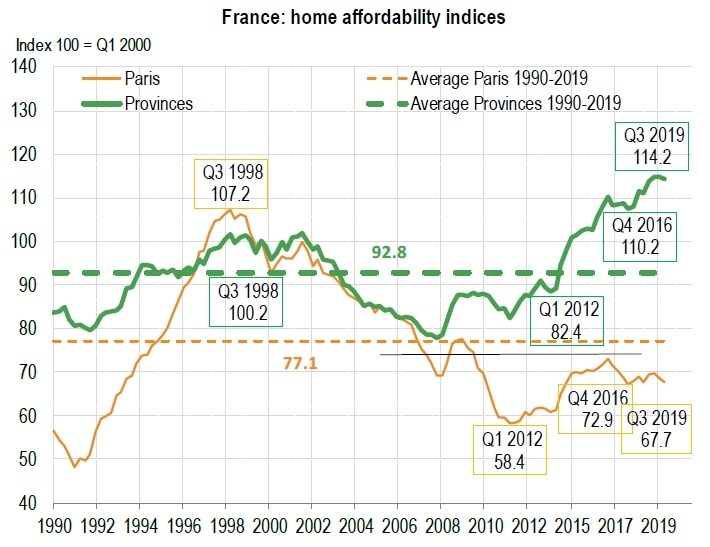

Home affordability trends in France: dichotomy between Paris and the provinces for the past decade

Our home affordability index measures the ratio of the borrowing capacity of households (based on average household income, average fixed mortgage rates and average mortgage duration1) to the average existing home price per square meter (m2).

Over the past ten years2, home affordability has increased by 30.4% in the provinces, but declined by 12.2% in Paris. Changes in average credit conditions (the average duration was extended to 18.8 years from 17.8 years, and mortgage rates declined to 1.30% from 4.30%) and disposable household income (+7.1%, notwithstanding differences in level) were relatively homogeneous at the national level, which means the differential can be attributed almost exclusively to the spread in existing home prices changes since 2009: home prices have increased by 64.2% in Paris compared to only 10.2% in the provinces. Moreover, this average figure masks significant price differentials from one region to the next.

Author

Laurent Quignon

BNP Paribas