Hawkish FOMC ‘dot plot’ triggers Dollar rebound

Highlights

-

US inflation report misses expectations, as core rate falls to fresh 3-year lows.

-

Dollar regains losses after FOMC hints at just one US rate cut in 2024.

-

Handful of ECB speeches eyed on Friday, including from President Lagarde.

The dollar was the big winner among the major currencies yesterday, as investors reacted to a hawkish set of communications from the Federal Reserve.

As anticipated, there was no change in policy following this week’s FOMC meeting. Chair Powell welcomed Wednesday’s inflation data during his press conference, which showed that US core inflation had dropped to a fresh three-year low 3.4% in May. The statement was also tweaked, noting that there had been ‘modest further progress’ on inflation, rather than a ‘lack of further progress’. Interestingly, however, the bank’s inflation projections were nudged marginally higher - PCE inflation is now seen ending 2024 at 2.6% (2.4% in March), with the core PCE forecast raised to 2.8% (from 2.6%).

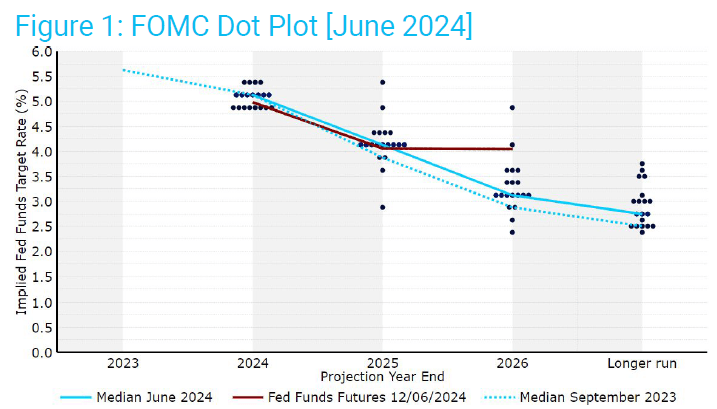

The big talking point was the bank’s updated interest rate projections. The median dot for 2024 was revised higher, as anticipated, and is now consistent with just one rate cut this year (down from three in March). While we were pencilling in two cuts, it remains a close call, with eight voting for 2 cuts, while the remaining eleven were in favour of either 1 cut or no change. Markets seem to be of the view that it wouldn’t take much to shift the balance in a dovish direction, with futures back pricing in 50 basis points of Fed cuts by year-end. This can perhaps explain the lack of a more significant move upwards in the US dollar on Wednesday evening.

Figure 1: FOMC dot plot [June 2024]

Source: LSEG Datastream Date: 13/06/2024

With the Fed stressing that it remains in data-dependant mode, upcoming inflation prints remain key to the near-term trajectory of the US dollar. Wednesday’s CPI report for May will have been welcomed by FOMC officials. Both the main and underlying rates of consumer inflation are now running at three-year lows in annual terms. Price momentum also appears to be easing, with monthly inflation flat for the first time since July 2022, while the monthly core measure posted its smallest gain since August 2021 when rounding to two decimal places. We will be awaiting the May PCE inflation data (28/06), the Fed’s preferred measure of price pressures, for signs of a similar downtrend.

Next up for markets will be a handful of speeches from ECB officials, including President Lagarde. Any dovish remarks here could be enough to send EUR/USD back towards the 1.07 level.

Economic calendar (BST) Friday

02:00 - BoJ Policy Decision.

09:30 - UK Consumer Inflation Expectations.

10:00 - ECB’s Lane speech.

10:00 - ECB’s De Guindos speech.

18:30 - ECB’s Lagarde speech.

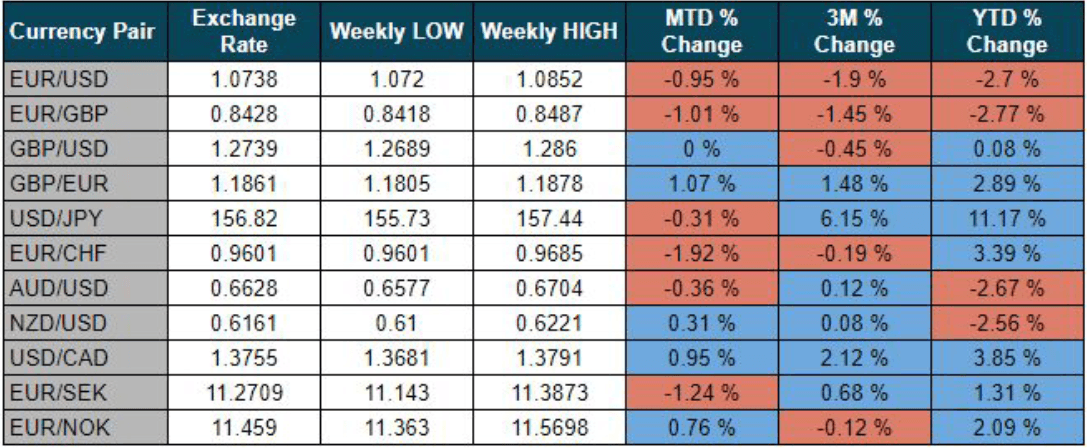

G10 Exchange rates [mid-market] (as of 13/06/24)

G10 Exchange Rates [mid-market] (as of 13/06/24)Source: LSEG Date: 13/06/2024

Author

Matthew Ryan, CFA

Ebury

Matthew is Global Head of Market Strategy at FX specialist Ebury, where he has been part of the strategy team since 2014. He provides fundamental FX analysis for a wide range of G10 and emerging market currencies.