Housing Starts rebound in February

Summary

Headwinds pick up for residential construction

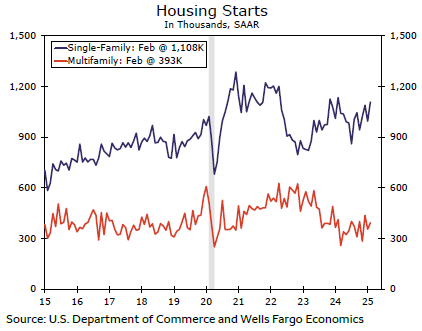

Housing starts jumped 11.2% in February, rebounding from an 11.5% decline in January. Although starts increased across the board, permits did not paint as strong of a picture. Single-family permits were essentially unchanged for the second straight month coinciding with weakening builder confidence amid increased economic and policy uncertainty. Multifamily permits also decreased in March. That said, the pace of new multifamily permits is essentially moving sideways, which is an improvement over the sharp pullback in multifamily construction over the last couple of years.

Interested in our outlook for the residential sector? We welcome you to join us today at 2:00pm eastern for a webinar discussing the report we published this morning focused on prospects for housing amid ongoing affordability challenges and changing economic policy.

Single-family stagnation

-

Single-family starts rose 11.4% in February, completely erasing the prior 8.6% drop coinciding with harsh winter weather in January.

-

Looking through the volatility, the pace of single-family permits foretells a slower pace of construction over the coming months. Single-family permits dipped 0.2% in February, the second straight month of essentially no change. This stagnation is likely reflective of elevated inventory levels and challenging affordability conditions clouding the outlook for buyer demand.

-

As mortgage rates remain elevated, builders have stepped up their use of mortgage rate buy-downs and other incentives to soften interest rate headwinds. However, builders also are becoming cautious on account of mounting economic and policy uncertainty.

-

The NAHB/Wells Fargo Housing Market Index (HMI) dipped three points in March to 39, the second consecutive decline. After a post-election bump, builder sentiment has now receded back to the level recorded before the election in August.

-

Weaker perceptions of buyer traffic and current sales conditions dulled builder sentiment in March. The component gauging sales expectations held steady, although it matched last year’s low point reached in June 2024.

Author

Wells Fargo Research Team

Wells Fargo