If this is recession, somebody forgot to tell the consumer

Summary

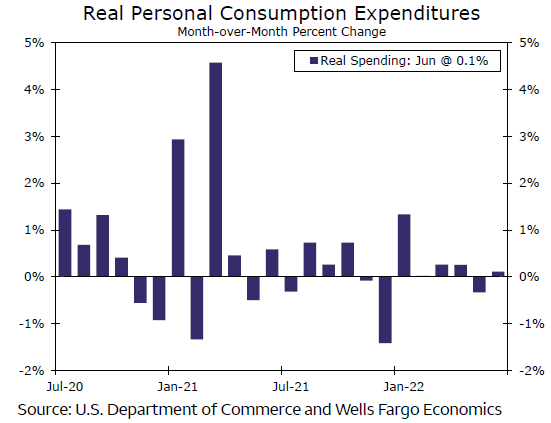

The 0.1% increase in real personal spending in June shows that even after adjusting for the highest inflation in 40+ years, consumers are still increasing spending, if only incrementally. But it is taking a toll, as consumers have not had to take their saving rate this low since 2009.

A different kind of financial crisis as saving rate craters

Like a dazed boxer still on his feet, the U.S. consumer is still in the fight with a consensus-beating increase in both income, which was up 0.6%, and spending, up 1.1%. After adjusting for inflation, real personal spending notched an incremental gain of 0.1%, and last month's real decrease of -0.4% got a slight bump up to -0.3% (chart). To some extent, these details were heralded by yesterday's Q2 GDP report, in which consumer spending was one of the few things still in expansion territory.

The consumer is reaching deep to find the means to go on spending in the face of the highest inflation in 40+ years. On trend, income is not keeping up with inflation, so in order to keep on spending, households are putting off saving. In fact, the saving rate at 5.1% is lower than it was during the financial crisis in 2009 (chart). Just as inflation is eroding purchasing power, wage growth isn't providing as much of a boost to income as it did recently. Wages and salaries advanced 0.46% in June, and while that's still above the average monthly growth rate that prevailed pre-pandemic (0.35%), it marks the slowest pace of wage growth in about a year and a half. Wage growth is moderating with the three-month annualized pace slowing to a still-strong 6.2% during the month (chart). Overall, real disposable personal income is now 5.8% below the level implied by its pre-pandemic trend.

Author

Wells Fargo Research Team

Wells Fargo