Gold’s confirmed breakout and its implications

Yes, gold price confirmed its breakout – in daily closing price terms. Yes, it is important.

Breakout to new highs

At the moment of writing these words, gold price is trading at about $2,161 – it’s new all-time highs in nominal terms, which is slightly higher than the late-2023 high. Gold price is trying to stay above this level, and while it’s been successful so far, the extremely overbought RSI suggests that it won’t stay as high for long.

And yet…

Gold is already after a confirmed breakout to new highs. Yesterday was the fourth consecutive daily close above the late-2023 highs (I marked the early-December one, but it was also the case with the late-December one).

A confirmed breakout opens the door to higher prices, and since it was a breakout to new all-time highs, gold could move much higher in the medium term.

We see the same thing in the GLD ETF and while focusing on the 2022 top.

Generally, three daily closes are needed to confirm a breakout and we saw more than that. The breakout was confirmed, and the implications are bullish.

Those are the facts.

But those are not the only facts that are present right now.

It’s also true that gold price is extremely overbought – the RSI based on the GLD ETF is almost as overbought as it was at the 2022 top. After that high, gold price declined for hundreds of dollars.

It’s also true that mining stocks are underperforming gold and the rally that we saw in gold was not even similarly big in case of silver. Nothing special happened in platinum nor palladium. So, we don’t have the bullish confirmations here.

Please just look at the long-term HUI Index chart below and see the recent rally’s size.

Barely noticeable, right? Gold – the metal those mining companies produce and sell just moved to new all-time highs. Why are the miners’ prices not soaring?

Will Gold hold its previous highs?

Why is this rally pretty much invisible from the long-term point of view, and why are gold stocks so low compared to their own all-time (2011) high? Those are extremely bearish signs for the precious metals market.

We have the USD Index that’s likely to move higher in the medium term, and we have stock market that is extremely overbought, and we all remember what happened to the prices of gold, silver, and mining stocks when stocks plunged in 2020 or 2008.

The USDX is close to its recent intraday lows as well as its 50-day moving average. It’s also close to the levels that stopped its decline during the August 2023 correction. It seems that it can turn up any day or hour now.

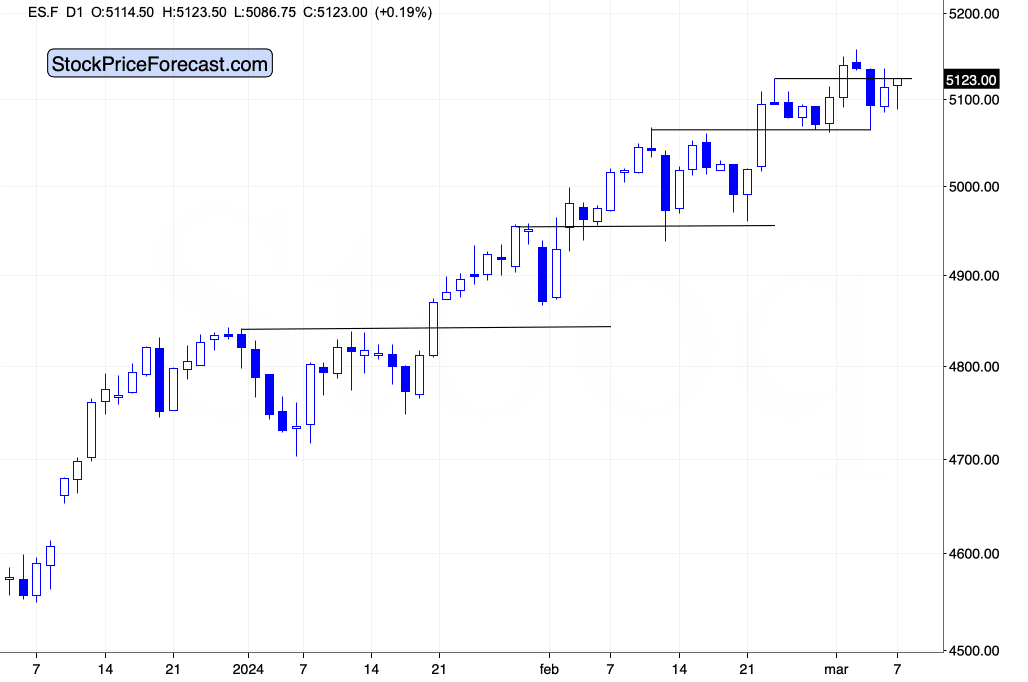

Stocks moved below their late-Feb high recently and while they are trying to get back above it, the fact that they finally did move below the said high already makes the current situation different.

Was that the final top for stocks? If so, it could have been the case that gold (and bitcoin, which soared recently as well) we pushed higher on the wave of the overall dovish and bullish sentiment.

And as stocks move lower, gold might plunge as well.

All right, so what is gold likely to do now?

It’s extremely overbought, so it’s likely to decline – regardless of the breakout and the fact that the medium-term outlook for gold might have just changed to bullish.

Why? Because even if it is the case that gold is going to soar substantially in the following months – despite everything happening on other markets – it’s still likely to correct to the previous highs and verify them as support. Even in the bullish scenario.

And then the real test will take place. Will gold really be able to hold above the previous highs in terms of the closing prices?

If it does, it might be off to new highs shortly thereafter. If it doesn’t, it’s a long way down from there.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any