Heaven help us if unemployment follow the path of the great recession

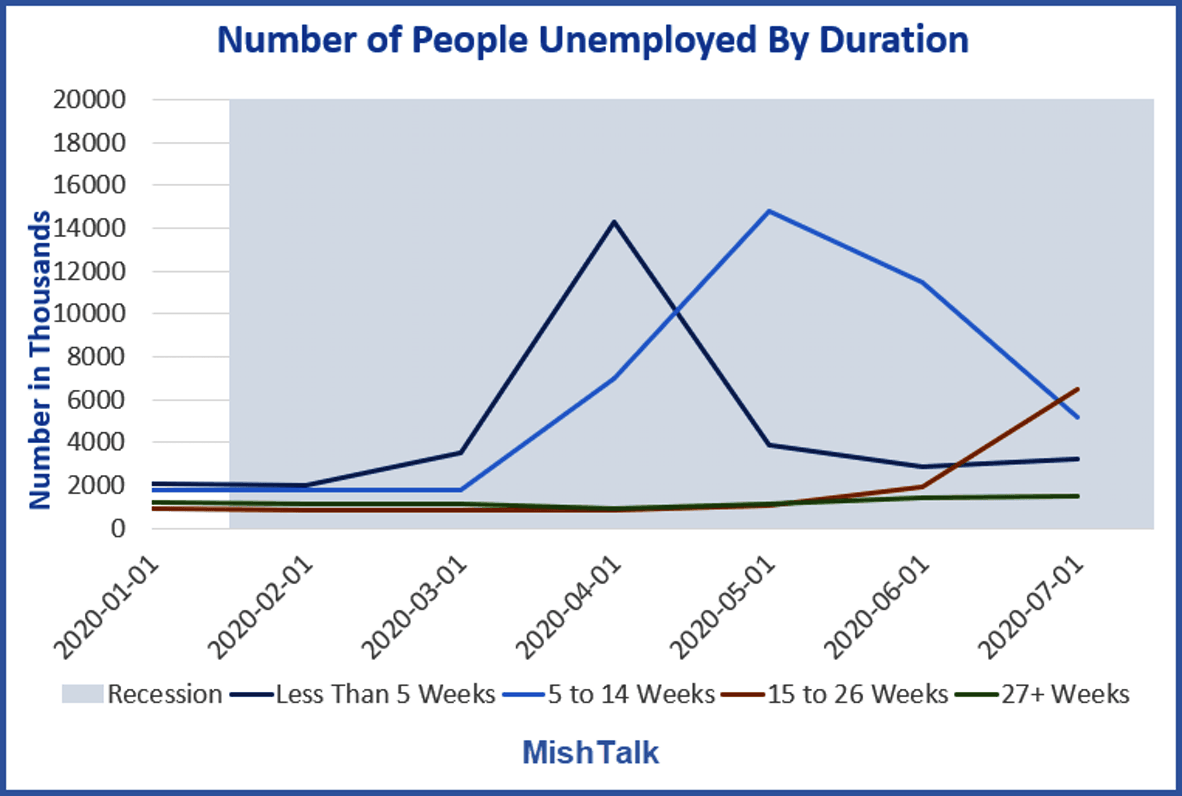

Here's a series of charts showing the duration of unemployment followed by a comparison to what happened in the Great Recession.

Lost jobs stay lost

The chart shows a sharp decline in the number of people unemployed 5 weeks or less.

Unfortunately, that was accompanied by a sharp rise in the number of people unemployed for 5-14 weeks.

Then the number of people unemployed for 15-14 weeks took a sharp decline.

Now, the the number of people unemployed for 15-26 weeks is sharply rising.

Percent of people unemployed by duration

Of those unemployed

- Of Those Unemployed, the Percentage of People Unemployed for Less than 5 Weeks Topped at 61.9%. that Percentage Is Now 19.6%.

- Of those unemployed, the percentage of people unemployed for 15-16 weeks rose sharply to 39.6%.

Number unemployed by group

- Less Than 5 Weeks: 3,202,000

- 5-14 Weeks: 5,169,000

- 15-26 Weeks: 6,484,000

- 27+ Weeks: 1,501,000

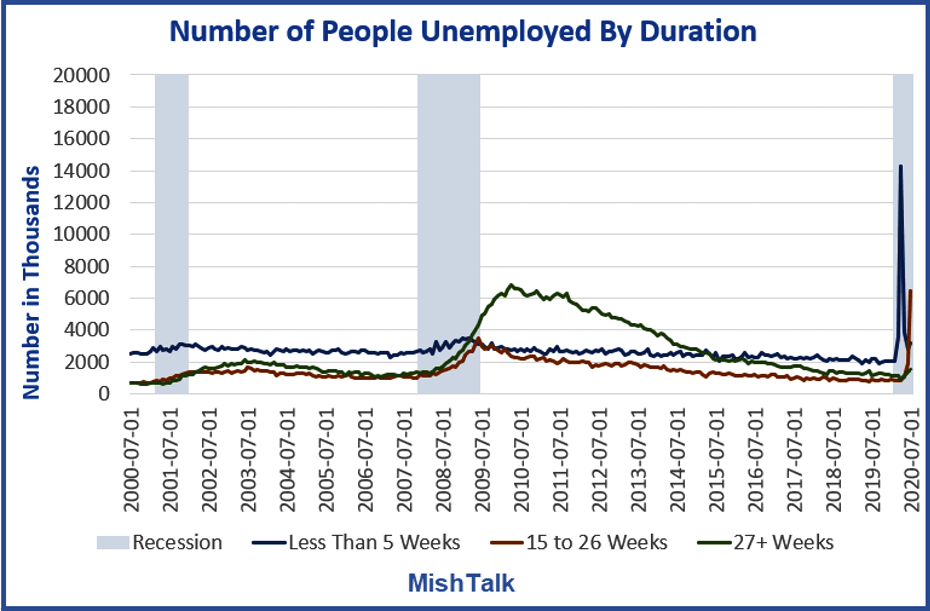

Number of people unemployed by duration 2000-2020

That red line is very ominous. Let's hone in on what happened during the Great Recession to see why.

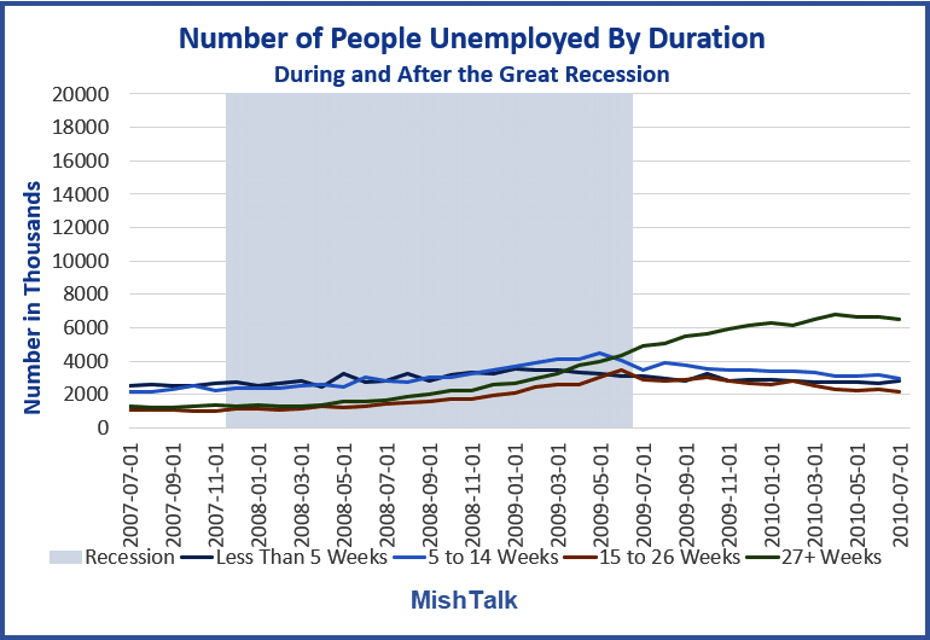

Unemployed by duration during and after the great recession

Great recession comparison key points

- The number of people unemployed for 15-26 weeks in the Great Recession peaked at 3,488,000 in June of 2009. That's when the recession ended.

- For over a full year, the number of people unemployed for 27 weeks or longer kept rising. It peaked at 4,988,000 in October of 2012 over a year after the recession ended.

Once people hit 15 weeks of unemployment they stayed unemployed for 27 weeks or longer.

Already we at 6,484,000 unemployed 15-26 weeks vs a max of 3,488,000 in the Great Recession.

What If?

If the unemployment trends follows the path of the great recession we will easily have over 10 million people unemployed 27 weeks or longer by the time this mess clears up.

That is not a prediction, it is an observation based on current data.

I do have one prediction and it is not a pretty one.

The number of people unemployed 15-26 weeks is nearly guaranteed to rise in the next jobs report and perhaps the next several jobs reports. Continued claims shows why.

Continued claims

The BLS reference week for the latest jobs report was July 12-18 at 16,951,000 collecting unemployment.

That was nearly month ago. Continued claims have proven to be stubborn.

Heaven help us

Another 4 weeks will pass between jobs reports. So potentially millions more will will roll into the 15-26 week category from the 5-14 week category, now in a steep decline.

If the number of people rolling into the 15-26 category is 1,500,000 or greater, which seems likely, the next jobs report will show 8 million or so people unemployed 15-26 week.

Then in two months, those unemployed 27 weeks or more will start ticking up rapidly.

Heaven help us if unemployment 27 weeks or longer continues for a year after the recession ends.

But that is what happened in the Great Recession.

Panic at the Fed

Yesterday, I noted Yet Another fed president supports more free money and a covid lockdown

Three Fed presidents have now called for more free money from Congress.

Two of them support hard lockdowns of at least 4 weeks.

If that remotely sounds like panic, it's because it is panic. The Fed is not in control.

It is only an illusion that they ever were.

Gold's response to free money

Gold has responded and rightfully so.

For discussion, please consider Gold soars to new high above $2000 while managed money sat it out

What about the US Dollar? I am, glad you asked.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc