Ichimoku cloud analysis: GBP/USD, USD/RUB, gold

GBP/USD, "Great Britain Pound vs US Dollar"

The currency pair is trading at 1.3768 under the Ichimoku Cloud, suggesting a downtrend. A test of the upper border of the Cloud at 1.3825 is expected, followed by falling to 1.3575. An additional signal confirming the decline might become a bounce off the resistance level. The scenario can be canceled by a breakaway of the upper border of the Cloud and securing above 1.3885, which will mean further growth to 1.3975. The decline can be confirmed by a breakaway of the Neck of the reversal Head and Shoulders pattern and securing under 1.3695. The aim of the move is 1.3520.

USD/RUB, "US Dollar vs Russian Ruble"

The currency pair is trading at 77.04 above the Ichimoku Cloud, suggesting an uptrend. A test of the signal lines of the indicator at 76.40 is expected, followed by gtowth to 79.55. The growth can be additionally confirmed by a bounce off the lower border of the ascending channel. The scenario can be canceled by a breakaway of the lower border of the Cloud and securing under 74.05, which will entail further falling to 73.15.

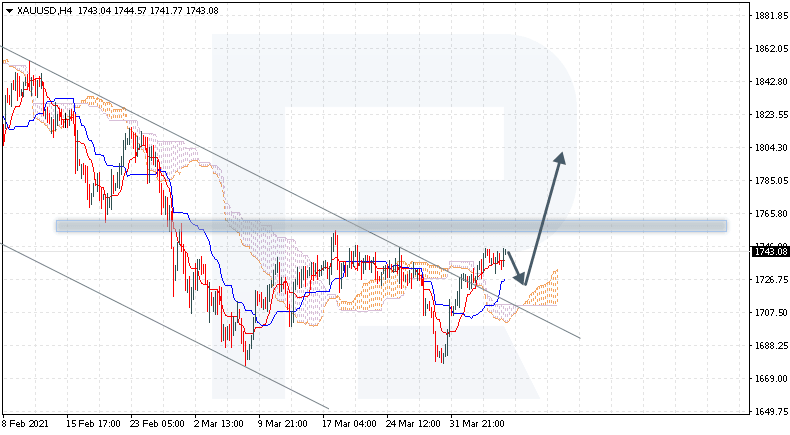

XAU/USD, "Gold vs US Dollar"

Gold is trading at 1743 above the Ichimoku Cloud, suggesting an uptrend. A test of the signal lines of the indicator at 1725 is expected, followed by growth to 1805. An additional signal confirming the growth will be a bounce off the upper border of the descending channel. The scenario can be canceled by a breakaway of the lower border of the Cloud and securing under 1685, which will entail further falling to 1615. The growth can be confirmed by a breakaway of the upper border of the Double Bottom reversal pattern and securing above 1765. The aim of the move is 1835.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.