Gold Elliott Wave technical analysis [Video]

![Gold Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-bars-50657756_XtraLarge.jpg)

Gold Elliott Wave analysis

Gold has maintained its strong upward momentum throughout 2024, with prices nearing another high in just over three weeks. The commodity has gained over 23% so far this year, and it is now testing levels close to a new all-time high. Despite this bullish progress, a minor pullback is likely to occur soon.

Daily chart analysis

On the daily chart, Gold has been following a long-term bullish trend since December 2015. According to Elliott Wave analysis, the supercycle wave (IV) of this larger uptrend was recently completed, setting the stage for a new impulsive move in wave (V). Within this wave (V), waves I and II were completed in May and October 2023, respectively. Gold is currently advancing within wave (3) of 3 (circled) of wave III, which has the potential to extend above the 2550 level before reaching its peak.

The consolidation phase observed between April 12 and June 26 aligns with wave 4 of (3), serving as a corrective structure within the larger trend. The current upward movement is shaping into an ending diagonal structure for wave 5 of (3). If this diagonal structure holds, Gold is expected to break previous highs and achieve a new peak. However, if the structure breaks down, a correction in the form of wave (4) may follow. Wave (4) would provide the market with a chance to digest recent gains before potentially resuming the bullish trend.

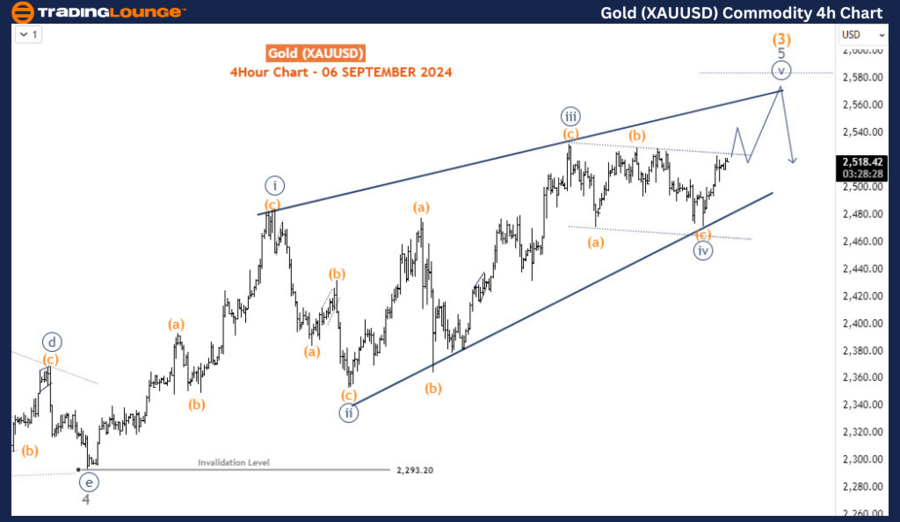

Four-hour chart analysis

On the H4 chart, the current price action is unfolding within wave v (circled) of 5 of (3), following the completion of a flat structure for wave iv (circled). The market has seen minor pullbacks, but as long as the price remains above 2472, further upward rallies are anticipated. For short-term traders, these minor dips could provide entry points as the price targets new highs.

In the medium term, however, the completion of wave (3) is nearing, and a pullback for wave (4) is expected. This pullback could be a healthy correction, allowing the market to regroup before the final stages of wave (V) resume. Traders should be prepared for potential reversals as wave (3) concludes and wave (4) begins, marking a pivotal moment in Gold's multi-year bull cycle.

This analysis emphasizes that while Gold continues to show strength, the Elliott Wave structure suggests an impending correction before the broader uptrend can resume.

Gold (XAU/USD) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.