Ichimoku cloud analysis: GBP/USD, XAG/USD, USD/CHF

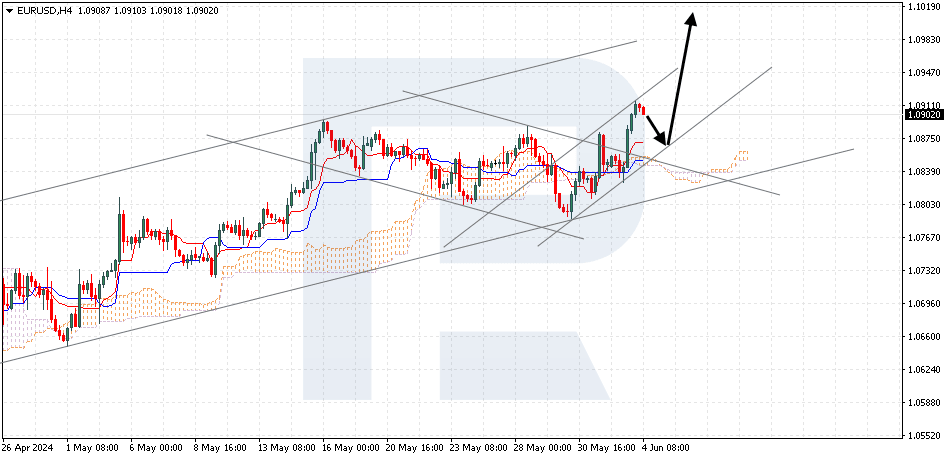

EUR/USD, “Euro vs US Dollar”

EUR/USD has gained a foothold above the resistance level. The pair is moving above the Ichimoku Cloud, suggesting an uptrend. A test of the Tenkan-Sen line at 1.0865 is expected, followed by a rise to 1.1065. A rebound from the lower boundary of the bullish channel would be an additional signal confirming the increase. The scenario could be invalidated by a breakout of the lower boundary of the Cloud, with the price securing below 1.0805, indicating a further decline to 1.0715.

XAG/USD, “Silver vs US Dollar”

Silver is rebounding from the indicator’s signal lines. The instrument is moving below the Ichimoku Cloud, indicating a downtrend. A test of the Cloud’s lower boundary at 30.65 is expected, followed by a decline to 28.35. A rebound from the upper boundary of the bearish channel would be an additional signal confirming the decline. A breakout of the Cloud’s upper boundary could invalidate this scenario, with the price securing above 31.75, indicating a further rise to 32.65. Conversely, the fall could be confirmed by a breakout below the lower boundary of the Double Top reversal pattern, with the price establishing itself below 29.55.

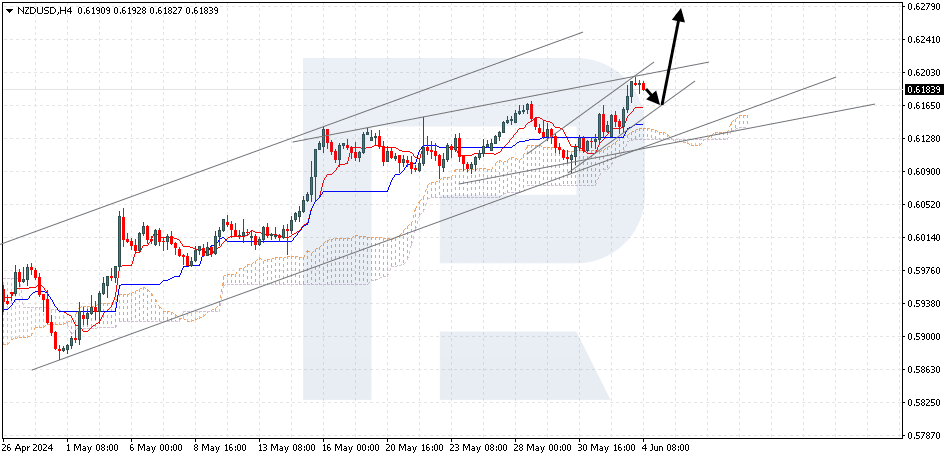

NZD/USD, “New Zealand Dollar vs US Dollar”

NZD/USD is testing the upper boundary of the bullish channel. The pair is moving above the Ichimoku Cloud, suggesting an uptrend. A test of the Tenkan-Sen line at 0.6165 is expected, followed by a rise to 0.6285. A rebound from the lower boundary of the bullish channel would be an additional signal confirming the upward movement. A breakout below the Cloud’s lower boundary could invalidate the scenario, with the price securing below 0.6110, indicating a further decline to 0.6015. Conversely, the rise could be confirmed by a breakout of the upper boundary of the bullish channel, with the price finding a foothold above 0.6225.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.