Ichimoku cloud analysis: EUR/USD, NZD/USD, USD/CAD

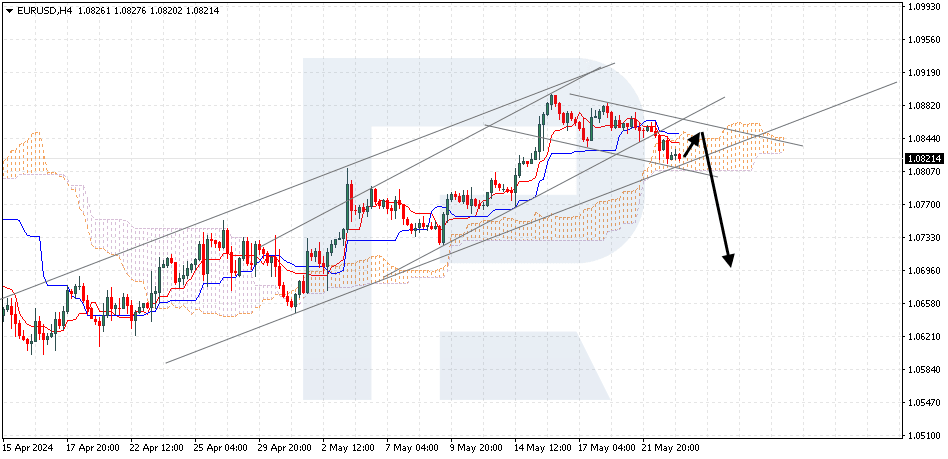

EUR/USD, “Euro vs US Dollar”

EURUSD has consolidated under the lower border of the bullish channel. The pair is moving inside the Ichimoku Cloud, suggesting a sideways movement. A test of the upper boundary of the Cloud indicator at 1.0845 is expected, followed by a fall to 1.0695. A rebound from the lower boundary of the bullish channel would signal a decline in quotes. This scenario can be invalidated by the upper boundary of the Cloud, with the price securing above 1.0885, indicating a rise to 1.0975. Conversely, a decrease could be confirmed by a breakout of the lower boundary of the ascending channel, with the price securing below 1.0785.

NZD/USD, “New Zealand Dollar vs US Dollar”

NZDUSD is testing the indicator signal lines. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the upper boundary of the Cloud at 0.6095 is expected, followed by a rise to 0.6235. An additional signal confirming the surge will be a rebound from the lower boundary of the bullish channel. A breakout below the lower boundary of the Cloud would invalidate this scenario, with the price securing below 0.6045, indicating a decline to 0.5955. Conversely, the rise could be confirmed by a breakout of the upper boundary of the bearish correction channel, with the price securing above 0.6155.

USD/CAD, “US Dollar vs Canadian Dollar”

USDCAD is moving away from the upper boundary of the bullish channel and above the Ichimoku Cloud, indicating a potential uptrend. A test of the Kijun-Sen line at 1.3640 is expected, followed by a rise to 1.3830. An additional signal confirming the surge will be a rebound from the lower boundary of the bullish channel. The scenario can be negated by a breakout below the lower boundary of the Cloud, with the price securing below 1.3595, indicating a decline to 1.3505. Conversely, the rise could be confirmed by a breakout of the upper boundary of the bearish channel, with the price securing above 1.3745.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.