Implications of less restrictive monetary policy

Implications of less restrictive monetary policy

-

Our August forecast update shows the economic expansion that has been in place since mid-2020 will continue. That said, the lackluster pace of hiring in July, combined with other labor market indicators continuing to weaken, implies weaker income growth which will eventually weigh on consumer spending.

-

In light of these adverse developments, we now look for the FOMC to cut rates by 50 bps at its meeting on September 18 with another 50 bps rate cut on November 7. We forecast the Committee will reduce its target range for the federal funds rate to 3.25%–3.50% by the middle of next year.

-

We have adjusted our consumer forecast and now look for real PCE to slow materially at the end of this year and start of next year before rebounding in the second half of next year amid less restrictive monetary policy.

-

Another area poised to eventually benefit from lower interest rates is housing, and we have taken up our residential forecast coinciding with recent declines in the mortgage rate and expectations for further rate softening next year.

-

We now look for the monthly pace of nonfarm payroll gains to average 116K over the next 12 months compared to 209K the past 12 months. The unemployment rate is likely to edge up to 4.5% in Q4, before less restrictive monetary policy and slower labor force growth helps turn the current upward trend around.

-

We have made no significant changes to our inflation outlook over the past month. The core PCE price index still looks set to increase 2.6% on a year-over-year basis in Q4-2024.

At the start of this year, a soft landing for the U.S. economy looked like a difficult task for the Federal Reserve to achieve. A Bloomberg survey of 45 economic shops at the start of the year put the odds of recession at 50%. The most recent version of the same survey put those odds at just 30% in July. Until very recently, financial markets appeared to have moved from “soft landing” to “no landing at all.” Then the July jobs report shook up the snow globe and reset expectations for the rest of the year and beyond. It is an unusual state of affairs for one report to meaningfully disrupt financial markets and reframe economic expectations. We explore what has changed, what hasn’t and what to watch at this pivotal point in monetary policy.

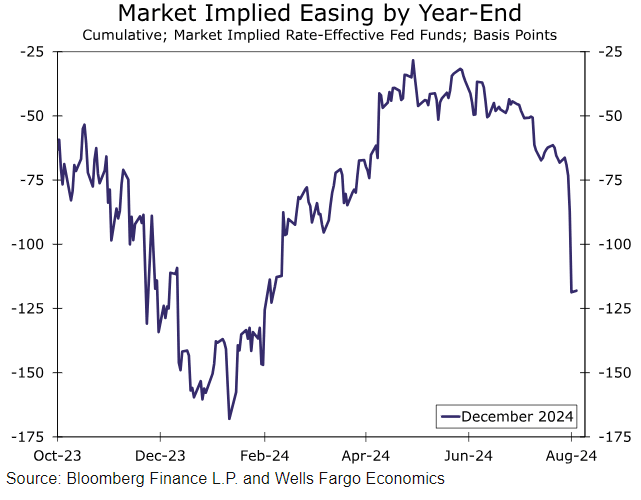

Long-simmering jobs market troubles finally boiled over

It is the normal state of things for financial markets to parse economic data for clues about everything from corporate profits to the health of the consumer, but 2024 has been characterized by a fascination with inflation data as though it were the only lens through which to view Fed policy. At the start of the year, with a tight labor market and inflation trending lower, financial market participants wagered steep rate cuts were in store by year-end (Figure 1). But those hopes were dashed by inflation data that came in too-hot-to-handle for the first several months of the year before giving way to a more orderly slowing in price growth recently. In the subsequent months, every piece of economic data was strip-mined for clues about inflation with little regard for data about other aspects of economic health. This preoccupation with the “low and stable prices” side of the Fed’s dual mandate felt reasonable, even safe, with the unemployment rate building on a record stretch of months below 4% as it was at the start of the year.

We have chronicled the deterioration in the labor market evident in indicators other than the monthly jobs report throughout the course of the year. But observations about fewer job openings, a lower quits rate and a shrinking share of consumers saying that jobs are plentiful tend to be discounted when the monthly jobs number keeps coming in above expectations. Suffice to say, in the wake of July’s disappointing jobs report and the seismic reaction from global financial markets, everyone is awake to the risk of a slowing U.S. jobs market and the “maximum employment” side of the Fed’s mandate is back in focus.

Author

Wells Fargo Research Team

Wells Fargo