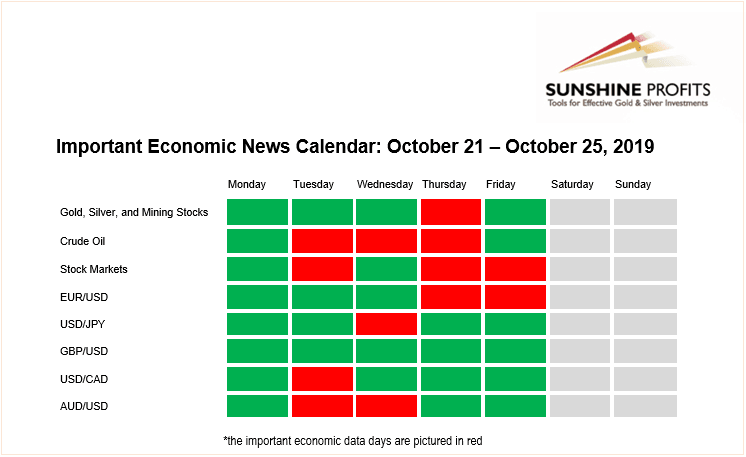

Important Economic News Calendar: October 21 – October 25, 2019

The markets remained surprisingly calm last week, despite worse than expected U.S. economic data releases. The third-quarter earnings season along with Brexit play may have overweighed the data pessimism. This week, we will have some potentially moving news releases along with more big names corporate earnings. So let’s take a look at those events.

The week behind

The U.S. Retail Sales and the Philly Fed Manufacturing Index were the most important market moving releases last week. They came worse than expected, but investors generally neglected them as only the price of gold and the Euro spiked at the time of Retail Sales number release on Wednesday. Stocks were gaining as the third quarter earnings season accelerated. And we pointed it out in our last week’s news calendar release. The economic data releases from Australia, Canada and the U.K. greatly influenced their exchange rates. Of course, the British Pound was also gaining because of the ongoing Brexit play.

The week ahead

What about the coming week? Thursday’s economic data releases from Eurozone will likely get the most attention as investors will wait for the ECB’s Monetary Policy update. In addition, there will be a lot of sentiment data from Europe and the U.S. that day. And the earnings season will further accelerate this week, as we will see some important releases starting Tuesday.

-

Thursday’s ECB’s Monetary Policy Statement and their Main Refinancing Rate followed by the Press Conference will be the most important news releases this week.

-

The third-quarter earnings season is accelerating! We will see Biogen, P&G, 3M, Twitter, Amazon, Intel, Visa, Verizon releasing this week, among others.

-

On Thursday, we will also await series of sentiment data from Eurozone and the U.S. They will likely affect markets.

-

The other noteworthy releases will include Tuesday’s and Wednesday’s economic data from Australia, Canada and Japan followed by Friday’s German Ifo Business Climate number.

You will find this week’s the key news releases below (EST time zone). For your convenience, we broken them down per market to which they are particularly important, so that you know what to pay extra attention to, if you have or plan to have positions in one of them. Moreover, we put the particularly important news in bold. This kind of news is what is more likely to trigger volatile movements. The news that are not in bold usually don’t result in bigger intraday moves, so unless one is engaging in a particularly active form of day trading, it might be best to focus on the news that we put in bold. Of course, you are free to use the below indications as you see fit. As far as we are concerned, we are usually not engaging in any day trading during days with “bold” events on a given market. However, in case of more medium-term trades, we usually choose to be aware of the increased intraday volatility, but not change the currently opened position.

Gold, Silver, and Mining Stocks

Tuesday, October 22

-

8:30 a.m. Canada - Retail Sales m/m, Core Retail Sales m/m

-

10:30 a.m. Canada - BOC Business Outlook Survey

Wednesday, October 23

-

6:00 p.m. Australia - Flash Manufacturing PMI, Flash Services PMI

Thursday, October 24

-

7:45 a.m. Eurozone - Monetary Policy Statement, Main Refinancing Rate

-

8:30 a.m. Eurozone - ECB Press Conference

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

Crude Oil

Tuesday, October 22

-

8:30 a.m. Canada - Retail Sales m/m, Core Retail Sales m/m

-

4:30 p.m. U.S. - API Weekly Crude Oil Stock

Wednesday, October 23

-

10:30 a.m. U.S. - Crude Oil Inventories

-

6:00 p.m. Australia - Flash Manufacturing PMI, Flash Services PMI

Thursday, October 24

-

7:45 a.m. Eurozone - Monetary Policy Statement, Main Refinancing Rate

-

8:30 a.m. Eurozone - ECB Press Conference

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

Stock Markets

Tuesday, October 22

-

Before Open U.S. – BIIB, LMT, MCD, PG, UPS, UTX Quarterly Earnings

-

10:00 a.m. U.S. - Existing Home Sales, Richmond Manufacturing Index

Wednesday, October 23

-

10:00 a.m. Eurozone - Consumer Confidence

Thursday, October 24

-

3:15 a.m. Eurozone - French Flash Manufacturing PMI, French Flash Services PMI

-

3:30 a.m. Eurozone - German Flash Manufacturing PMI, German Flash Services PMI

-

Before Open U.S. – CMCSA, DOW, MMM, NOC, RTN, TWTR Quarterly Earnings

-

7:45 a.m. Eurozone - Monetary Policy Statement, Main Refinancing Rate

-

8:30 a.m. Eurozone - ECB Press Conference

-

8:30 a.m. U.S. - Durable Goods Orders m/m, Core Durable Goods Orders m/m, Unemployment Claims

-

9:00 a.m. China - CB Leading Index m/m

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

-

10:00 a.m. U.S. - New Home Sales

-

After Close U.S. – AMZN, GILD, INTC, V Quarterly Earnings

Friday, October 25

-

4:00 a.m. Eurozone - German Ifo Business Climate

-

Before Open U.S. – GT, PSX, VZ Quarterly Earnings

-

10:00 a.m. U.S. - Revised UoM Consumer Sentiment

EUR/USD

Tuesday, October 22

-

10:00 a.m. U.S. - Existing Home Sales, Richmond Manufacturing Index

Wednesday, October 23

-

10:00 a.m. Eurozone - Consumer Confidence

Thursday, October 24

-

3:00 a.m. Eurozone - Spanish Unemployment Rate

-

3:15 a.m. Eurozone - French Flash Manufacturing PMI, French Flash Services PMI

-

3:30 a.m. Eurozone - German Flash Manufacturing PMI, German Flash Services PMI

-

4:00 a.m. Eurozone - Flash Manufacturing PMI, Flash Services PMI

-

7:45 a.m. Eurozone - Monetary Policy Statement, Main Refinancing Rate

-

8:30 a.m. Eurozone - ECB Press Conference

-

8:30 a.m. U.S. - Durable Goods Orders m/m, Core Durable Goods Orders m/m, Unemployment Claims

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

-

10:00 a.m. U.S. - New Home Sales

Friday, October 25

-

4:00 a.m. Eurozone - German Ifo Business Climate

-

10:00 a.m. U.S. - Revised UoM Consumer Sentiment

USD/JPY

Tuesday, October 22

-

All Day, Japan - Holiday

Wednesday, October 23

-

8:30 p.m. Japan - Flash Manufacturing PMI

Thursday, October 24

-

7:45 a.m. Eurozone - Monetary Policy Statement, Main Refinancing Rate

-

8:30 a.m. Eurozone - ECB Press Conference

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

GBP/USD

Thursday, October 24

-

7:45 a.m. Eurozone - Monetary Policy Statement, Main Refinancing Rate

-

8:30 a.m. Eurozone - ECB Press Conference

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

USD/CAD

Monday, October 21

-

All Day, Canada - Federal Election

Tuesday, October 22

-

8:30 a.m. Canada - Retail Sales m/m, Core Retail Sales m/m

-

10:30 a.m. Canada - BOC Business Outlook Survey

Wednesday, October 23

-

8:30 a.m. Canada - Wholesale Sales m/m

-

10:30 a.m. U.S. - Crude Oil Inventories

Thursday, October 24

-

7:45 a.m. Eurozone - Monetary Policy Statement, Main Refinancing Rate

-

8:30 a.m. Eurozone - ECB Press Conference

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

AUD/USD

Tuesday, October 22

-

6:20 p.m. Australia - RBA Assistant Governor Kent Speech

Wednesday, October 23

-

10:30 a.m. U.S. - Crude Oil Inventories

-

6:00 p.m. Australia - Flash Manufacturing PMI, Flash Services PMI

Thursday, October 24

-

7:45 a.m. Eurozone - Monetary Policy Statement, Main Refinancing Rate

-

8:30 a.m. Eurozone - ECB Press Conference

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.