How yields will push SPX around now

S&P 500 opened with a bullish gap indeed, daily breadth was quite positive (sectoral view), but (short duration) Treasuries auction stood in the way (forcing S&P 500 selling) – we got though late session decent buying, so is everything squared and all right?

ES supports had been respected – 6,115 and 6,125 are the more important ones, the premarket call for 6,135 test in our interaday channel worked out well first touch – but which way are the risks balanced? The decisive factors are today‘s Treasury auctions and FOMC minutes (expect them not to be aligned, very varying opinions expressed).

SMCI did well (my key pick early last week alongside HOOD and UPST), but today‘s packed yet only 6min lasting video gives you a very clear answer as to where I see the key shift happening. Let me just say that China stocks will notice, BIDU didn‘t enthuse me, so beware BABA chasers, the clock to midnight is ticking! Just as with the Forbes cover, you hear extensive China bullish coverage only when some top is almost knocking on the dorr. Check also AAPL, rejected at $245 – even META stumbled…

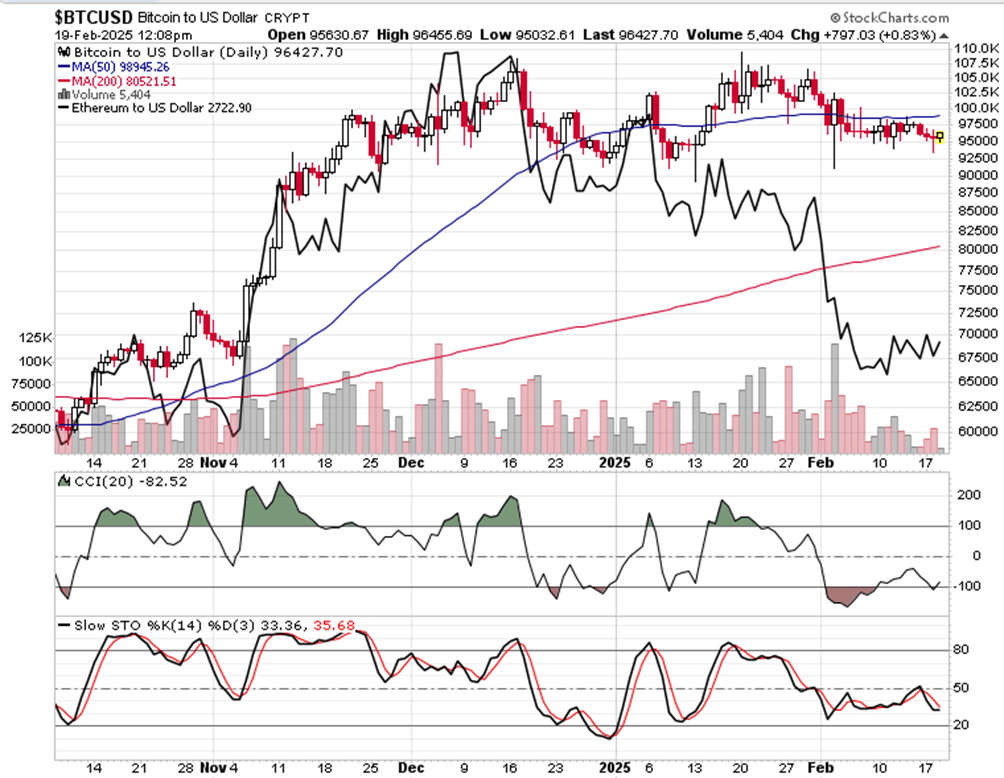

What do I make of it? Having reviewed the in-depth video, check below in the client sections. How do you like this odd weakness in Bitcoin – are risks here skewed to the upside really heavily?

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.