Good rhetoric from US-China trade talks keeps us very bullish in the USD

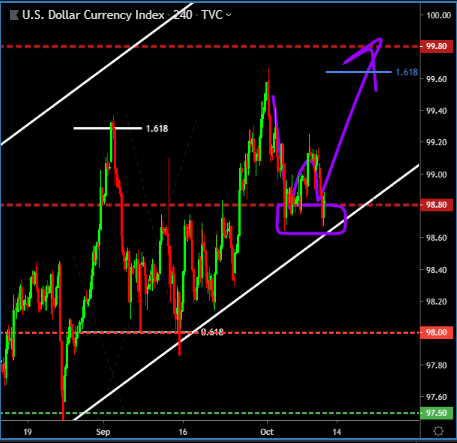

My view on the US Dollar remains very much bullish and with today's good rhetoric from both the US and Chinese delegations on trade talks this scenario becomes ever more likely.

After breaking above the 98.80 we've seen a retest of this level at least twice over the past week and today it got rejected again.

the next key historic level is the 99.80 around the 1.618% retracement of the last leg down which confluences with the previous highs and could be a BIG bulls target. In any case the make it or break it of this bullish structure is very dependent on how this trade talks will play out. If we get a deal between the 2 delegations a rally in the USD is expected. But if they fail to see common ground and this trade war escalates, a bearish move below the bullish structure to at least the previous lows is expected (98.00 level)

Author

Orlando Gutierrez

Learn 2 Trade

Orlando has been involved in the financial markets for about 10 years. His focus is Global Macro and he is a strong believer that the best way to trade the currency markets is focusing on the big picture and holding on to big macro trends.