Ichimoku cloud analysis: USD/CAD, USD/JPY, AUD/USD

USD/CAD, “US Dollar vs Canadian Dollar”

USD/CAD has secured under the support level. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the lower border of the Cloud at 1.3530 is expected, followed by a decline to 1.3345. An additional signal confirming the decline will be a rebound from the resistance level. The scenario can be cancelled by a breakout of the upper border of the Cloud, securing above 1.3615, which will mean further growth to 1.3705.

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY is pushing off the Tenkan-Sen line. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the lower border of the Cloud at 134.85 is expected, followed by a decline to 130.85. An additional signal confirming the decline will be a rebound from the lower border of the bullish channel. The scenario can be cancelled by a breakout of the upper border of the Cloud, securing above 136.55, which will mean further growth to 137.45.

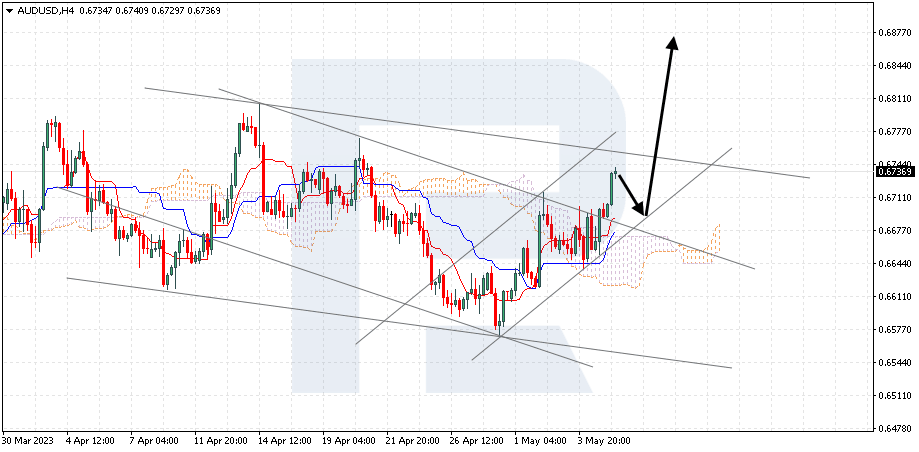

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD is getting ready to break out the upper border of the descending channel. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 0.6690 is expected, followed by growth to 0.6875. An additional signal confirming the decline will be a rebound from the lower border of the bullish channel. The scenario can be cancelled by a breakout of the lower border of the Cloud, securing under 0.6590, which will mean a further decline to 0.6405. Meanwhile, the growth can be confirmed by a breakout of the upper border of the descending channel, securing above 0.6775.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.