Gold’s volatility

The current volatility of the yellow metal has been a topic of discussion in the markets. One day it’s rising to highs and then directly falls back to lows. For an instrument that is supposed to be a stable thing in the markets without much fear from external threats, Gold has been acting just like an instrument for the past couple of months. But then again, this year has shown us that almost anything is possible. So what’s the reason making Gold act in such a way?

Well, several factors come to mind. Whether it’s from the recent U.S. election results or the fact that we currently have a pandemic on our hands, everything is affecting the precious metal in one way or another. However, before I kick off this article, let’s take a look at how the instrument is actually doing.

Technically Speaking

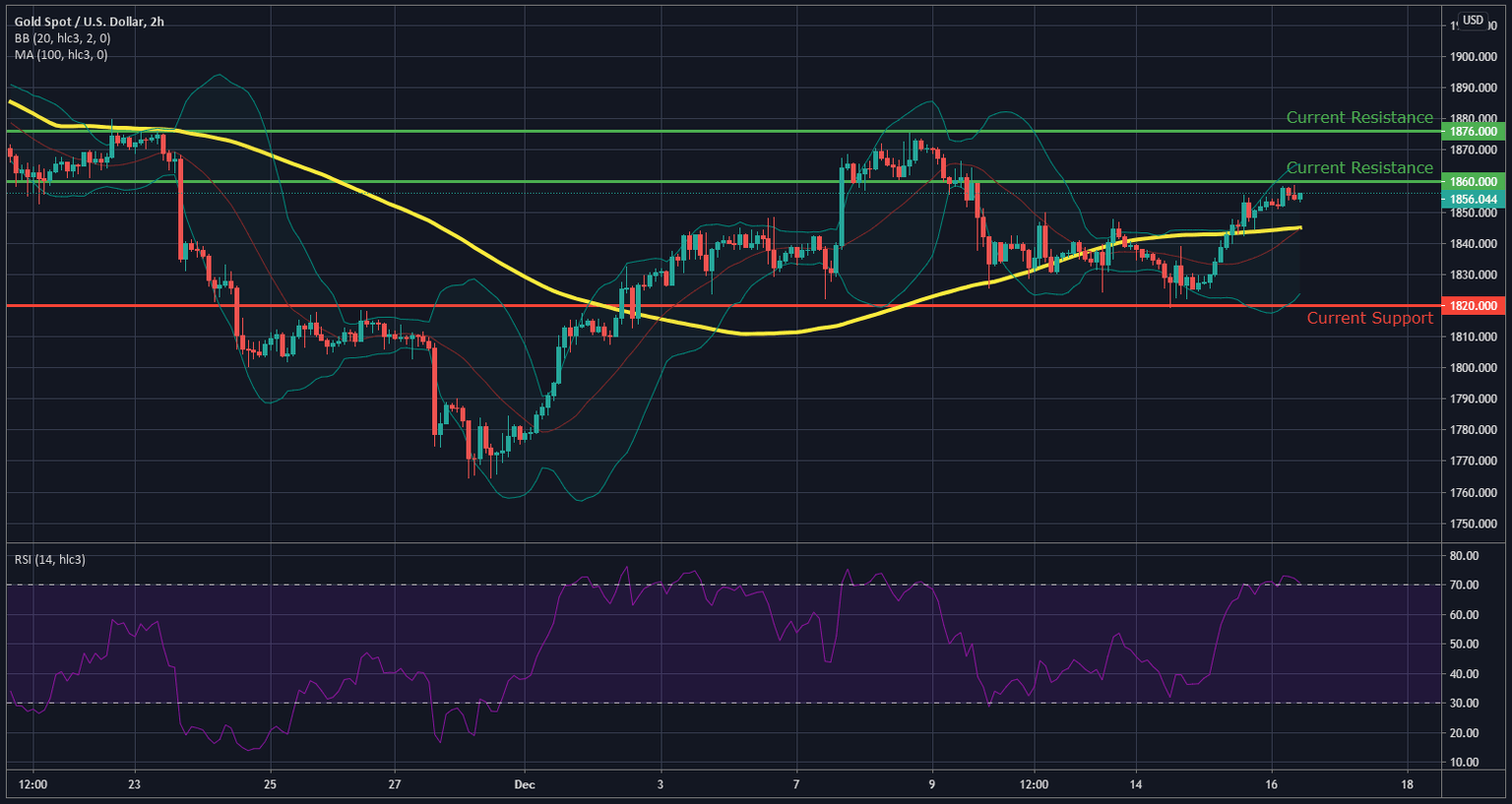

The first thing to look at when analysing the graph below, is the fact that Gold seems to be trading all over the place. Yes, that’s because of volatility as we’ve explained in the beginning, there’s also some rhyme and reason behind this movement, I’ll get to that in the next section. Let’s look at the technical view of Gold. We see that XAU is trading currently just below the $1,860 resistance level. This level used to be a support, but was broken and has not turned into resistance which the instrument is finding hard to break above.

Looking at the RSI (Relative Strength Index), we can see that the indicator is very close to the 70-level which signifies overbought conditions. What’s even more interesting about this, is the fact that both the RSI and price action are plateauing and seem to be trading sideways for the time being. This suggests one of two things, either there is going to be some consolidation at this $1,860 level as Gold Bulls situate themselves for another push higher, as the RSI falls down towards the 50 level. On the other hand, there could be a move lower in the price action which would translate with a steep move downwards in the RSI.

These two outcomes are most probable at the current junction, but another move higher is not entirely out of the question. In order for the instrument to resume moving higher, Gold must be able to break above the $1,860 level which would in turn allow it to target the previous high of December at $1,876. There is also the 100-SMA (Simple Moving Average), should Gold fall behind that line, the possibility of more downside builds higher and it would mean that there is going to be some increased volatility in the market.

Now that we’ve covered what’s the current situation in Gold. Let’s tackle the main question, which is volatility.

Why is Gold so Nervous?

