Gold Weekly Forecast: XAU/USD remains sensitive to US yields as focus shifts to CPI

- Gold ended up closing the second straight week in positive territory.

- XAU/USD needs to stabilize above $1,700 to reattract buyers.

- September CPI inflation data from the US will be next week's key release.

Gold managed to build on the previous week’s gains and rose decisively on Monday. The break above $1,700 attracted technical buyers on Tuesday and XAU/USD climbed to its highest level since September 12 at $1,730 mid-week. Renewed dollar strength ahead of the weekend, however, caused the pair to erase a large portion of its weekly gains. September inflation data from the US could trigger a significant market reaction and help the precious metal determine its next direction.

What happened last week?

The improving market mood at the beginning of the week made it difficult for the greenback to find demand and gold gained traction. In the meantime, the UK government’s decision to roll back the proposed scrapping of the 45% tax on high earners triggered another leg lower in global bond yields. With the benchmark 10-year US Treasury bond yield falling nearly 5% on Monday, XAU/USD rose more than 2% and registered its biggest one-day gain since March. During the American trading hours, the data published by the ISM showed that price pressures continued to ease in the manufacturing sector in September while employment contracted.

On Tuesday, risk flows continued to dominate the financial markets and the dollar sell-off picked up steam. As the US Dollar Index (DXY) lost more than 1% on the day, the yellow metal climbed above $1,700 and attracted technical buyers, reaching a fresh multiweek high of $1,730. It’s also worth noting that the Reserve Bank of Australia’s (RBA) decision to hike its policy rate by only 25 basis points in the Asian session fueled a rally in global stocks. The CME Group FedWatch Tool’s probability of a 75 bps Fed rate hike in November declined to 50%, reflecting the impact of the RBA’s dovish hike on the market pricing of the Fed’s rate outlook.

After having gained nearly 4% in the first two days of the fourth quarter, gold went into a consolidation phase and registered modest losses mid-week. The ADP reported that private sector employment in the US rose by 208,000 in September, compared to the market expectation of 200,000. Additionally, the ISM Services PMI survey revealed that input inflation continued to rise at a strong pace in the service sector. More importantly, the Employment Index component rose to 53 in September, beating analysts’ estimate of 49.6 by a wide margin. Upbeat data releases helped the DXY stage a rebound and didn’t allow XAU/USD to regather bullish momentum.

Markets stayed relatively quiet during the European trading hours on Thursday and gold fluctuated in a tight channel at around $1,720. In the second half of the day, hawkish comments from Fed officials helped the 10-year US T-bond yield stretch higher and forced the yellow metal to stay on the backfoot. Atlanta Fed President Raphael Bostic said that the Fed’s battle against inflation was likely still in its early days and San Francisco Fed President Mary Daly reiterated they will raise rates into the restrictive territory and hold them there for a while. Finally, Minneapolis Fed President Neel Kashkari reminded markets that the US central bank was “quite a ways away” from a pause in policy tightening.

The US Bureau of Labor Statistics announced on Friday that Nonfarm Payrolls rose by 263,000 in September, better than the market consensus of 250,000, and the Unemployment Rate declined to 3.5% from 3.7% in August. Fueled by the upbeat jobs report, the 10-year US T-bond climbed higher toward 4% and caused gold to return to the $1,700 area ahead of the weekend.

