in Q1 2022. Actually, it might be even a bit later, as the Omicron coronavirus variant could contribute to supply disruptions and add to inflationary pressure.

What’s important here is to remember that current inflation is not merely a supply problem. It’s true that the energy index is surging, but the shelter index is also rising, and it has even surpassed the pre-pandemic level, as the chart below shows. So, inflation has a really broad nature, which makes perfect sense, as it was caused by a boost in the money supply and strong demand. The BLS report confirms this view: “The monthly all items seasonally adjusted increase was the result of broad increases in most component indexes, similar to last month.”

Implications for Gold

The inflationary beast not only reared its ugly head, but it started roaring and growing stronger. The CPI inflation rate jumped to 6.8% in November, and it’s probably not the final number! Actually, it could have been even higher if the Omicron variant of coronavirus had not emerged, slowing down some expenditures.

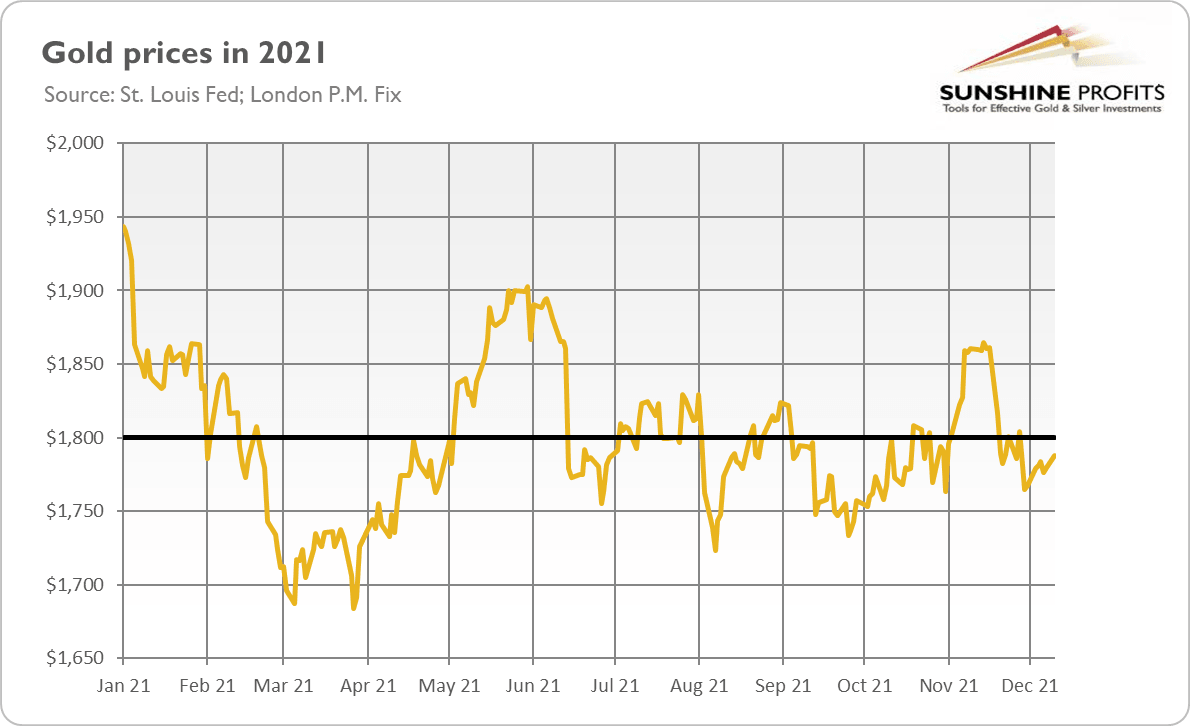

What does this acceleration imply for the gold market? Well, one week ago I wrote: “My bet is that inflation will stay elevated or that it could actually intensify further. In any case, the persistence of high inflation could trigger some worries and boost the safe-haven demand for gold.” Indeed, inflationary pressure intensified further, which pushed gold prices higher, as the chart below shows.

However, I also expressed concerns about the Fed’s reaction to high inflation and its implications for gold:

I’m afraid that gold bulls’ joy would be – to use a trendy word – transitory. The December FOMC meeting will be probably hawkish and will send gold prices down. Given the persistence of inflation, the Fed is likely to turn more hawkish and accelerate the pace of tapering.

The higher than expected inflation rate in November, and a very modest gold’s reaction to it, only strengthen my fears that tomorrow could be a great day for monetary hawks and a sad day for gold. Given such high inflation, the Fed has simply no choice and must accelerate the pace of the tapering and hiking cycle. So, to paraphrase Iron Maiden, sacrifice is going on tomorrow.

On the other hand, gold often bottomed out in December historically (in recent years, it did so in 2015, 2016, 2017, and 2019). We’ll find out soon whether my fears were justified!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Arkadiusz Sieroń

Sunshine Profits

Arkadiusz Sieroń received his Ph.D. in economics in 2016 (his doctoral thesis was about Cantillon effects), and has been an assistant professor at the Institute of Economic Sciences at the University of Wrocław since 2017.