When we talk about volatility, we usually explain it as nervousness in the market. If there’s one thing that markets hate and that would be uncertainty which is what we are facing currently. Actually, this is one of the main reasons that the market is going all over the place. Anyway, the focus is on Gold here, and one of the main reasons that Gold is acting so nervously is the fading anxiety after the U.S. elections.

If we look at the overall performance of the haven metal in December, we notice that it’s still above 4%. However, it remains more than 10% below its record high in August. This is because the yellow metal was hurt by a broad rally in stocks and riskier commodities with investor anxiety fading after the U.S. election. Gold is still up more than 20% for the year, making it one of the better-performing major assets in 2020.

Investors were nervous about the outlook for the global economy and the (now resolved) U.S. Elections. That trend boosted demand earlier in the year, before Joe Biden’s victory in the presidential race and key Republican wins in Senate races combined with hopeful vaccine news to send prices tumbling in November.

The market had expected that there was going to be a ‘Blue Wave’ in the U.S. election process, allowing Joe Biden to win the Presidency as well as Democrats taking control of the Senate. Investors had hoped that this combination would boost Gold by unleashing much larger stimulus programs on the economy.

Instead, Republicans performed better than many analysts expected. Investors are looking at that as well as a rise in coronavirus cases and ongoing stimulus discussions in Washington as Gold’s swings continue.

According to Tai Wong, head of base and precious metals derivatives trading at Bank of Montreal, “We’re going to certainly get volatility at least through the first quarter of 2021. There are so many uncertain things.”

With the outlook for Gold darkening, hedge funds and other speculative investors have reduced their exposure to Gold in recent weeks, pushing them to their lowest level in 1 ½ years, this is according to data compiled by the CFTC (Commodity Futures Trading Commission). Meanwhile, billions of dollars have flowed out of the largest Gold exchange-traded funds like the SPDR Gold Shares. That marks a reversal from earlier in the year, when hefty inflows added momentum to the Gold rally.

And the dollar continues to weaken as traders project a global economic resurgence in 2021, making Gold cheaper for overseas buyers. “The prospects overall remain solid for Gold even though they aren’t as positive as they were this summer when prices hit records,” Mr. Wong said.

So there are alot of contradicting factors hitting the Gold market at the same time giving the instrument such increased volatility.

Author

Alexander Douedari

Independent Analyst

Alexander Douedari is an Award Winning Hedge Fund Manager and Selfmade 7-Figure Trader. Now Mentor for Students all around the world.