Next week

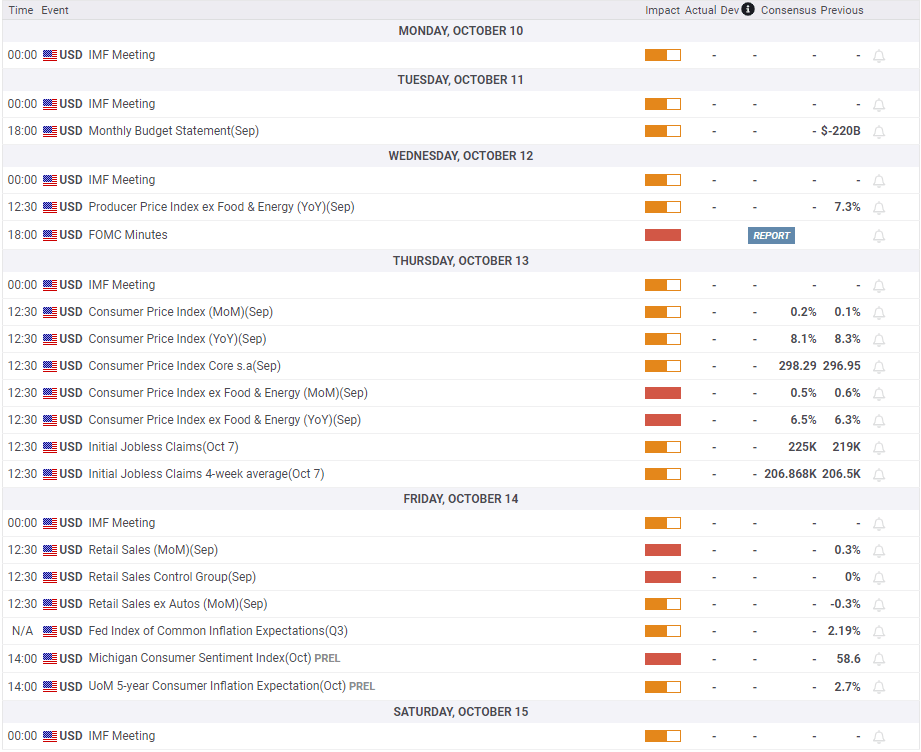

There won’t be any high-impact data releases from the US early next week. The FOMC will release the minutes of the September policy meeting on Wednesday. At this point, this publication is unlikely to offer any major surprises regarding the Fed’s policy outlook. The hawkish dot plot reaffirmed policymakers' intention to hike the policy rate above 4.5% and keep it there next year. In case the statement shows that rate-setters are more concerned about the growth outlook than September’s policy statement led markets to believe, the dollar could lose interest and open the door for another leg higher in gold. Ahead of Thursday’s inflation report, however, the market reaction is likely to remain short-lived.

The Consumer Price Index (CPI) is forecast to rise to 8.5% on a yearly basis in September from 8.3% in August. The annual Core CPI, which excludes volatile food and energy prices, is projected to climb to 6.5% from 6.3%. Investors are likely to put more weight on the core figure and a print above 6.5% could fuel another leg higher in yields. On the other hand, an unexpected decline in core inflation should help XAU/USD gather bullish momentum. Nevertheless, the Fed made it clear that they will not overreact to a single inflation reading and the initial market reaction could fade unless it influences the market pricing of the next Feed action in a significant way.

The US Census Bureau will publish the Retail Sales data for September. Ahead of the weekend, the University of Michigan’s Consumer Sentiment Survey for October will be watched closely by market participants, especially the 5-year Consumer Inflation Expectation component, which declined to 2.7% in September from 2.9% in August. Another decline in this data could cause the USD to come under selling pressure and vice versa.

