Ichimoku cloud analysis: EUR/USD, USD/JPY, EUR/GBP

EUR/USD, “Euro vs US Dollar”

EUR/USD is testing the bullish channel’s downside border. The instrument is currently moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test Kijun-Sen at 1.0220 and then resume moving downwards to reach 1.0005. Another signal in favour of a further downtrend will be a rebound from the rising channel’s downside border. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 1.0335. In this case, the pair may continue growing towards 1.0435.

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY is moving outside the bearish channel. The instrument is currently moving above Ichimoku Cloud, thus indicating an ascending tendency. The markets could indicate that the price may test the cloud’s upside border at 133.95 and then resume moving upwards to reach 136.85. Another signal in favour of a further uptrend will be a rebound from the descending channel’s upside border. However, the bullish scenario may no longer be valid if the price breaks the cloud’s downside border and fixes below 132.35. In this case, the pair may continue falling towards 131.45.

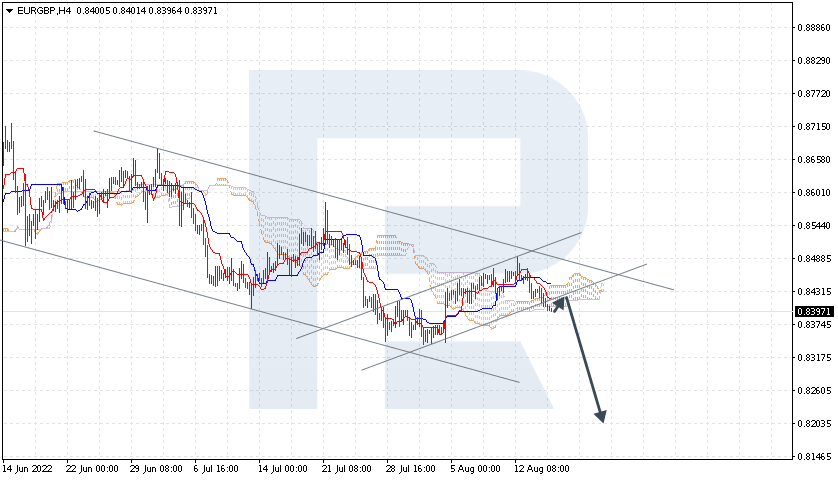

EUR/GBP, “Euro vs Great Britain Pound”

EUR/GBP has fixed below the bullish channel’s downside border. The instrument is currently moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test the cloud’s downside border at 0.8405 and then resume moving downwards to reach 0.8205. Another signal in favour of a further downtrend will be a rebound from the rising channel’s downside border. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 0.8495. In this case, the pair may continue growing towards 0.8590.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.