Ichimoku cloud analysis: AUD/USD, XAU/USD, GBP/USD

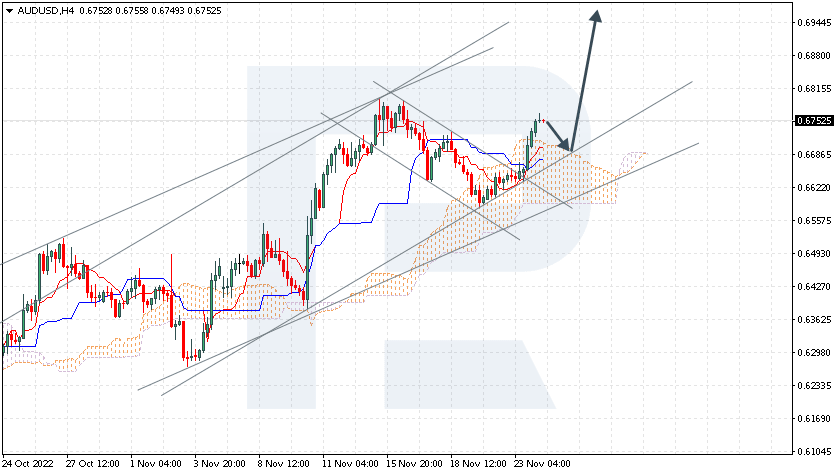

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair is growing inside the bullish channel, moving above the Ichimoku Cloud, which suggests the prevalence of an uptrend. A test of the upper border of the Cloud is expected at 0.6695, followed by growth to 0.6945. Growth will be additionally supporter by a bounce off the lower border of the bullish channel. The scenario can be cancelled by a breakaway of the lower border of the Cloud under 0.6535, which will entail further falling to 0.6445.

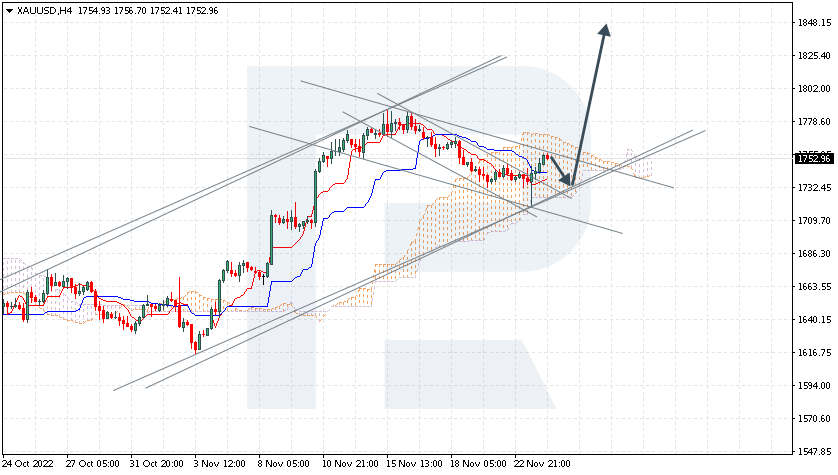

XAU/USD, “Gold vs US Dollar”

Gold is pushing off the upper border of the descending channel. The instrument is moving inside the Cloud, which means a flat. A test of the lower border of the Cloud is expected at 1735, followed by growth ti 1845. An additional signal confirming the growth will be a bounce off the lower border of the bullish channel. The scenario can be cancelled by a breakaway of the lower border of the Cloud and securing under 1705, which will entail further falling to 1665. The growth will be confirmed by a breakaway of the upper border of the descending channel and securing above 1765.

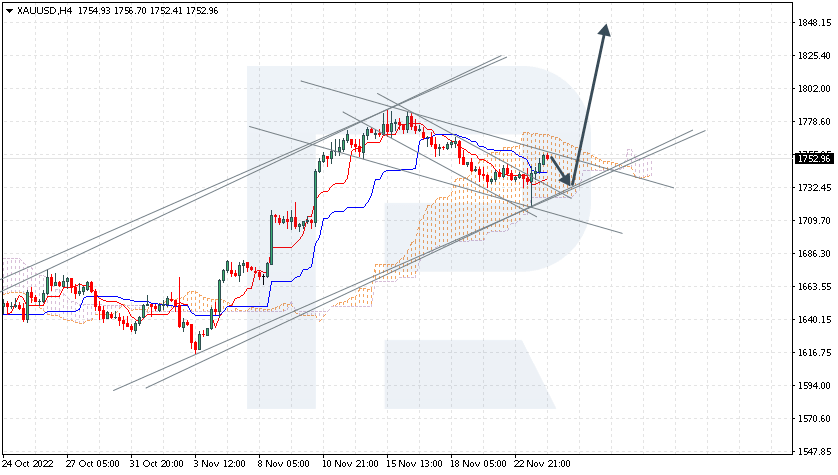

GBP/USD, “Great Britain Pound vs US Dollar”

The pair has secured above the resistance level, going above the Ichimoku Cloud, which means an uptrend. A test of the signal lines of the indicator is expected at 1.1945, followed by growth to 1.2475. An additional signal confirming the growth will be a bounce off the lower border of the bullish channel. The scenario can be cancelled by a breakaway of the lower border of the Cloud and securing under 1.1585, which will entail further falling to 1.1595.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.