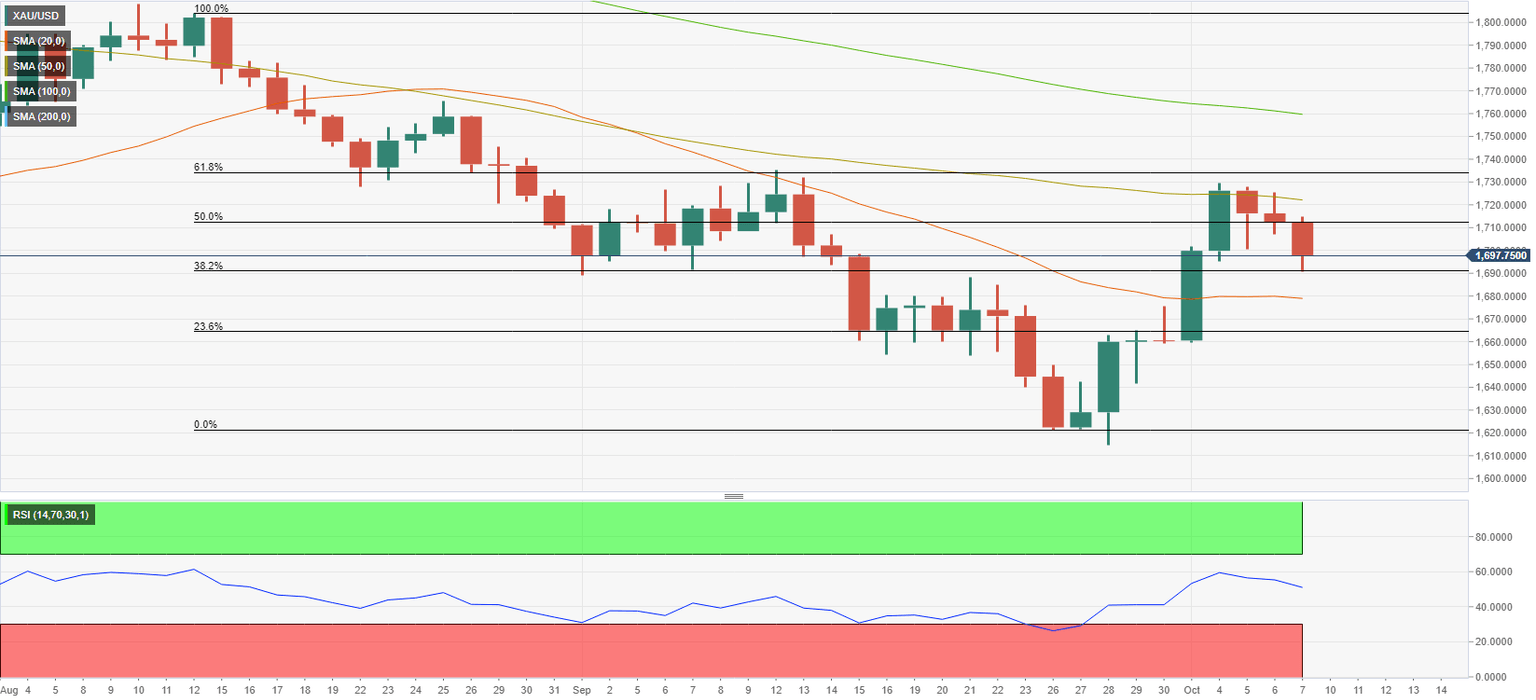

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart declined to 50 toward the end of the week, suggesting that gold has lost its bullish momentum and turned neutral in the near term. In case XAU/USD manages to hold above $1,700, it is likely to face initial resistance at $1,710 (Fibonacci 50% retracement of the latest downtrend) before $1,720 (50-day SMA). With a daily close above the latter, the pair could test $1,730 (Fibonacci 61.8% retracement) and target $1,760 (100-day SMA) if it manages to flip it into support.

On the downside, $1,690 (Fibonacci 38.2% retracement) aligns as interim support before $1,680 (20-day SMA). If gold falls below the latter and starts using it as resistance, it could extend its slide toward $1,665 (Fibonacci 23.6% retracement).

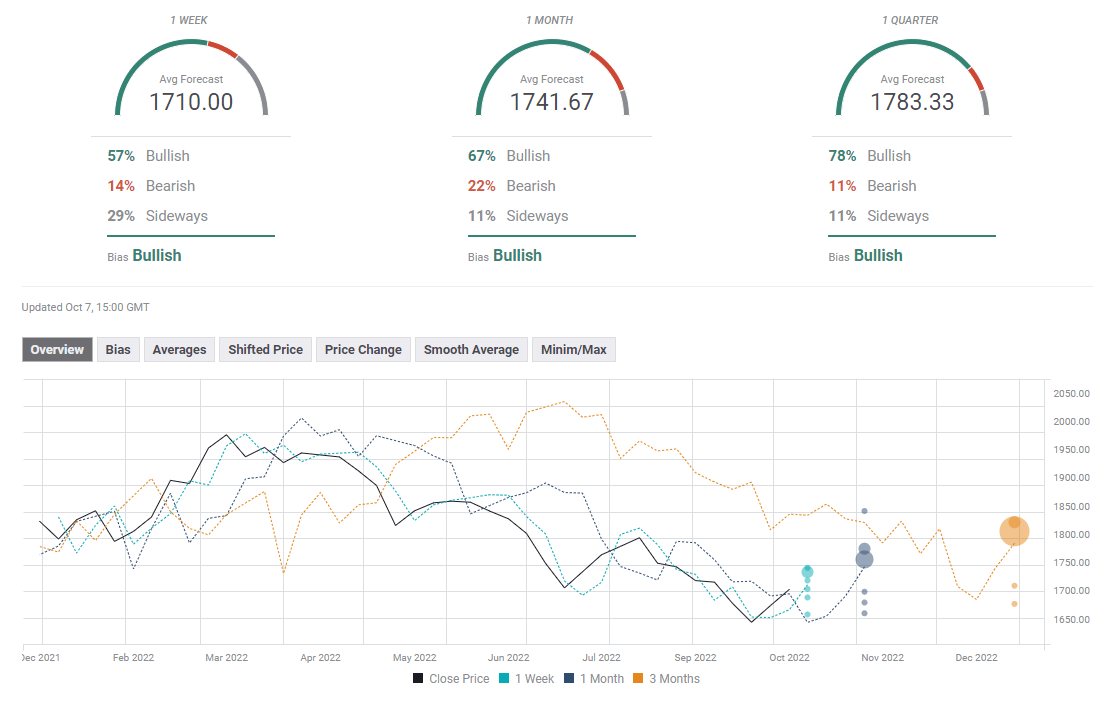

Gold sentiment poll

Despite the decline witnessed in the second half of the week, the FXStreet Forecast Poll shows that experts expect gold to remain bullish in the near term with the one-week average target sitting at $1,710. Similarly, the one-month outlook also points to a bullish tilt.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.