Huge Difference Between ISM and PMI: Which One is Wrong?

Chris Williamson, Chief Business Economist, Comments

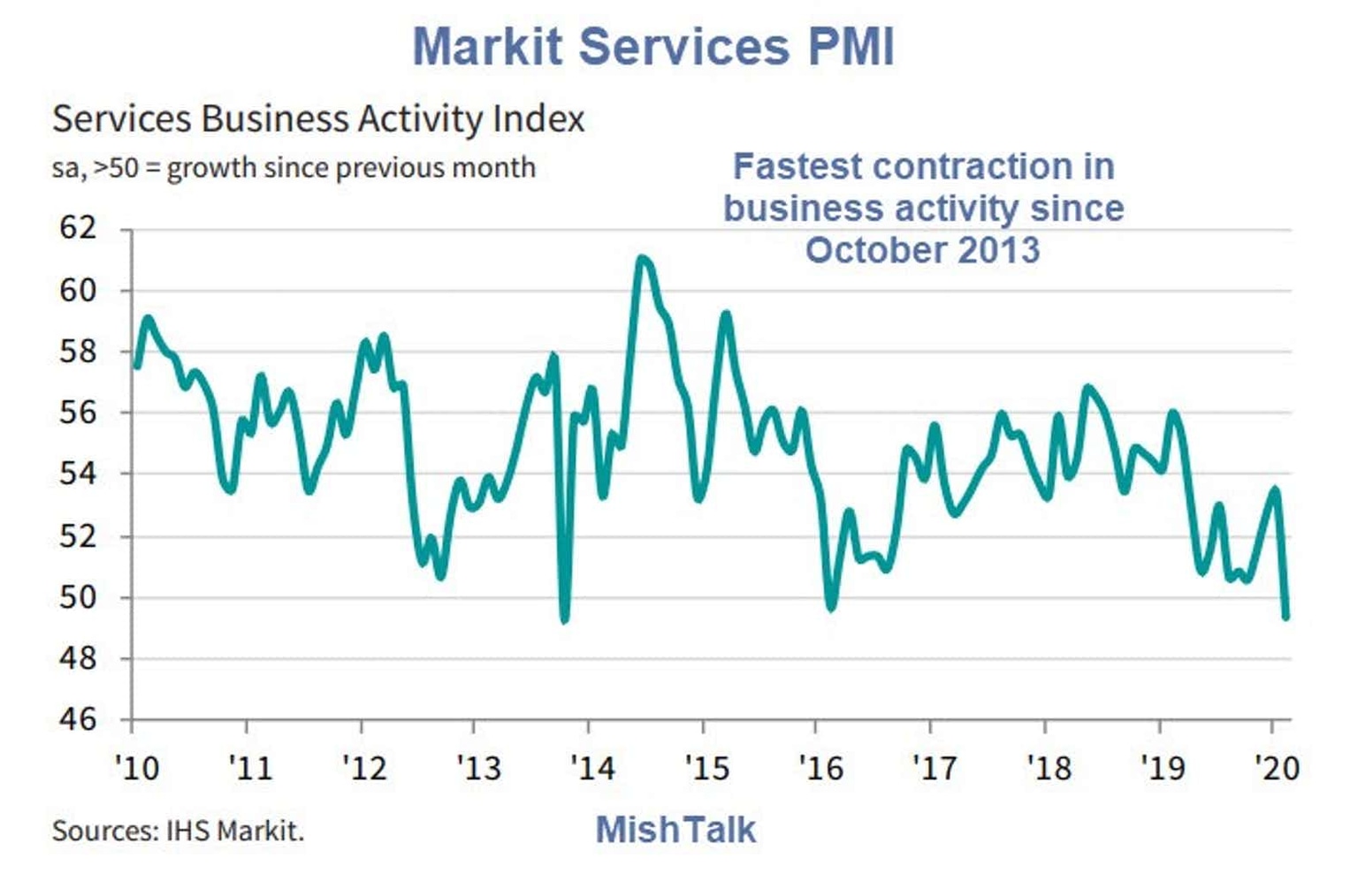

- "The US service sector took a knock from the coronavirus outbreak and growing uncertainty about the economic and political outlooks in February. The fall in the headline index measuring business activity levels was the second largest seen since the global financial crisis over a decade ago, exceeded only by the brief slump in activity during the 2013 government shutdown.”

- “Combined with a weak manufacturing survey in February, the data are consistent with annualised GDP growth slipping from around 2% at the start of the year to just 0.7% midway through the first quarter.”

- “Business sectors such as travel and tourism are reporting weakened activity due to the virus outbreak, most notably in terms of foreign visitors and overseas sales. However, other sectors such as financial services and business services are reporting virus-related hits to demand, suggesting a more broad-based weakening of demand across the economy, exacerbating the supply-shock that is constraining manufacturing.”

- “Companies have meanwhile grown increasingly concerned about client spending and investment being curbed ahead of the presidential election. Political and economic uncertainty, the coronavirus outbreak and financial market turmoil all risk building into a cocktail of risk aversion that has severely heightened downside risks to the economy in coming months. Much will depend of course on the speed with which the virus can be contained and how quickly business can return to normal.”

ISM Non-Manufacturing Index

The February 2020 Non-Manufacturing ISM® Report On Business® not only show business expansion but growth in production, new orders, employment, deliveries, prices, backlog of orders, new export orders, and imports.

Word About Diffusion Indexes

I have discussed this before but it's worth repeating.

Both the Markit PMI and ISM NMI are diffusion indexes. They both measure, or claim to, service sector and manufacturing sector output.

Diffusion indexes do not measure magnitude, only direction. For example, one company hiring a single worker will offset another company firing 300 because one is positive, the other negative.

ISM vs Markit

ISM concludes first-quarter GDP is growing at 3.0% vs 0.7% for Markit.

Setting GDP aside, the component numbers of ISM are not remotely believable.

On February 18 (for January), I commented on the Largest Shipping Decline Since 2009 and That's Before Coronavirus.

Europe is a basket case. China is even worse, in lockdown mode.

Yet, ISM says new export orders are expanding much faster.

That these surveys are so wildly different with ISM numbers truly unbelievable suggests the ISM sample is either too small or is not remotely representative of the industries it measures, or both.

Mike "Mish" Shedlock

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc