How much Gold is there in the world?

How much gold is there in the world?

The quick answer is not much - at least not relatively speaking.

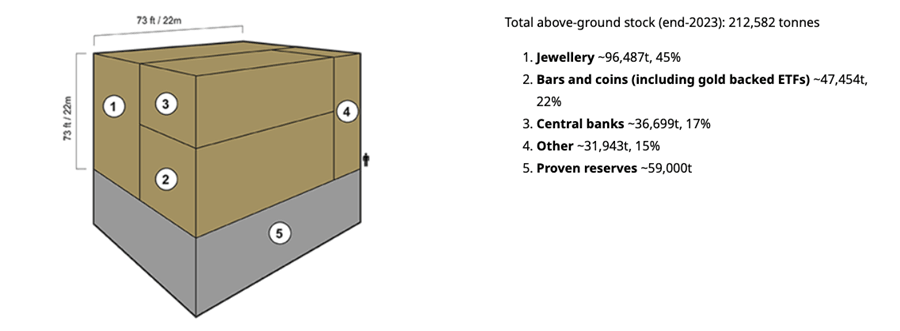

According to the World Gold Council, as of the end of 2023, around 212,582 tons of gold have been mined throughout history. About two-thirds of that amount was dug out of the ground since 1950.

That sounds like a lot of gold, but if you melted down every ounce of gold ever mined and formed it into one block, it would only measure 73 feet on each side.

Or to look at it another way, you could take all of the gold in the world and fit it into four and a half Olympic-sized swimming pools.

Here is a cube that size next to a semi.

The U.S. Geological Survey (USGS) comes in with a slightly lower estimate of 187,000 tons.

Each year, mining adds approximately 2,500-3,000 tons of gold to the above-ground stock.

Knowing how much gold remains in the ground is a difficult task. The USGS estimates that known mineable reserves total about 57,000 tons.

There is likely much more gold buried beneath the earth's surface but a lot of it would be difficult to reach given the current technology. Some estimates put the total of inaccessible gold deep beneath the earth's surface at around 400,000 tons.

There are as many as 1.6 quadrillion (16,000,000,000,000,000) tons of gold in the earth's molten metallic core.

Scientists estimate there are about 20 million tons of gold suspended in the ocean. That's a lot of gold, but it is spread out through a lot of water. According to NOAA, that's only about one gram of gold for every 100 million metric tons of ocean water in the Atlantic and North Pacific. That comes to 13.3 million tons. There is no economically viable way to extract it.

The bottom line is gold is scarce and that's part of what gives it its value.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.