How quickly will Japan’s economy bounce back?

Executive Summary

Although Japan appears to have more successfully contained the spread of COVID-19 compared to many other major developed countries, Japan's economy still struggled mightily in the first half of 2020. Real GDP was down 9.9% year-over-year in Q2, a bit more than the 9.5% contraction in the United States, but still less than the 15.0% collapse in the Eurozone. Higher frequency economic data suggest a rebound began to take hold towards the end of the second quarter. Like households in the United States, Japanese households have seen their incomes lifted in the aggregate by government transfer payments, which has helped to offset the decline in other sources of personal income. In the near-term, we believe this firepower can spur a boost to economic growth. But over the medium- to longer-run, the recovery will need to be more self-sustaining, something the Japanese economy has struggled to achieve in the past, particularly if external demand is weak. Our forecast for the Japanese economy has real GDP still roughly 4% lower at the end of 2021 than it was at the end of 2019. While we believe the risks to this forecast are skewed to the upside, the sizable hole signals just how long we think it will take to close the output gap in Japan.

Japan's Economy Looks to Bounce Back in the Second Half of 2020

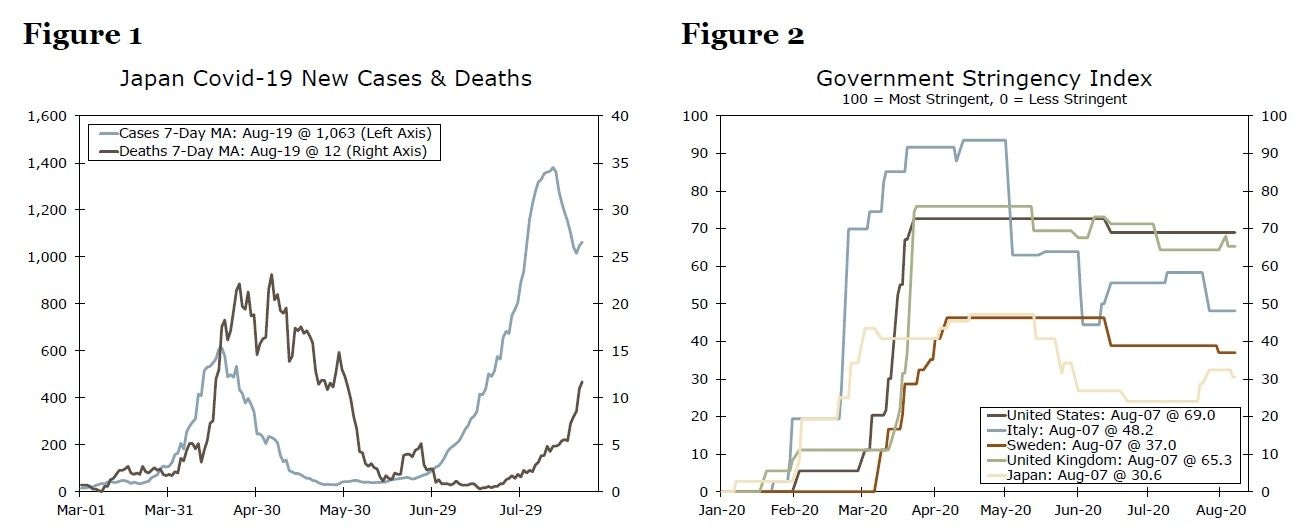

New COVID-19 cases in Japan peaked around 600 per day on a weekly average basis in April (Figure 1), a much lower level than in most of Europe or the United States. As April turned to May and June, new cases steadily receded such that the outbreak appeared largely under control. Around July 1, cases began to accelerate again, with deaths not too far behind. But new cases appear to have topped out once again, and on a relative basis COVID-19 has wrought a far lower human toll on Japan than in most of Europe or the United States. Japan has a total of just nine deaths per million people, in comparison to 523 per million in the United States or 586 per million in Italy. With a less serious public health situation, policymakers in Japan have generally adopted less stringent limitations on mobility and private activity (Figure 2).

Author

Wells Fargo Research Team

Wells Fargo